Analyzing some of the key metrics in Bitcoin (BTC) it appears that despite the ongoing market revisions ongoing renewed interest, prices are ready for a surge in prices.

Accumulated trend score

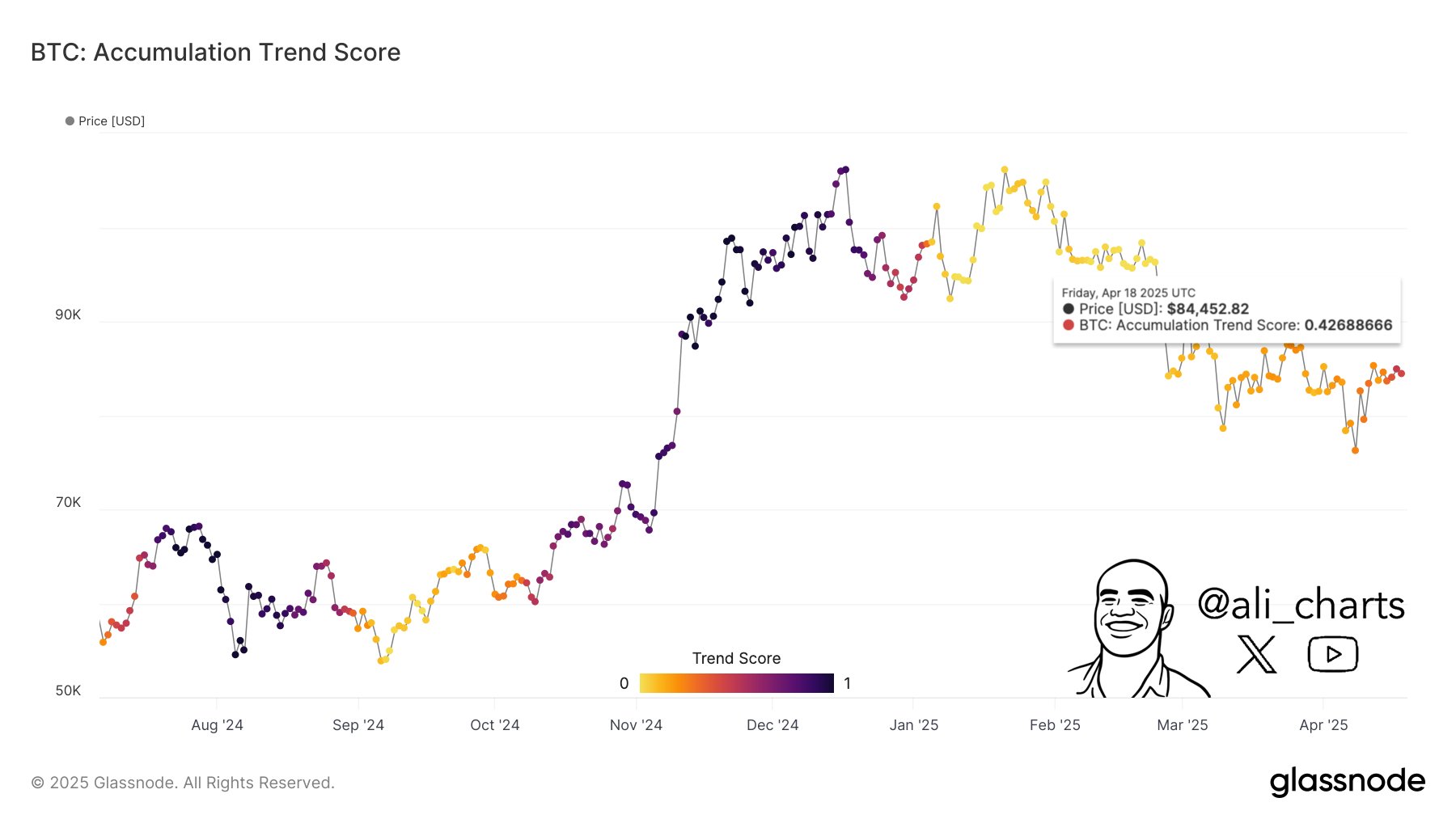

On April 18, 2025, Bitcoin’s accumulation trend score reached 0.4268, but BTC prices were suspended at $84,957.

Accumulation activity showed moderate signs, while indicating that it showed investors’ entrance after the market stagnated according to this analytical score.

Following a 1.0 accumulation score by the second half of 2024, a strong bullish swing in Bitcoin prices, especially when BTC went below $70,000 to over $90,000 in November and December.

The latest accumulation scores ranged between 0.2 and 0.3 since March 2025 and early April, indicating a decline in purchasing activity.

BTC accumulation trends | Score: X

Accumulation score of 0.42 indicates that potential institutions alongside large holders may have bullish intentions on BTC price recovery.

BTC is approaching a value of 1.0, so by building support from accumulation activity, it could maintain an upward movement, potentially exceeding the previous price level of $90,000.

Trend scores indicate that the potential period of this careful purchase may not last as long as it has not reached a strong confidence level.

Another drop in demand will cause BTC to return to its distribution stage, with additional price stabilization or modifications.

A key requirement for monitoring this score is continually present as accumulated blockchain data can ultimately generate large uptrends.

BTC price movement tracking

The Bitcoin cycle has entered a turning point as 170,000 BTC moved from short-lived ownership to a longer time frame.

The major movements of Bitcoin from temporary holders to long term holder positions throughout history often form the basis for significant fluctuations in market prices.

Historical data shown on the chart shows that changes in Bitcoin prices coincide across green zones as prices rise and the red zone lead to price drops.

The current movement shows fresh Bitcoin owners are getting coins in extended time frames that frequently serve as signs before prices rise.

BTC used the output band | Source: Cryptoquant

The ongoing pattern indicates that the establishment of a strong investor base through the exit of weak investors and increases the prospect of expanded price rise through stronger hand accumulation.

BTC prices could undergo downward corrections towards the recent integrated support level if new demand does not emerge from this shift.

The current Bitcoin price, close to $84,975, could affect future market directions as holders change positions, but the actual outcome will depend on the amount of markets participants will participate in.

Dynamic market fluctuations can arise from investors handling this change in market structure.

Lags between Global Money Supply and Bitcoin

The price separation of Bitcoin from global M2 money supply occurred in September 2024 at the same size, leading to a 90% increase in price in BTC.

The latest data shows M2 supply from the top 21 central banks has seen a sharp increase of between $105 trillion and $108 trillion.

The Bitcoin market maintained nearly the same price level, nearly $84,000, with similar timing delays as in the third quarter of 2024.

M2 Global Supply and BTC Growth Rate | Source: x

Bitcoin’s price stabilized at $60,000, but the market experienced a liquidity expansion that surged over the course of weeks, with its value rising above $114,000.

The current increase in M2 supply demonstrates the potential future power as a fuel source for such delayed market changes.

With increased demand in the risky asset market, BTC could recover or surge beyond its previous price peaks.

If macroeconomic factors become stiff or if the M2 curve shows early growth delays, potential upward price movements may not occur as expected.