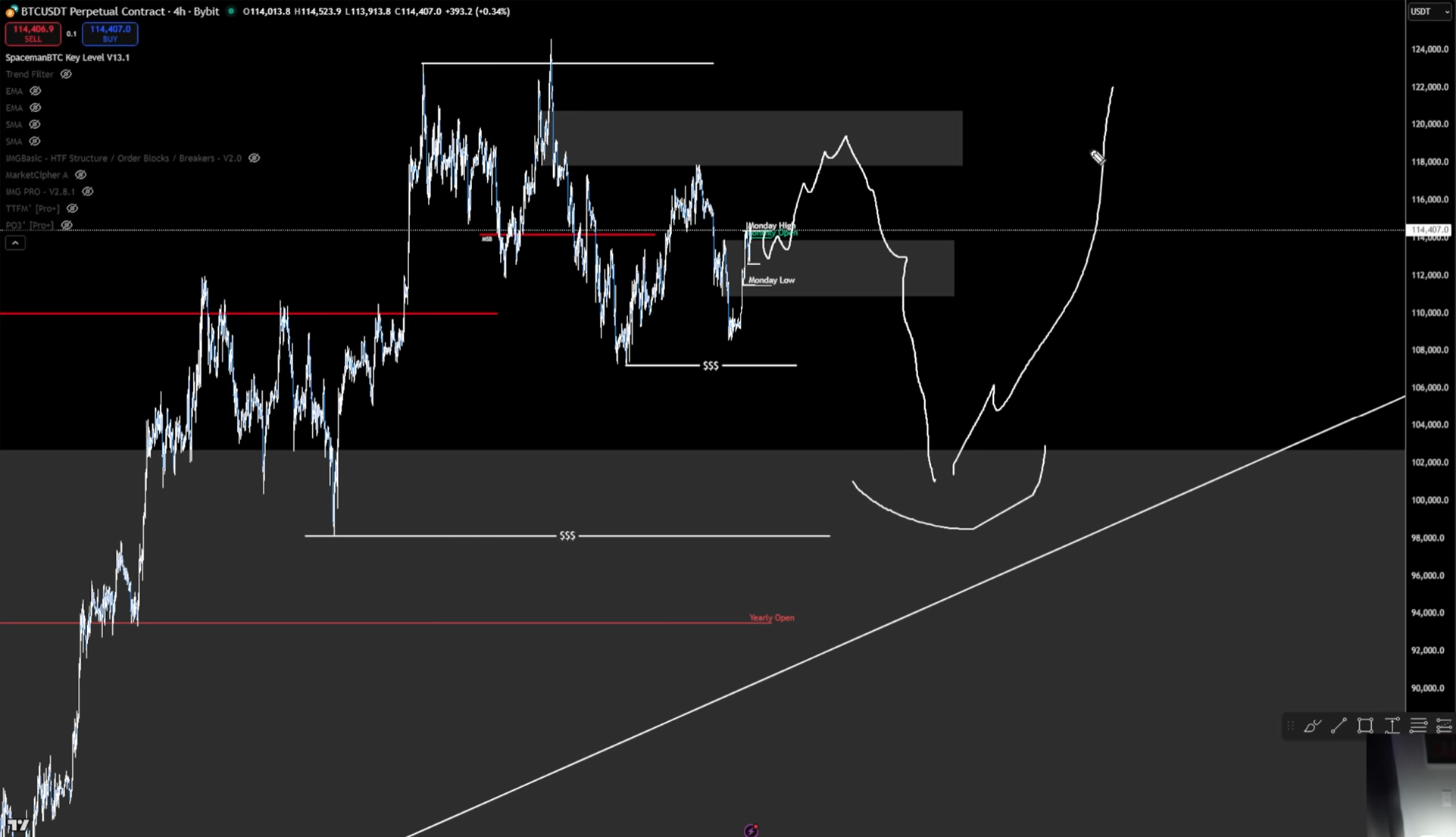

Main, a Crypto analyst trader, notes that Bitcoin may be preparing for a sharper drawdown before it resumes its wider uptrend at the end of the year, claiming that its “$98,000 liquidity level per week” is below the price and can be targeted in early October.

Two price scenarios for bitcoin

On September 30th, in a video analysis titled “Has Bitcoin just got to the top? Everyone is ignoring it…”, the main outlined the two-track playbook.

“TLDR – I think we need a bigger fix right away. To get rid of the $98,000 liquidity level every week,” Main wrote in the teaser via X.

Regarding the structure of Bitcoin, Main said the market respects the recent roadmap. Push-ups, re-tests, and decision points defined by the higher time frame “breaker” levels and low intriwake values. “We had a daily flip to Bitcoin, right? We closed on the breaker,” he said. While the monthly charts are constructive, he said, “weekly charts are technically bearish.”

