Ethereum (ETH) prices have once again flirted at the $4,000 level, up over 2.5% in the last 24 hours, trading nearly $3,877. It rekindled the hopes of new legs higher and perhaps fresh best hope.

You may feel like the setup is familiar, but the background this time is very different. As July approaches, ETH finds itself caught in a converging net of catalysts. Heavy leveraged bets, deep pocket ETF inflows, thin exchange supply, strength and Bitcoin rise. And it all sets the stage for a potentially explosive August. My fingers crossed!

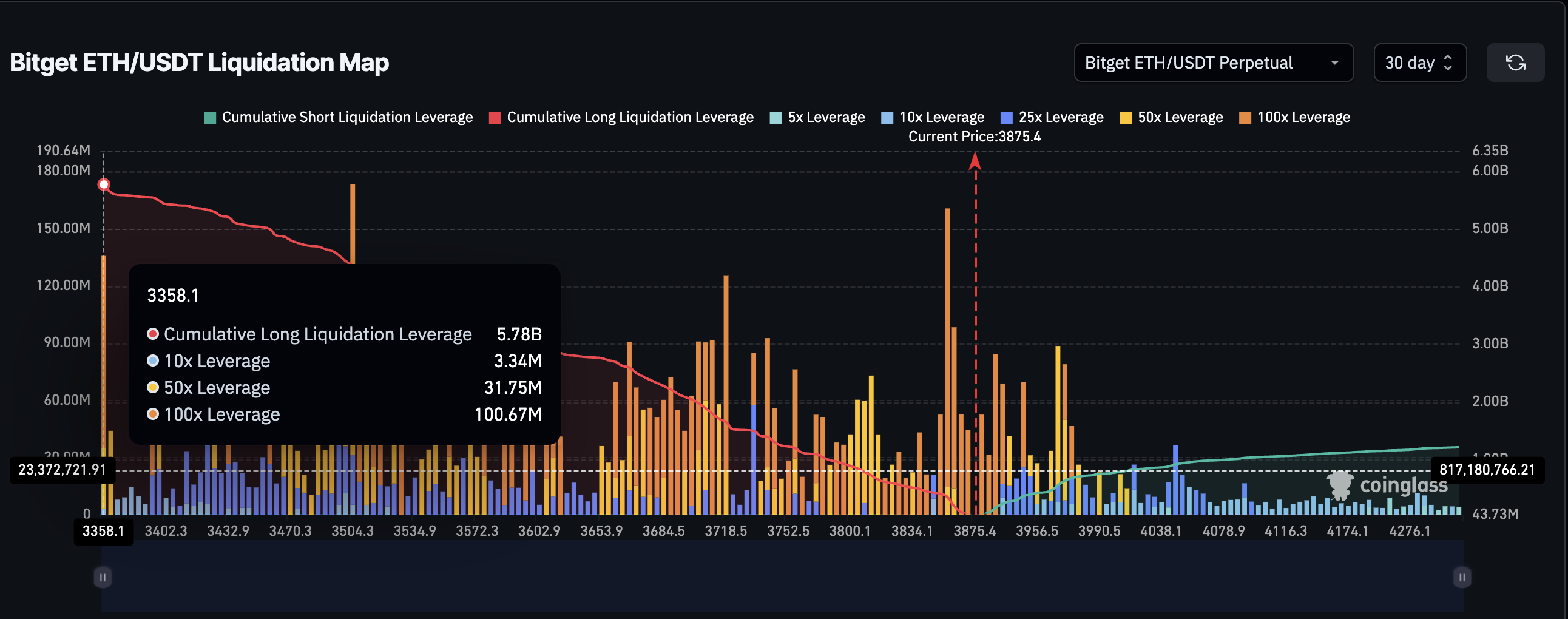

The leverage stack is heavy at: Can ETF inflows stabilize the zone?

According to the latest Bitget Eth/USDT liquidation map, cumulative long leverage of over $5.78 billion is currently stacking between $3,358 and $3,875. The ETH is traded around the top edge of this zone, so it is hovering near the danger pocket.

Higher pushes can reverse this zone into the price launch pad. Or, if it slips, it could cause a cascade of liquidation.

ETH Clearing Map: Coinglass

What makes this cluster different from the previous leverage construction is the kind of money that supports it.

In July 2025, the ETH ETF (Exchange Traded Fund) recorded a net inflow of $5.12 billion, the highest monthly tally of the past year. This is not just about retail. It accumulates the facility’s firepower and manifests in both spot allocation and apparently derivatives.

ETH ETF USD inflow: SOSO value

That belief gives the Bulls a breathing chamber to what would otherwise be a high-risk leverage trap. There is no good reason to believe that the July ETF fever will not flow until August.

If ETH recovers $3,900 with momentum, it could cause a forced short throttle, especially as it waits for more than $1 billion to be taken out in a short position. Yes, even the short position is quite a position.

Exchange Reserve adds another bullish tier

In addition to bullish stories, there are low replacement preliminary data. ETH has earned more than 57% from last month’s low, but exchange holdings have not increased. In fact, the monthly exchange reserve is at the second lowest point in more than a year.

Ethereum Price and Exchange Reserve: Cryptoquant

This is not just a small supply. What’s even more impressive is that even though large wallets are on sale, the reserves haven’t skyrocketed.

This suggests supply absorption. Supply absorption suggests that retail and institutional demand are increasing the pressure on the sell-side.

If you have ETF money in it and your exchange reserves shrink during price increases, take-away is easy. The belief is strong, and the sellers are overtaken.

The ETH/BTC ratio has increased sharply. Altseason in the Air?

