Spot Bitcoin and Ether exchange-traded funds (ETFs) are facing their biggest daily outflows since their inception, but two new altcoin products are bucking the trend.

Despite the widespread market rout, the Solana (SOL) and XRP (XRP) ETFs have yet to record a single day of outflows since their launch, according to crypto ETF data aggregator SoSoValue. This gives the two altcoin ETFs a rare green mark in an otherwise red ETF environment.

The amount of inflow is becoming considerable. According to the data, the Solana-based spot ETF has recorded cumulative net inflows of nearly $500 million, while the XRP ETF has recorded cumulative net inflows of $410 million to date.

The divergence comes amid one of the most severe multi-week outflows in the history of the Spot Bitcoin (BTC) and Ether (ETH) ETF. While flagship crypto products are undergoing massive redemptions, steady inflows into new ETFs suggest small but notable hints of confidence among investors seeking exposure beyond the two biggest assets.

Solana ETF saw inflows in November. Source: Farside Investors

XRP and Solana ETFs record consistent inflows despite market stress

On Thursday, Bitwise Asset Management launched the XRP ETF under the ticker “XRP.” The ETF had a strong debut, raising $105 million on its first trading day, according to SoSoValue data.

Asset manager Canary’s XRPC added another $12.8 million on Thursday, bringing the day’s total inflows to $118 million.

Canary CEO Steven McClurg congratulated Bitwise on its launch and said the company is “supporting” Bitwise despite being a competitor in the space.

sauce: Stephen McClurg

Canary also contributes to the consistency of XRP ETF inflows. It currently holds the record for the largest day of XRP ETF inflows, with $243 million in inflows into XRPC on November 14th.

Solana-based ETFs showed a similar pattern of resilience, posting consistent daily inflows despite the broader market decline.

SOL-based ETF products have seen daily inflows of $8.26 million to $55.61 million this week, with November 19th seeing the highest daily inflows.

Related: $5 billion disappears in one day, meme coin market sinks to 2025 lows

Despite ETF gains, Solana and XRP tokens are in the red

Even though SOL and XRP-based ETFs have posted steady gains, the performance of the underlying assets behind the exchange-traded products has been weak over the past month.

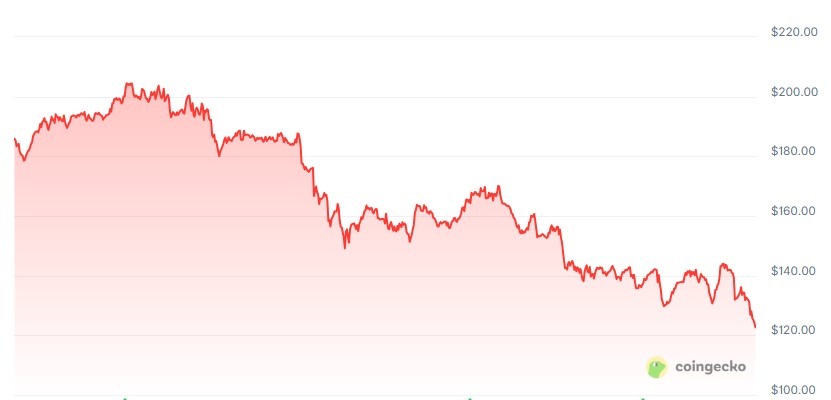

According to CoinGecko data, Solana has fallen 32.5% in the last month and 10.9% in the last week. At the time of writing, the token is trading at $122.94, which represents a 52.3% decline over the last year.

Solana 30 day price chart. Source: CoinGecko

Meanwhile, XRP has shown a similar performance recently, dropping 21.2% in the past 30 days and 16.6% in the last week.

But its annual chart tells a different story. According to CoinGecko, the asset is currently trading at $1.86, representing an increase of 49.9% over the past year.

magazine: Bitcoin whale metaplanet is “underwater” but keep an eye on more BTC: Asia Express