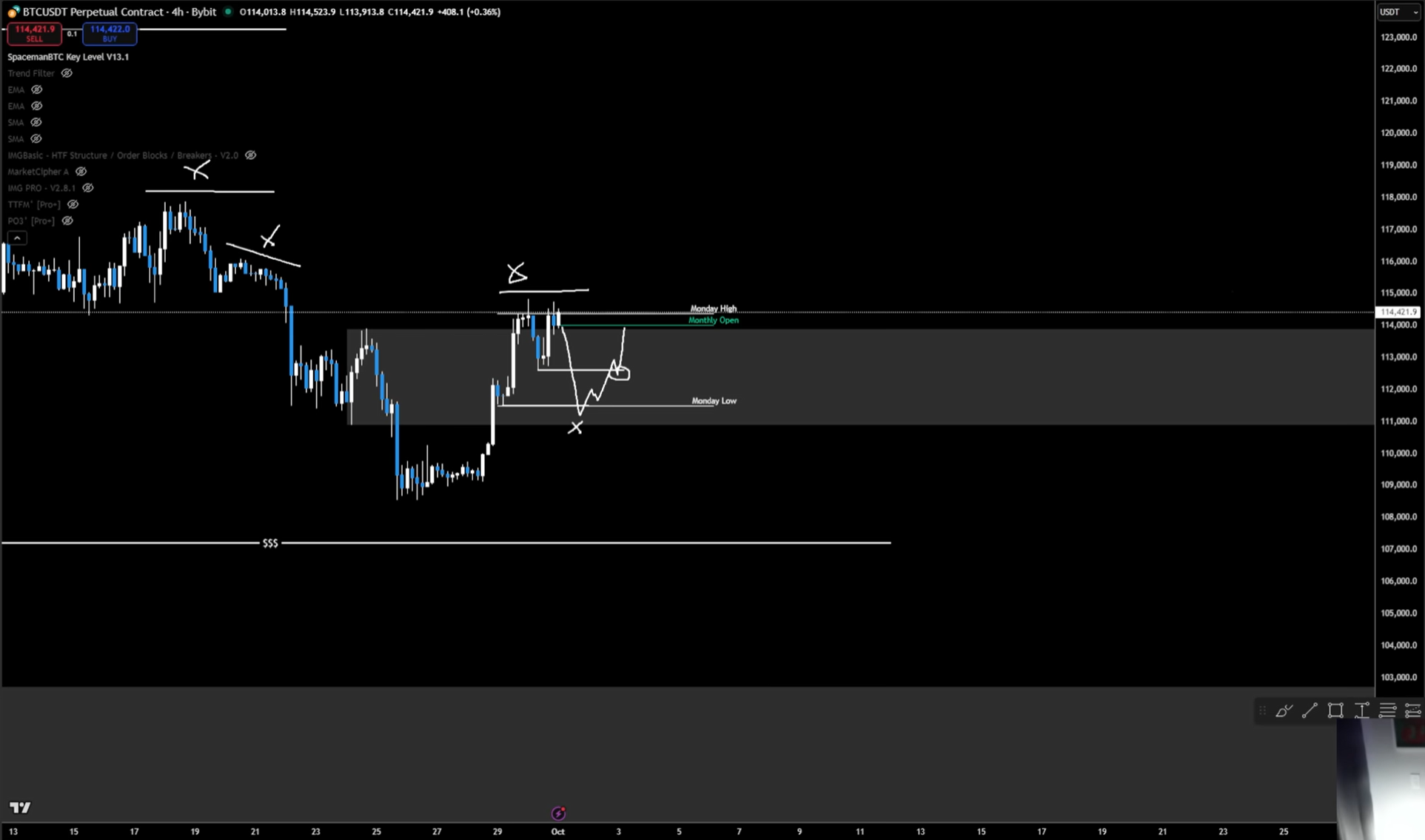

With two high time frames leaning towards soft weekly, he is looking for a four-hour chart to sync the next deal. “If H4 is bullish, then you take the setup by running some kind of liquidity on H4 and at least it’s synced with every day.”

In his view, the immediate trigger is to wipe out the low locality to tighten the risk rather than “appen” to a wide retest with a wide invalidation. “I hope that one of these small liquidity pools of H4 will run here and that will become my setup and my stop is getting tight. There is a clear target here,” he explained.

He highlighted “Monday Low” as a related pivot, highlighting that taking it could produce a long-term average reversal of the nearby daily bearish breaker and previous highs. “Maybe we’ll even do this first, right? Then we get a pullback. But either way, that’s what I’m looking for in Bitcoin here.”

Main emphasized that invalidation is unnegotiable. If Price loses the Intole Baseline on a closing basis, he abandons the long stage and prepares for a bigger washout. “If Bitcoin closes the H4 underneath here, it will close the nuclear weapons to probably $98,000,” he said. In other words, the same liquidity dynamics he tries to exploit for tactical bounce believes that if he breaks a “$98k” cleanout, the weekly chart is still “owed.”

Last dipping before the fourth quarter fireworks

He mapped the Ethereum structure to be similar, flipping daily and 12-hour trends into a constructive, weekly order block, just as accurate entry is required through a low-frame liquidity grab. “A very similar ETH, right? We had a daily flip bullish… we have a breaker. It’s retesting this order block here,” he said. He described the H12/weekly combination where “weekly SFP” and “structural breaks” are in motion, but emphasizes the placement of stops unless Monday’s low sweep provides cleaner triggers. “To me, ETH looks good here to fill this up here…assuming we can get that setup,” he added.

The conditional nature of the plan is central. Main is willing to try a continuous length on nearby resistance only if the market prints a sweep that tightens his neutralization. If he fails, he expects a flaw first. “If we don’t get this little setup here, are we going to do at least one of these? He repeated the time slot checks. “If H4 falls below Monday’s low (nearly $111,000), all bets are off and could actually start an October drop.”

Despite caution, the macro taxi attitude continues to maintain the Q4 dip. The main was repeatedly framing the weaknesses of early October, and was an opportunity rather than a cyclical start. “The idea is that, in the end, this dip might come, whether it’s from here, after a push, or whether it’s a dip we want to buy. “It’s October, November, December. We’re in the fourth quarter… I think we’re trading high in the fourth quarter.”

At the time of pressing, BTC traded for $116,238.

Featured images created with dall.e, charts on tradingview.com