Bitcoin intervened on September 23, 2025, with a price of $113,014 and a $2.25 trillion crown on its head. Traders pushed $521.6 billion through the book in 24 hours, watching Coinbounce bounce bounce between $111,644 and $113,384 like a caffeinated pinball.

Bitcoin

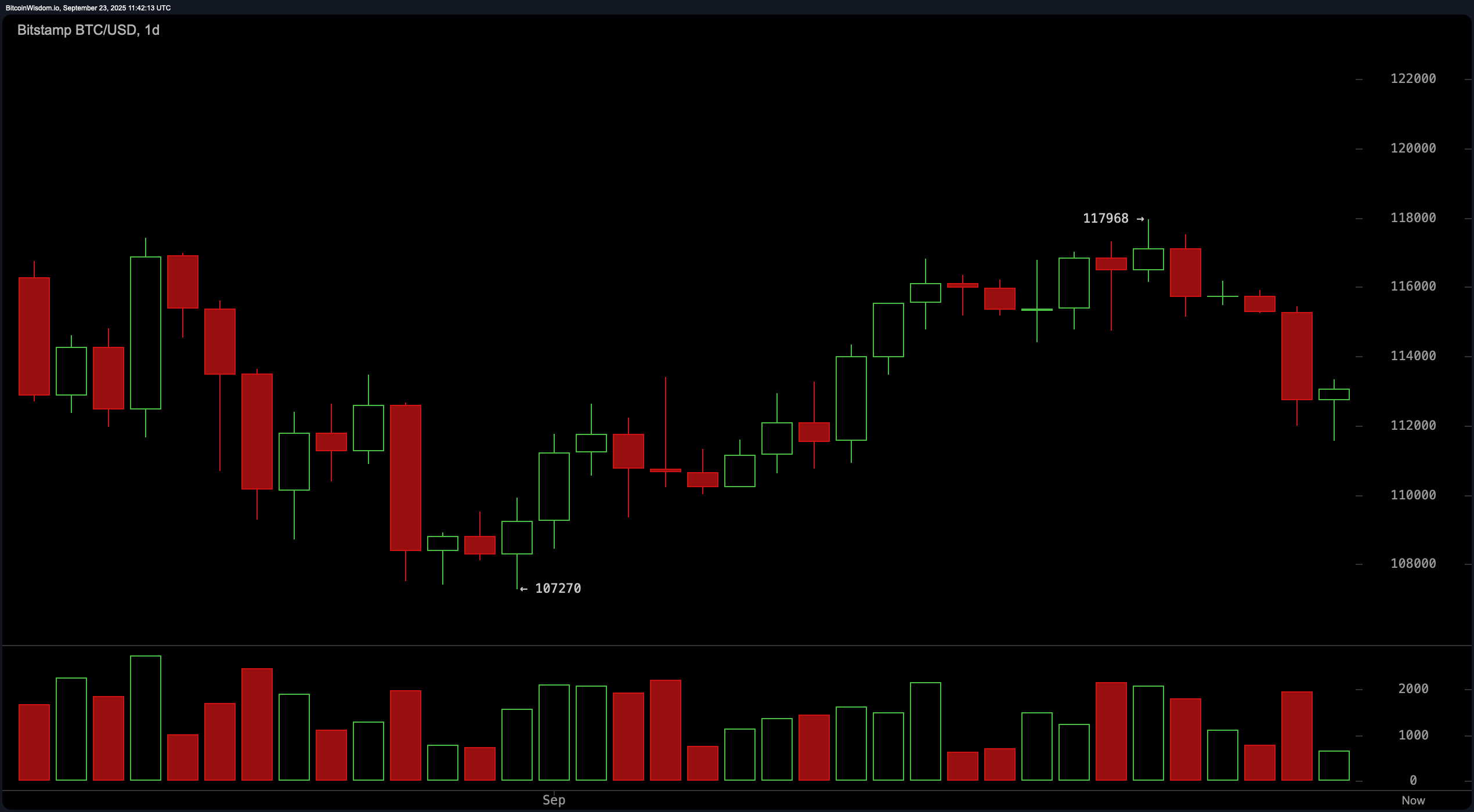

On the daily charts, Bitcoin has gotten the look of a tired champion. It bends at $117,968 and falls to $111,571 before a round top. Today’s candles suggest a recovery of nearly $113,000, but the atmosphere is still bearish. The Oscillators – Relative Strength Index (RSI), Probabilistic, and Mean Index (ADX) – shrugged on neutrality.

Momentum fired a cheeky purchase signal, but the Moving Average Convergence Divergence (MACD) remained gross and bearish. Short-term moving averages are mostly red flags, except for the 30th Simple Moving Average (SMA) that they gave a polite nod to the Bulls.

BTC/USD via BitStamp on September 23, 2025. Daily charts.

The four-hour chart shows Bitcoin toeing towards recovery, but has still been tied to a downtrend since its peak at $117,968. A faint blast of bullishness peers in, suggesting that price action may be looking for the bottom when the RSI begins to wink higher. Traders are turning their eyes to the $111,571 to $113,500 zone for entry. Resistance is hiding around $114,500 and $116,000. The oscillator has continued to play Switzerland, but breakouts over $113,500 with muscular muscles could potentially shift short-term moods from the MEH to mildly bullish.

BTC/USD via BitStamp on September 23, 2025. 4 hour chart.

Zoom in to the 1 hour chart and Bitcoin flashes double bottoms close to $111,571. The classic “Don’t Count Me Aut Out” movement. With green candles creeping up, the females are giving a potential playground between $112,000 and $112,500. If a coin is arrested for $113,300, then you will feel more confident if your target is sitting at $113,500 and $114,500. The short-term outlook is bullish, but resistance is the security guard at the door – proceed with caution.

BTC/USD via BitStamp on September 23, 2025. 1 hour chart.

Oscillators beyond the time frame? confusion. The RSI parked at 46 and was neither hot nor cold. I sat on the fence with a probability of 40. The Commodity Channel Index (CCI) and ADX also threw neutral signs. However, momentum flashed the purchase signal at -2,955 and bullied the intensity. But MACD’s 370 reading clings to its sales bias, reminding traders that the Bears still have claws unless momentum flips the script.

Moving Average took part in an indecisive party. EMA and SMA from the 10th, 20th, 30th and 50th periods all sang bearish songs, with long-term heavyweights (100th periods EMA and 200 EMA and SMA) backing the Bulls with their purchase signal. While long-term support appears to be alive and lively, traders should look sharply at the volume and set the stop loss below $111,500 in case gravity falls on another swing.

Bull Verdict:

Bitcoin’s short-term swagger may be volatile, but bullish divergence, momentum buying signals, and tips for long-term moving average support suggest that it could be set for rebounds. If $113,000 has a voluminous $113,500 crack, the $116,000 sprint is not out of the question.

Bear Verdict:

The bear case is still wandering. There is no volume punch to confirm flashing sales of MACDs, bearishness that has tilted averages for most movements, and optimism. Bitcoin was able to return to $111,500 before sustainables emerged. To the Resistance Cave, the Bulls are just shadow boxing.