Claims that Wall Street trading firm Jane Street is causing a bitcoin “dump” every day at 10 a.m. resurfaced on Dec. 12 after bitcoin plummeted during the day.

Social media speculation once again pointed to institutional investors and ETF market makers. However, a closer look at the data reveals a more nuanced story.

What is the story of “10 AM Jane Street”?

According to this theory, Bitcoin is often sold between 9:30 and 10 a.m. Eastern time, when the U.S. stock market opens. Jane Street is frequently mentioned because it is a leading market maker and authorized participant in the US Spot Bitcoin ETF.

Allegedly, these companies would lower prices to cause liquidations and then buy them back at lower prices. However, regulators, exchanges, and data sources have never seen any such coordinated activity.

BREAKING: 10am operations are back.

Bitcoin fell $2,000 in 35 minutes, wiping out $40 billion in market capitalization.

$132 million worth of longs were liquidated in the past 60 minutes.

This is getting crazy. https://t.co/0DRTFfL08r pic.twitter.com/RByT4CWF65

— Bull Theory (@Bull Theoryio) December 12, 2025

Bitcoin futures data shows no active dumping

Bitcoin remained flat during the US market open today, maintaining a narrow range around $92,000 to $93,000. As of just 10 a.m. ET, there was no sudden or unusual drop.

The plunge occurred in late trading, near midday in the United States. BTC briefly stabilized below $90,000, but this suggests lagging pressure rather than an open-driven move.

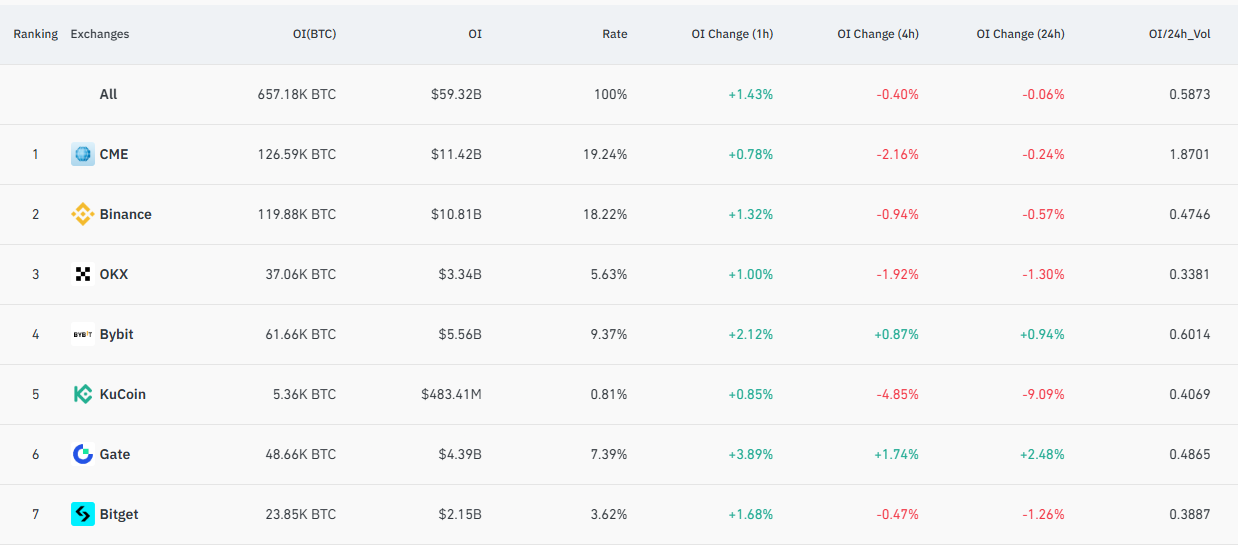

Open interest in Bitcoin futures on major exchanges remained generally stable. Total open interest was almost flat on the day, indicating that new short positions were not accumulating significantly.

In CME, which is most relevant for institutional trading, open interest decreased slightly. This pattern typically reflects risk mitigation or hedging rather than aggressive directional selling.

Total BTC futures open interest. Source: Coinglass

When a large, proprietary company promotes coordinated dumping, a sudden spike or collapse in open interest typically occurs. That wasn’t the case.

