Decentralized exchange (DEX) trading activity surged to new highs in October, demonstrating the global cryptocurrency market’s continued shift towards on-chain finance.

According to data from DeFiLlama, perpetual DEX trading volume exceeded $1.36 trillion last month, the highest level ever. This number surpassed August’s peak of $759 billion and became a new benchmark for on-chain trading activity.

Hyperliquid takes the lead as on-chain perpetual gains momentum

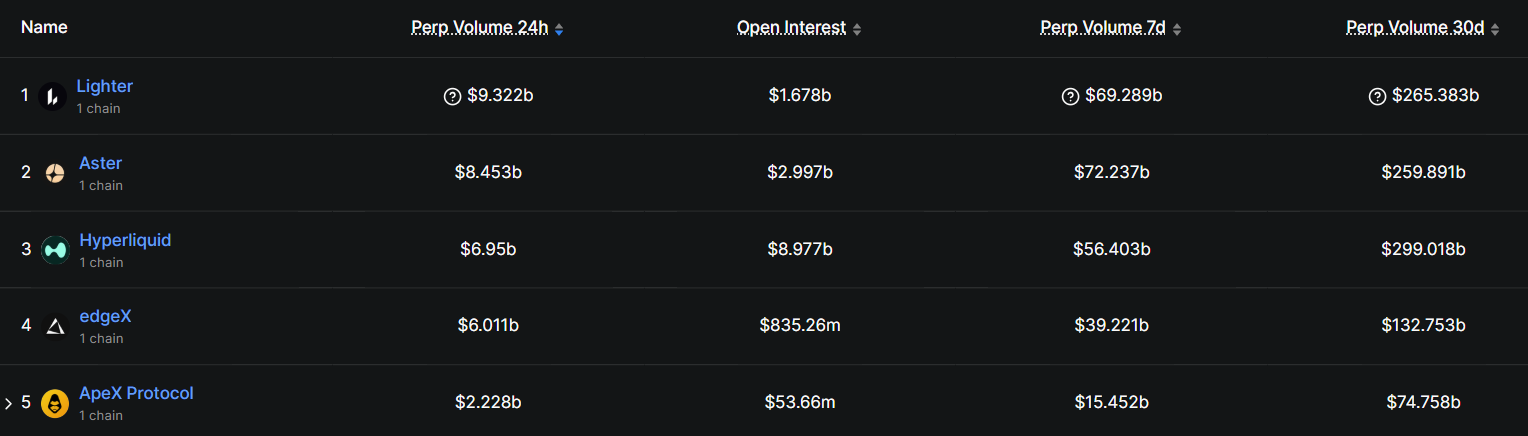

The rapid increase in trading volume confirms the growing confidence of investors in on-chain platforms. Hyperliquid, the layer 1 blockchain that has dominated the persistent DEX landscape, accounted for approximately $299 billion of the October total.

This was followed by Lighter, an Ethereum-based DEX, which processed approximately $265.4 billion, and Binance-linked Aster, which processed approximately $259.9 billion.

Top 5 Perps DEX Platforms. Source: Defilama

The performance of new players such as Lighter and Aster shows that traders are steadily migrating away from centralized exchanges (CEX). They are instead turning to decentralized venues that offer greater transparency, lower fees, and direct control of their assets.

In fact, the spot volume share from DEX to CEX has doubled from less than 10% last year to more than 20% in 2025.

Notably, Hyperliquid is both a driver and beneficiary of that momentum.

Industry analysts believe that this on-chain boom is due to several intertwined factors. The rise of platforms offering improved interfaces and incentives such as airdrops and points programs has attracted retail traders in droves.

But this trend also reflects deeper structural changes. Following repeated centralized exchange scandals and increased regulatory scrutiny, many traders now believe that DEXs are a safer place to maintain custody and provide early access to new tokens.

Still, October’s record numbers were not purely natural.

This spike in trading volume coincided with roughly $20 billion in forced liquidations across leveraged positions at the beginning of the month. The wave was sparked after President Donald Trump said the United States could raise tariffs in response to new restrictions on China’s rare earth exports.

The comments caused a significant decline in risk assets, sending crypto prices lower and triggering a wave of record trading activity across platforms.

In fact, CoinShares later reported that the resulting market turmoil had generated record weekly trading volume of over $53 billion in regulated crypto investment products such as ETFs.

The post DEX trading volume surges above $1 trillion as investors shift away from CEX appeared first on BeInCrypto.