Ethereum prices have been consolidated for over a month and have yet to push the key $5,000 mark. The consolidation has been following a major gathering since April, driving assets beyond multiple levels of resistance and could likely continue if the market can break through the $4,800 level in the coming weeks.

Technical Analysis

By Shayan

Daily Charts

The daily chart provides a clear overview of ETH upward trends within the large upward channels since April this year, with prices replicating several important levels, including 100-day and 200-day moving averages, and are currently marked around $3,700 and $2,900, respectively, with the $3,700 and $2,900 marks, respectively.

Currently, assets are gradually rising within the harsh ascending channels around the midline of the larger channel. If small channels are classified, the market could revisit the $4,000 level. Meanwhile, if the market bounces higher and surpasses the $4,800 resistance zone, then a historic gathering of over $5,000 is expected.

4-hour chart

Falling into the four-hour time frame, it has been revealed that recent consolidation is primarily surrounded by a range between the $4,300 demand zone and the $4,800 supply zone.

With the low trendlines of green rising channels, they are also trapped in prices, so the time for the market to make decisions is nearing. The breakdown of channels and demand zones leads to a retest of the $3,850 demand zone and the lower limit of the larger upward channel, but rebounds from this zone push prices above the $4,800 supply area closer to the main level at the $5,000 level.

On-Chain Analysis

Discovery rate (7-day moving average)

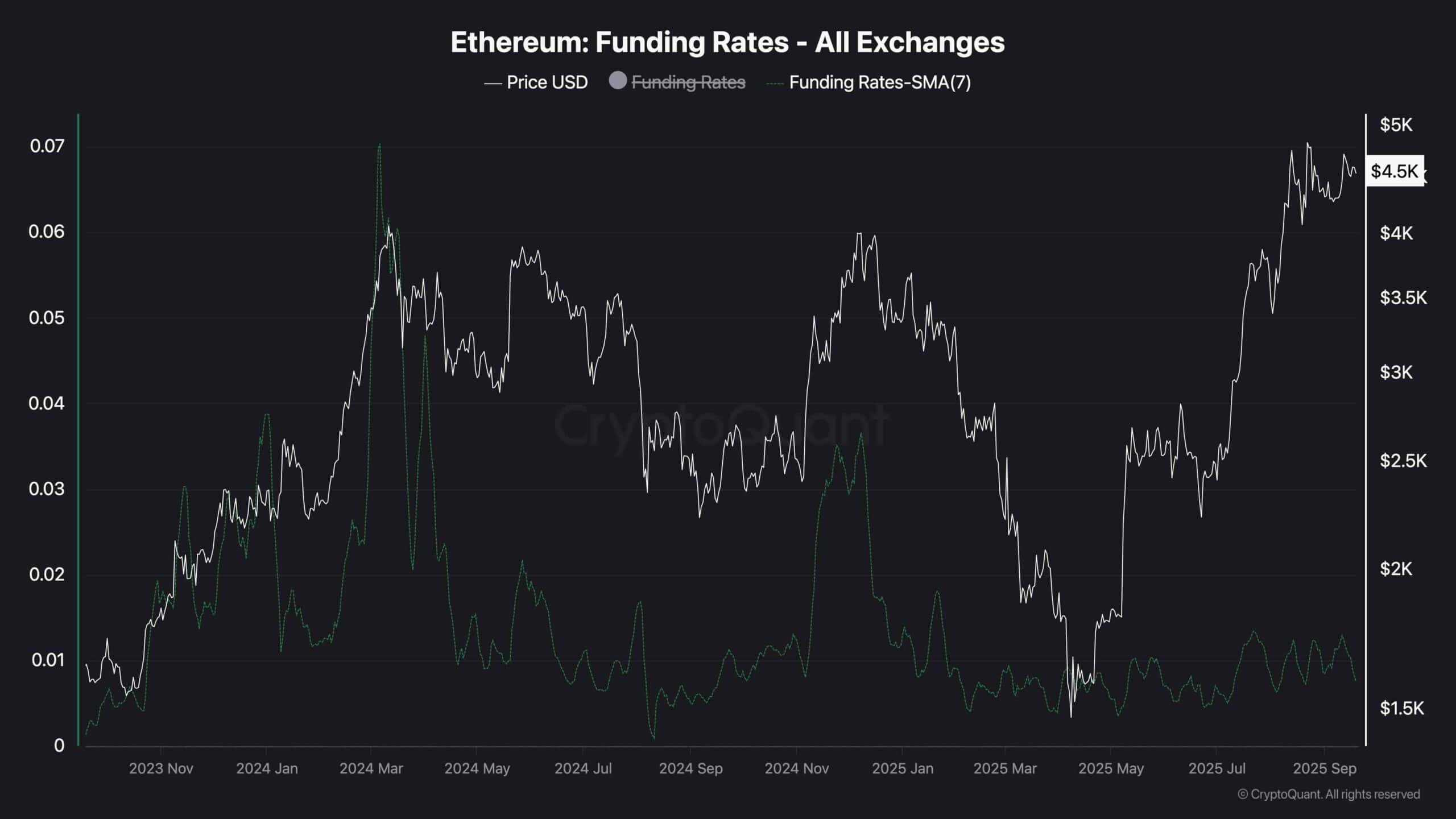

This chart, away from technical analysis, shows the seven-day moving average of Etheremu funding rates. Funding rate metrics measure how aggressive buyers and sellers are in the futures market, with positive value indicating more aggressive position acquisitions by buyers.

As is clear from the charts, the seven-day moving average of funding rates has been positively worth for quite some time. However, these values were not comparable to the peaks seen in March 2024 and later 2024, and prices also reached long-term highs.

This could indicate that there is still room for growth in the market as the futures market has not yet been significantly overheated. However, attention is still being paid to positive funding rates, as they can always lead to a liquidation cascade.