Explanation of movements due to liquidation

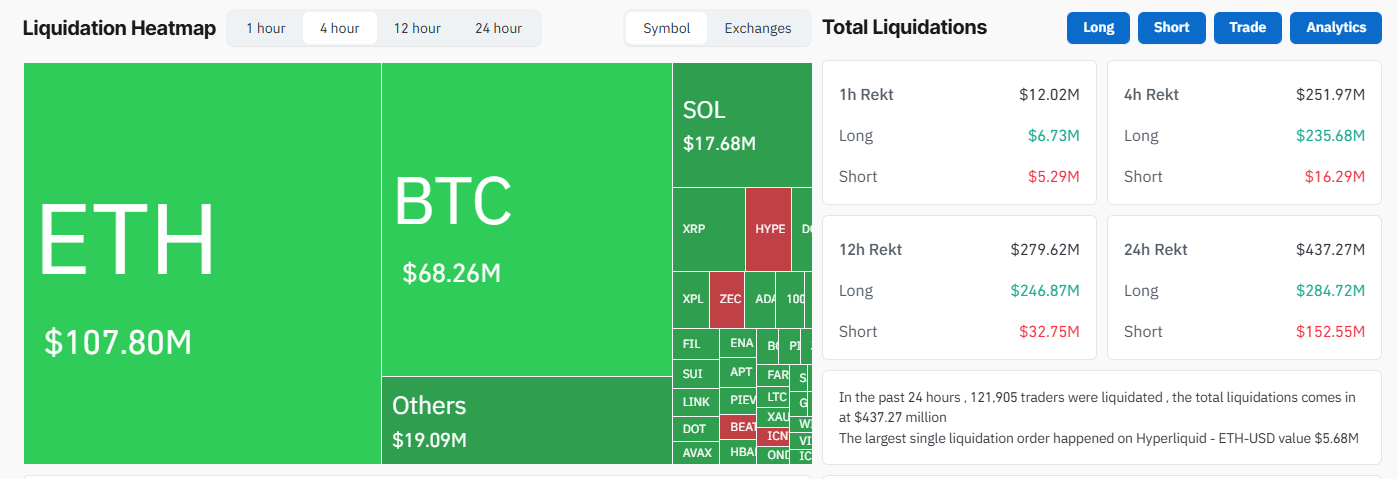

Liquidation data provides a clearer explanation. Total cryptocurrency liquidation in the past 24 hours exceeded $430 million, with long positions accounting for the majority.

Bitcoin alone caused more than $68 million in liquidations, but Ethereum liquidations were even higher. This is indicative of a market-wide leverage flash rather than a Bitcoin-specific event.

Cryptocurrency liquidation on December 12th. Source: CoinGlass

If prices fall below key levels, forced liquidations may accelerate the decline. This often causes a sharp decline without the need for a single strong seller.

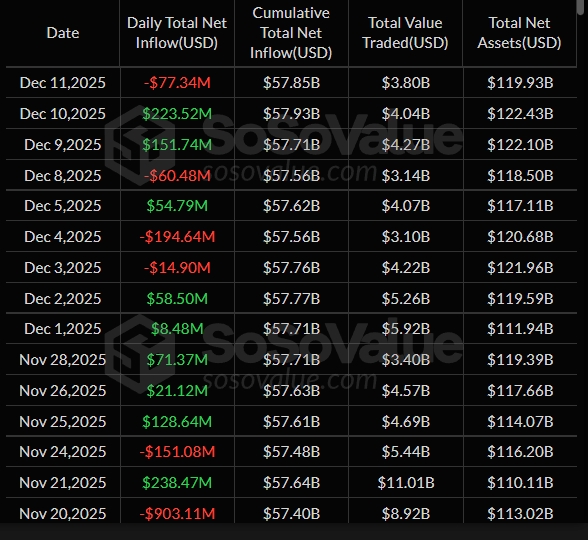

Most notably, the US Spot Bitcoin ETF recorded $77 million in outflows on December 11th after two days of steady inflows. Today’s temporary price shock was largely reflected in this move.

US Bitcoin ETF daily inflows. Source: SoSoValue

No single venue has ever led sales

The move was distributed across exchanges including Binance, CME, OKX, and Bybit. There was no evidence that sales pressure was concentrated on one venue or one instrument.

This is important because collaborative operations typically leave a footprint. The event demonstrated broad cross-market participation consistent with automated risk unwinding.

Why the story of Jane Street keeps repeating itself

Bitcoin volatility is often concentrated during US market hours due to ETF trading, macro data releases, and institutional investor portfolio adjustments. These structural factors can cause price movements to appear patterned.

Jane Street Bot is already in Polymarket xD

While most traders chase stories, one Polymarket account has turned a 15-minute crypto prediction window into a mechanical profit engine.

Trader has not built a sophisticated arbitrage bot.

He found something much simpler: momentum lag… pic.twitter.com/KHUJog4u6C

— gemchanger (@gemchange_ltd) December 12, 2025

Jane Street is well-known for its role in shaping the ETF market, making it an easy target for speculation. However, market making involves hedging and inventory management and is not a directional price attack.

Today’s move fits into a well-known pattern in the crypto market. Leverage build-up, price slips, liquidations cascade and the story continues.

Did Jane Street cause a Bitcoin dump at 10am today? The post appeared first on BeInCrypto.