U.S. stocks opened with a burst of optimism on Wednesday, but that enthusiasm faded by mid-afternoon as stronger-than-expected jobs numbers pushed up Treasury yields and waned hopes for short-term interest rate cuts from the Federal Reserve.

Early Wall Street pop wanes as hot jobs data pushes yields higher, weighs on stocks

At the time of this writing, February 11, 2026, the Dow Jones Industrial Average, after briefly rising more than 300 points in early trading, was down about 120 points, or 0.2%, to around $50,068. The S&P 500 index fell about 0.2% to about 6,928, and the Nasdaq Composite Index fell 0.5% to about 23,000. Markets remain open and intraday fluctuations continue.

The trigger was the non-farm payroll report for January, which was delayed due to the recent government shutdown, and showed that the number of employees increased by 130,000, far exceeding the estimate of nearly 50,000. The unemployment rate fell from 4.4% to 4.3%, strengthening the view that the labor market remains strong.

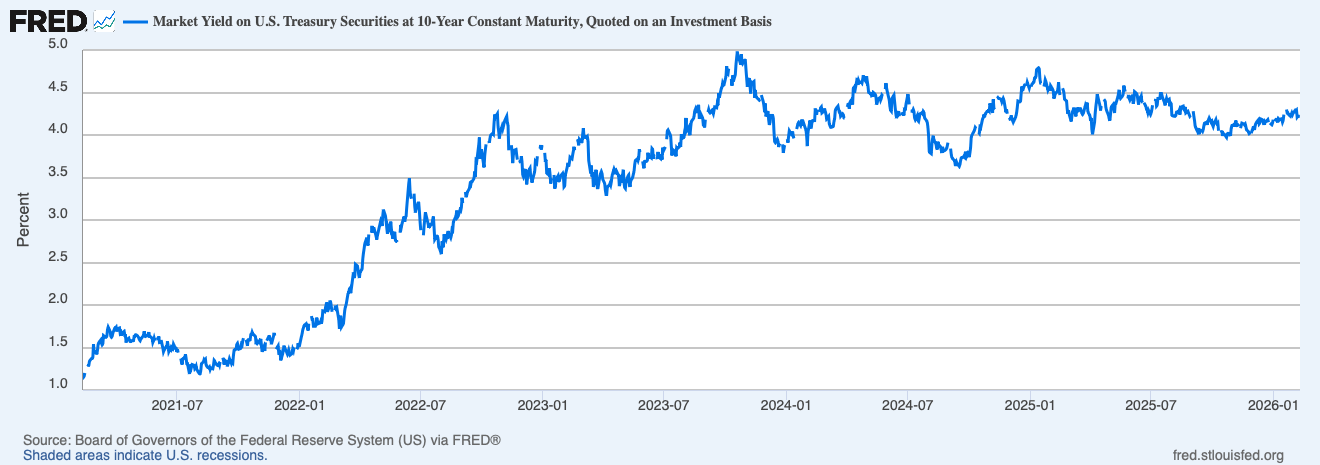

That strength had its pitfalls. Government bond prices fell, and the yield on 10-year bonds rose to about 4.22% from about 4.18% previously. Higher yields often weigh heavily on stock valuations, especially in areas of high market growth. Traders are recalibrating their expectations that the Fed will ease in 2026, with limited interest rate cuts now factored in and most expectations moving beyond mid-year.

The estimated market yield on a 10-year fixed maturity U.S. Treasury bill, on an investment basis, represents the annualized return an investor would require to hold a 10-year U.S. Treasury bond, expressed as a percentage of its price rather than its face value.

The reversal marks a change from Tuesday’s close, when the Dow Jones Industrial Average set a three-year record of 50,188.14. However, the S&P 500 and Nasdaq closed lower, reflecting pressure from weak retail sales data and selective profit-taking in tech stocks.

Earnings season added further cross-currents. Vertiv Holdings rallied sharply after reporting a positive outlook related to data center demand, while Lyft, Robinhood and Mattel fell after weak earnings and outlooks. Stock-specific reactions widen sector performance disparities, and volatility remains elevated even though index-level movements appear modest.

Technology stocks and communications services stocks that led the recent advances in the artificial intelligence (AI) craze have faced new scrutiny. Financial stocks were relatively resilient as rising yields supported net interest margins, while energy stocks were supported by strong oil prices amid geopolitical tensions.

