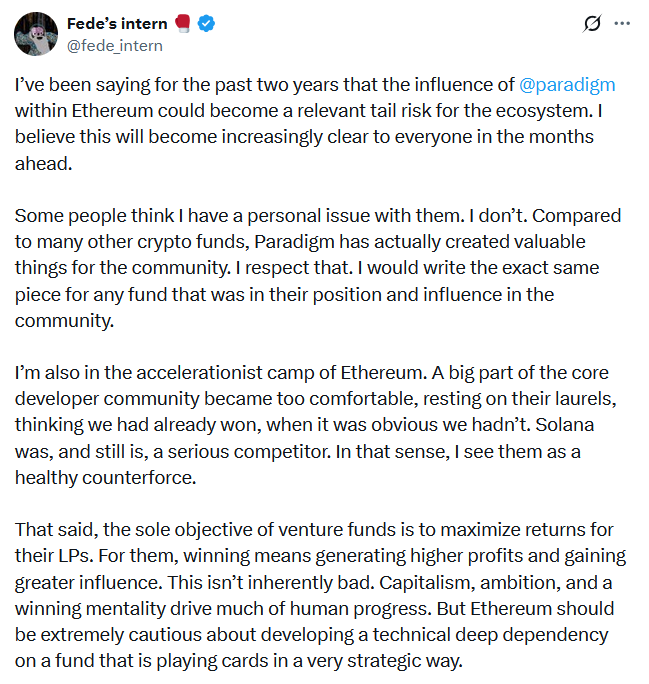

Ethereum developer Federico Carone said the growing influence of companies such as Paradigm on the network could be a “tail risk” to the Ethereum ecosystem.

A core Ethereum developer at Company X, who is referred to as a “Fede intern,” argued in a post on Sunday that while Paradigm has “created something of value for the community,” he is concerned about the growing influence of venture funds whose end goals are profit and influence.

“I have been saying for the past two years that the @paradigm impact within Ethereum could be a relevant tail risk to the ecosystem, and I believe this will become increasingly clear to everyone in the coming months.”

sauce: Federico Carone

Carone added that while Paradigm’s hiring of leading Ethereum researchers and funding of open source libraries “important to Ethereum” may seem good on the surface, it doesn’t sit well with those who think Ethereum should represent a “philosophical and political” movement that is “bigger than any company.”

Paradigm has made a series of Ethereum plays over the years, including Reth, an Ethereum development software based on the Rust language.

One notable recent initiative is partnering with fintech giant Stripe to incubate Tempo, a competing layer-1 blockchain.

Tempo is still in development and will be L1 focused on stablecoins and payments, with Stripe essentially controlling the network. Its ethos is in stark contrast to Ethereum’s decentralized and open-source nature, given that it is a corporate-controlled chain.

Ultimately, Carone’s concerns center around the different objectives of decentralized and centralized organizations, and the dangers of allowing funds of any kind, not just Paradigm, to have too much influence over the Ethereum ecosystem.

“We have to be very careful that Ethereum is technically deeply dependent on funds operating their cards in a very strategic way.”

“When companies gain too much visibility and influence over open source projects, priorities start to drift away from the long-term vision of the community and toward corporate incentives. That’s when misalignment begins.”

Cointelegraph reached out to Paradigm for comment, but did not receive a response as of press time.

Carone calls for balance in a follow-up post. sauce: Federico CaroIt is

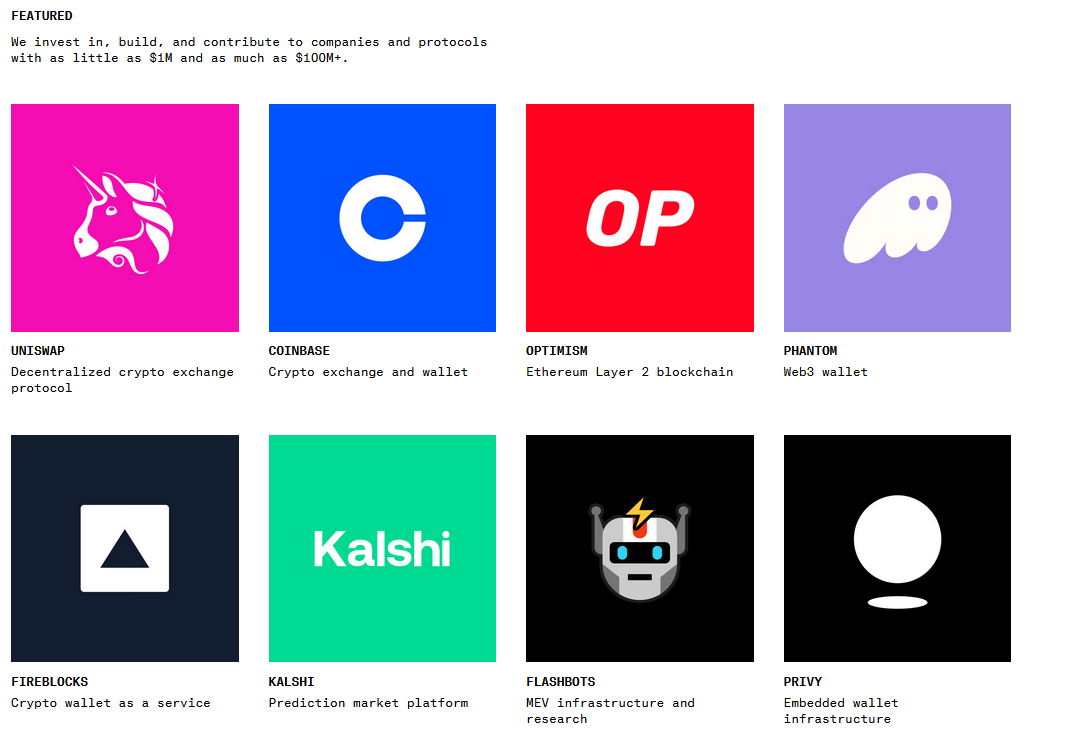

paradigm crypto venture

Paradigm is a cryptocurrency and AI investment company founded in 2018 by Matt Hwang, formerly of VC giant Sequoia, and Coinbase co-founder Fred Asum.

The company invests broadly across markets, covering everything from DeFi and NFTs to blockchain security, infrastructure, and startups.

Part of Paradigm’s investment portfolio. sauce: paradigm

In Tempo’s initial announcement in September, Paradigm outlined its goal as advancing crypto technology and adoption through a “combination of investing, building, and research.”

“This helps us understand friction points and opportunities and brings us closer to the limits of what is possible,” the announcement reads.

Other than purely economic play, We have made several moves that demonstrate our firm belief in the crypto community. From filing court briefs in support of Tornado Cash co-founder Roman Storm to hiring acclaimed blockchain detective ZachXBT as an advisor to fund research and help protect VC firms.