Jupiter (JUP) turned into a multi-purpose app on Solana, and fees and revenue peaked. Nevertheless, the JUP token is still under pressure.

Despite the increased interest in the Solana ecosystem, JUP is still trading at low levels with no signs of a breakout. Jupiter’s services are key to meme token trading, general routing to Solana DEX, and other tasks. This app is often one of the main commission generating apps on Solana.

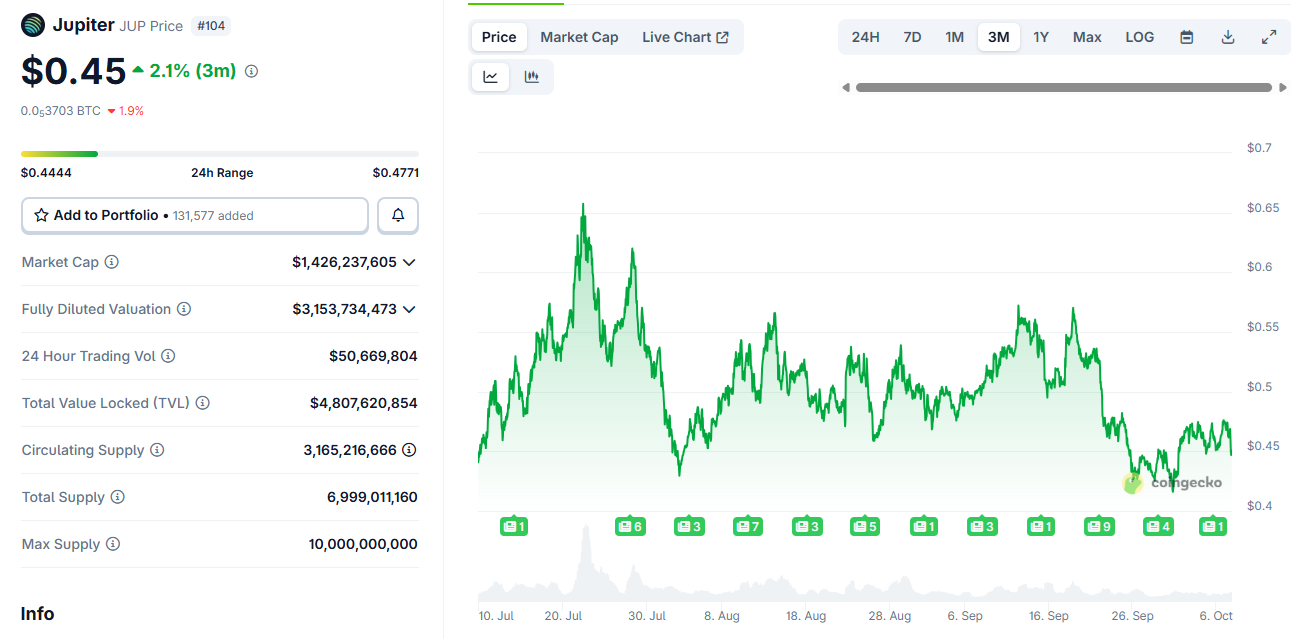

JUP traded in a relatively narrow range and failed to break out despite overall optimism for altcoins. |Source: Coin Gecko

However, native JUP tokens do not show any relationship with project performance. JUP traded between $0.65 and $0.45 over the past six months, peaking at $1.25 in December 2024. JUP open interest in the derivatives market is just $83 million, down from $249 million at the beginning of 2025.

JUP is also near the lowest price against SOL, leaving investors stuck with an asset that lags behind major networks.

Another proof of the high valuation of cryptocurrencies is that bs@JupiterExchange has one of the largest user bases on defi, one of the highest revenues, and is actively expanding its products, with many announcements planned for existing products like @jup_lend and Jupnet launching soon, so keep an eye out.

— DMH 🦇🔊🌊 (@DeFi_Made_Here) October 3, 2025

Despite its successful product, JUP still has a market capitalization of only $1.42 billion. The token still has an FDV of $3.15 billion, which could indicate years of selling pressure.

Questions are also currently being raised in the Jupiter community about the utility of JUP and the impact of increased trading. One suggestion is to try to migrate the JUP utility and copy the Hyperliquid model with buybacks based on protocol fees.

Why is JUP lagging behind?

JUP receives support from teams in the form of buybacks. However, the token may also face selling pressure from retailers and early whales. Additionally, the 2025 Jupurey event caused significant selling pressure, with prices falling from their local highs in December 2025.

Even the recent Meteora MET airdrop for Jupiter stakers was not enough to increase demand for the token and lift the market price from its lows. JUP also did not rise, despite Jupiter offering perpetual futures trading.

JUP is planning another Jupuary event in early 2026 to distribute 700 million tokens. Until then, other measures to support prices may be inefficient, as the market still expects airdrop recipients to sell.

Jupiter is still introducing new products

JUP is also expanding its supply through Active Staking Rewards (ASR), leading to some token inflation. In addition, the team still has more than $58 million in strategic JUP reserves, Litterbox, that have not been burned or locked up. One proposal involves burning the strategic stockpile and reducing the total supply of JUP.

I’ve said it many times and I’ll say it again:

– burn the trash can

– 3-4b Burn the supply

– Changed ASR reward from 50% protocol fee to SOL

– Allow staked JUP to be used as collateral

– Use JUP as gas fee for JUPNETI’m a $JUP supporter, but the team needs to address these points

— David (@davidkimoficial) October 5

The community is concerned about the overly generous monthly ASR program, which will increase supply by about 10% on top of the upcoming Jupuary.

Jupiter still generates $2.41 million in daily fees based on its most widely used products, including its native DEX, router, and perpetual futures market.

Jupiter recently released a new product. desktop wallet It integrates all of your services and provides access to the Solana ecosystem at an even lower price. The desktop wallet plans to expand into NFT trading and complex DeFi positions.

Want to present your project in front of the top people in crypto? Get featured in the next industry report that combines data and impact.