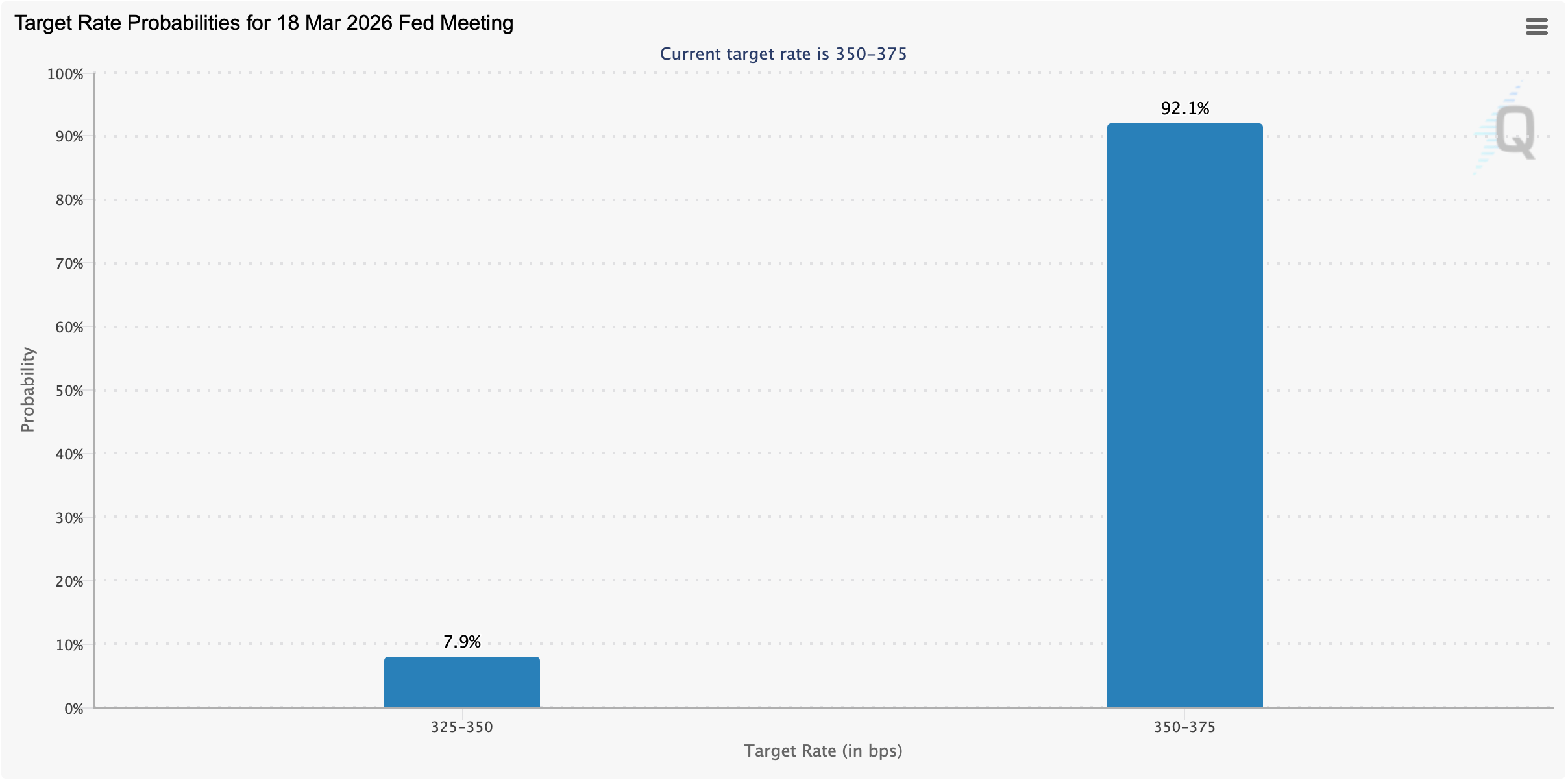

As of Wednesday, February 11, the US Federal Reserve is widely expected to keep the federal funds rate unchanged when policymakers reconvene in 35 days.

Precious metals such as gold and silver rose on Wednesday, with gold rising 0.66% to above the $5,000 level. Silver was trading at $83 per ounce, up 2.43% from the previous day. Like U.S. stocks, the cryptocurrency economy has fallen, with the sector falling 3.2% to $2.28 trillion by midday. Bitcoin has fallen 3.8% against the dollar over the past seven days.

Looking ahead, Friday’s Consumer Price Index (CPI) report will likely be the highlight event of the week. Inflation data could either strengthen the “long-term high” narrative or reopen the door to early interest rate easing. analysissts expects fourth-quarter earnings growth for the S&P 500 index to be close to 12%, with forecasts for 2026 expected to be in the mid-teens, but these assumptions are subject to stable inflation and steady demand.

For now, the market message is clear. Strong economic data is welcome, but not if it complicates the Fed’s path. With the CPI on track and profits still starting to roll in, Wall Street appears poised for more intraday whiplash before the week ends.

Frequently asked questions 📉

- Why did US stocks fall at noon on February 11, 2026?U.S. Treasury yields rose after January’s better-than-expected jobs report, denting expectations for the Federal Reserve’s short-term interest rate cuts.

- How do government bond yields affect the stock market?Rising yields will increase borrowing costs, putting pressure on stock valuations, especially for growth-oriented stocks.

- Which indexes are underperforming today?The Nasdaq Composite has fallen far behind the Dow and S&P 500.

- What will be the next major catalyst for the market this week?Friday’s Consumer Price Index (CPI) data could shape expectations for inflation and Federal Reserve policy.