Zooming out, the ETH/BTC ratio tells its own bullish story. The pair rose to 0.032, nearly 40% from the June low, and sits on the brink of completing a rare sequence of golden crossovers across 20D, 50D, 100D and 200D EMA (exponential moving average).

ETH/BTC ratio: TradingView

Only one movement remains. A 50-day EMA (orange) will overtake 200 days (blue). When that happens, it confirms a full-fledged bull structure. The same kind of historically extended Altcoin is run.

Given the context, strong ETF influx, thinning exchange reserves, and long leverage stacks – this crossover is not iconic. That could be the technical verification needed to expand momentum through August.

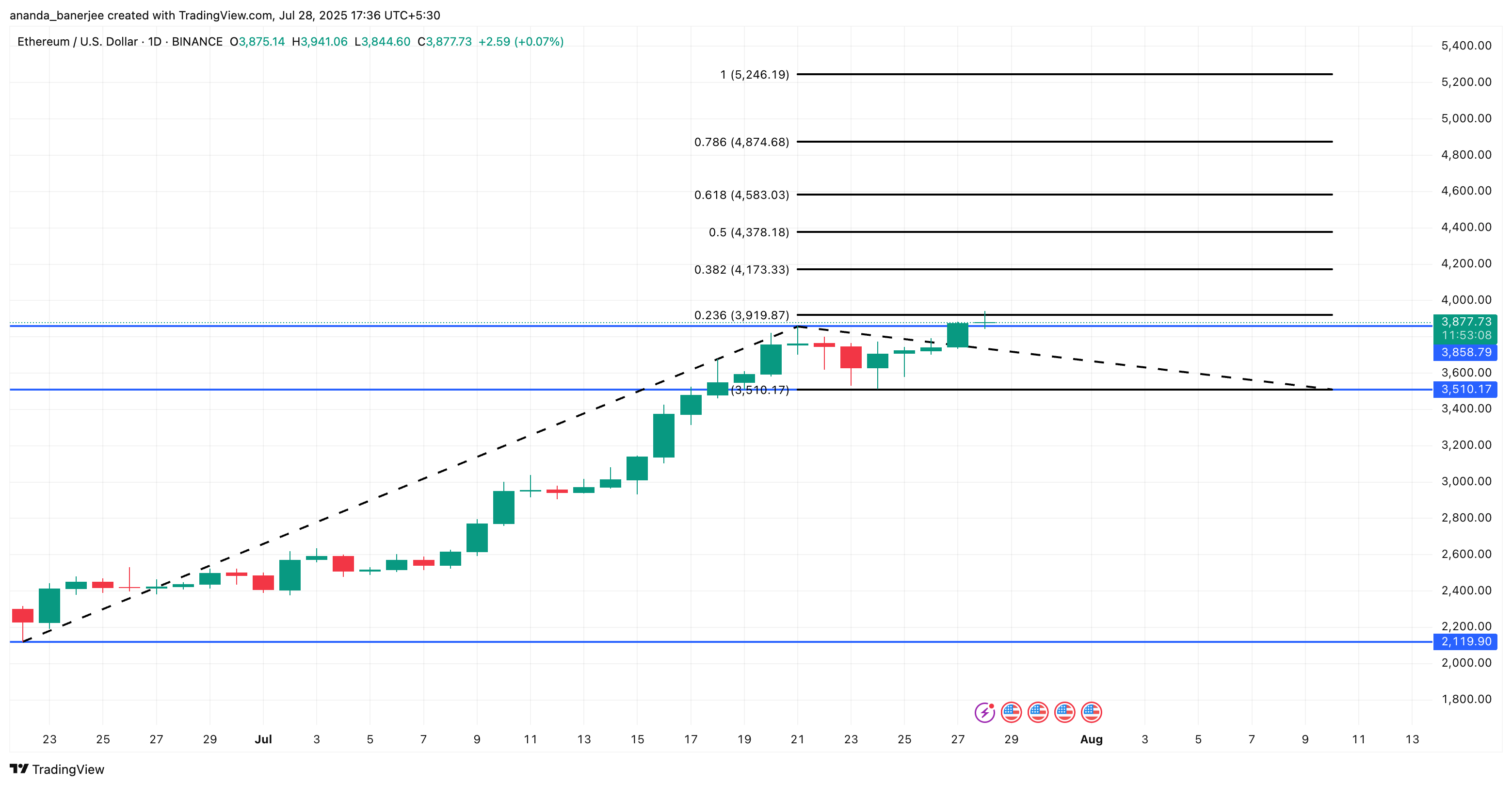

Ethereum Price Action: Key Resistance defines a battle zone

As Ethereum’s outperformance against Bitcoin gains traction, its strength could quickly spill over ETH/USD price action. The ETH/BTC ratio has historically served as a lead indicator for USD breakouts. With the Golden Crossover almost complete, the momentum of the ETH appears to be ready to shift gears

ETH is currently being pushed at $3,919 on the 0.236 Fibonacci expansion level. A clean break and more daily closings could ignite the target as follows:

- $4,173 (0.382 fib)

- $4,378 (0.5 FIB)

- $4,583 (0.618 FIB)

- $4,874 (0.786 FIB)

The move above $4,874 features the newest ever Ethereum Price (ATH) priming. And, as ETH holds 55% of the meetings in July alone, the probability of “ATH” is becoming more and more possible.

ETH Price Analysis: TradingView

However, failing to exceed $3,919 will stall the rally, making ETH vulnerable to retesting support around $3,510. Trendline invalidation level. It’s the line the Bulls need to defend to avoid re-entering a wider integration range. Also, remember that a drop of price can cause the aforementioned liquidation levels.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s daily crypto newsletter.