Ethereum (ETH) is giving investors serious cases of whiplash. The market has clearly gained a dominant edge after a 13.40% decline in the past week and trading volumes reached $17.644 billion over the past 24 hours.

Analysts look at price patterns, technical indicators and liquidation trends to grasp Ethereum’s next potential move. Incidentally, ETH will trade for $1,893.17 at the time of reporting.

Mixed Signal: Falling Wedges and Bearish Outlook

According to Daan Crypto Trades, Ethereum has consolidated following a major market slump. He points to the falling wedge pattern as a possible sign of a trend reversal.

This technical structure is usually considered bullish, suggesting that price recovery may be imminent if ETH breaks beyond the resistance zone. To make this happen, ETH must be broken and held above the key resistance zone before thinking about moving to a $2,000+ region.

$eth has been integrated since the big dump.

This falling wedge pattern was formed. This could be a decent structure for reversing local trends.

But for that, I want to look at the breakout and hold it above the white zone. If we can do that, we can start looking for… pic.twitter.com/cbdokpev0t

– Daan Crypto Trades (@daancrypto) March 14, 2025

The ETH/BTC ratio remains close to multi-year lows despite showing slight resilience. This bounce alone isn’t strong enough to see a trend reversal. Significant changes in momentum require sustained intensity and breaks of major resistance levels.

Related: Ethereum will be raised to $1612.81 support after short-lived spikes

Conflict Opinions: $800 for the Table?

In addition to uncertainty, Ali Martinez offers a bearish perspective, highlighting the outbreak of Ethereum, but if the momentum is strong, ETH can move to $800.

#ethereum $eth is erupting and if momentum applies, it could be on track to move to $800! pic.twitter.com/rctddakq8r

– Ali (@Ali_Charts) March 13, 2025

Leverage and liquidation: Volatility recipes

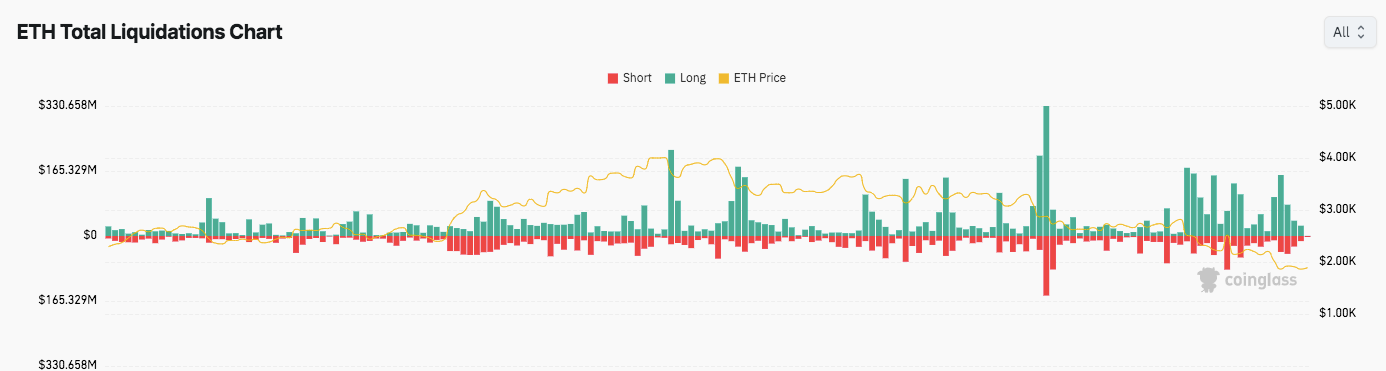

The Ethereum Total liquidation chart highlights the impact of leveraged transactions on price movements. Important liquidation spikes occur around the key price ranges between $2,000 and $3,000. A surge in ETH prices increases long liquidation, while a drop in prices causes short liquidation.

Source: Coinglass

The highest liquidation level is above $330 million, revealing that aggressive leveraged positions will be wiped out. The large, long liquidation spikes strengthened the high-risk nature of leveraged transactions, coinciding with a sharp price drop. In other words, high leverage can lead to large losses.

Technical Indicators: RSI and MACD Analysis

ETH/USD Daily Price Chart, Source: TradingView

From a technical standpoint, ETH’s relative strength index (RSI) is around 33.29, which is oversold. RSIs below 30 usually indicate an asset is undervalued and potentially sets a stage for price rebound.

Related: Ethereum mining alternative Ravencoin jumps by nearly 70% in a week

However, the MACD remains negative, with both the MACD line and signal line being below zero. This confirms bearish momentum, but crossovers can indicate a reversal of the trend. So, while the RSI suggests possible bounce, the MACD still flashes the warning sign.

Disclaimer: The information contained in this article is for information and educational purposes only. This article does not constitute any kind of financial advice or advice. Coin Edition is not liable for any losses that arise as a result of your use of the content, products or services mentioned. We encourage readers to take caution before taking any actions related to the company.