Ether price (EthereumAccording to market analyst Michael Van de Poppe, the native cryptocurrency of the Ethereum Layer 1 blockchain network will bottom out in April 2025, with its price trend mirroring the 2019 cycle.

Van de Poppe said the proliferation of stablecoins, tokenized real-world assets (RWA), which are traditional or physical assets represented as tokens on the blockchain, and developer activity on the Ethereum network are reasons to be bullish on Ethereum’s price.

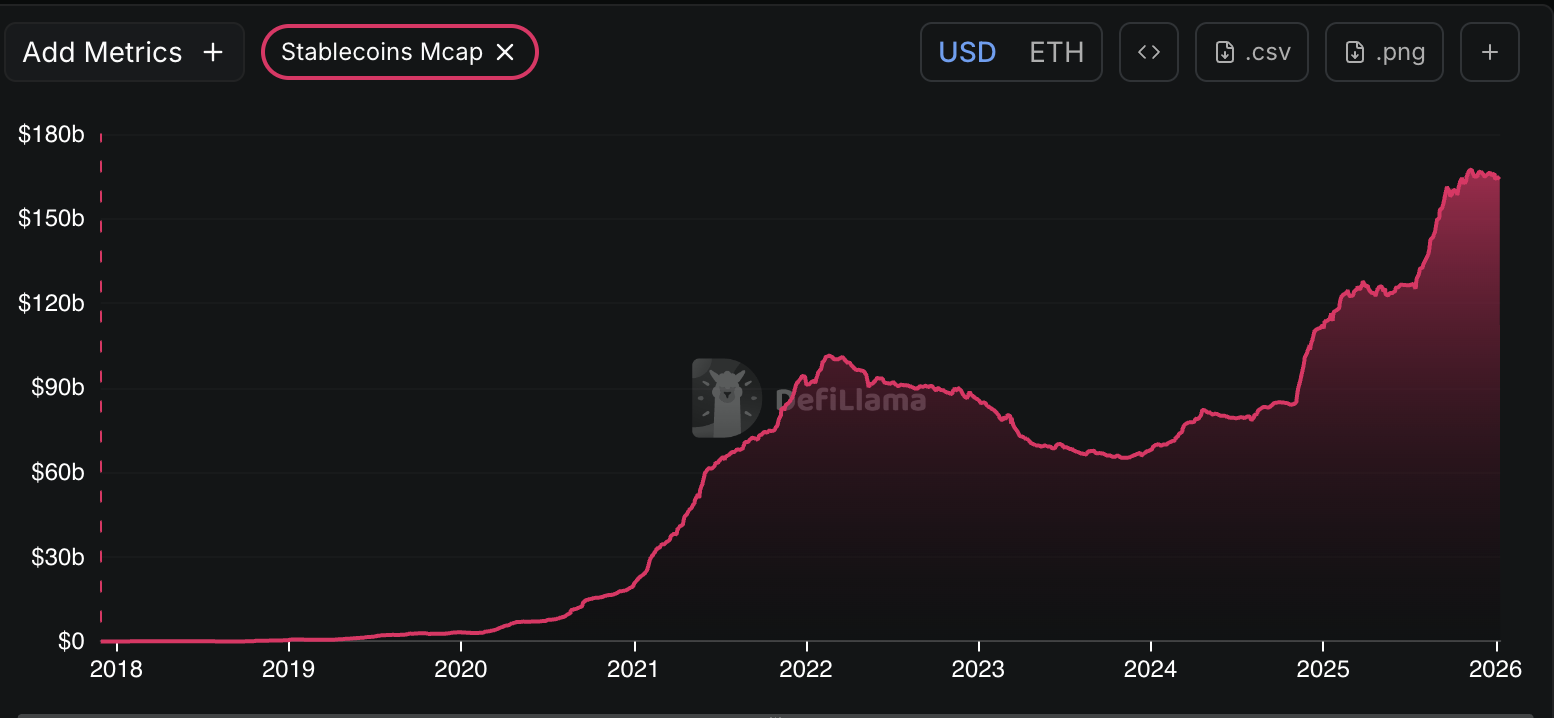

“Ethereum stablecoin supply increased by over 65% in 2025, doubling from its peak in 2021,” he wrote in a post on Sunday X.

Ethereum stablecoin market capitalization. sauce: Defilama

According to DeFiLlama, Ethereum’s stablecoin market capitalization exceeds $163.9 billion, with approximately 52% of the market capitalization accounted for by stablecoin issuer Tether’s USDt (USDT) dollar-pegged stablecoin.

According to Token Terminal, Ethereum processed approximately $8 trillion in stablecoin transfer volume in the fourth quarter of 2024 alone.

In a contrarian analysis of investor sentiment, Ethereum dead or dying Ethereum It briefly topped $3,300, above the 365-day moving average, but has since fallen to around $3,100, the price at the time of publication.

Ethereum After breaking above the 365-day EMA, it returned to the $3,100 level. sauce: TradingView

Related: Ethereum Will the next price be $5,000? Last time this happened, Ether recovered 120%

of Ethereum–BTC This ratio reflects the 2019 cycle

“Ethereum It is said to be dead because it has been in a downward trend for 4 years against Bitcoin (BTC). But after April 2025, there will be a bottom and we are already in the Ethereum market,” Van de Poppe said.

He shared Ethereum and Bitcoin charts (Ethereum–BTC) Indicators that track ratios, prices and strength Ethereum against BTCbottomed out at around 0.017 in April and recovered to a local high of 0.043 in August 2025.

of Ethereum–BTC This ratio bottomed out in April 2025 and has since recovered. sauce: michael van de poppe

Following the market-wide crash in October, which disrupted the upward trend in prices in the crypto market, this ratio rose to its current level of 0.034 at the time of writing.

According to crypto market analysis firm Santiment, current investor sentiment towards Ethereum is similar to the investor sentiment pattern before previous price increases.

magazine: Ethereum’s Fusaka fork explained to beginners: What exactly is PeerDAS?