Today’s Ethereum Price: $1,760

- Ethereum’s accumulation address purchased ETH for over 111 million people last week.

- A steady decline in ETH net taker volume indicates that short traders are experiencing seller fatigue.

- The Ethereum exchange saw a net inflow of 178,900 ETH on Thursday as investors booked profits from recent price increases.

- Eth Bears continues to put pressure on $1,800 and a 50-day SMA hurdle.

Ethereum (ETH) fell 1% on Friday as sellers controlled exchange activities in the last 24 hours. Despite recent sales, an increase in flow to accumulated addresses and a decrease in net taker volume indicates that bullish momentum has gradually returned.

Despite recent sales pressure, Ethereum accumulation addresses dominate

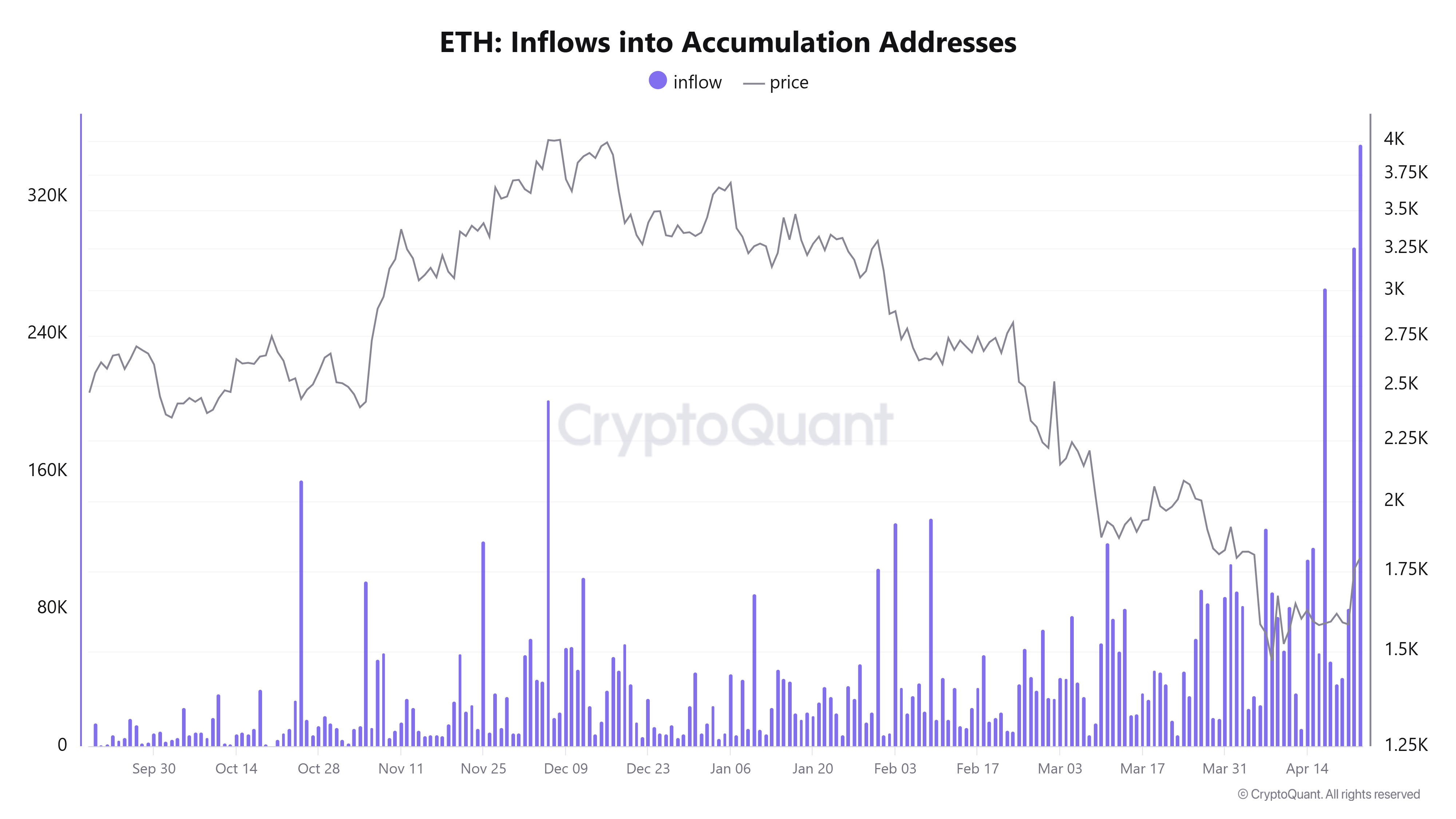

Ethereum’s accumulation address – a metric tracking address that never spent money on – has seen an influx of ETH of over 111 million people between April 17th and 23rd, boosting confidence over the past week.

ETH flows into the storage address. Source: Cryptoquant

This shows the return of bullish sentiment among long-term ETH investors, with the highest accumulation address injections every week in 2025.

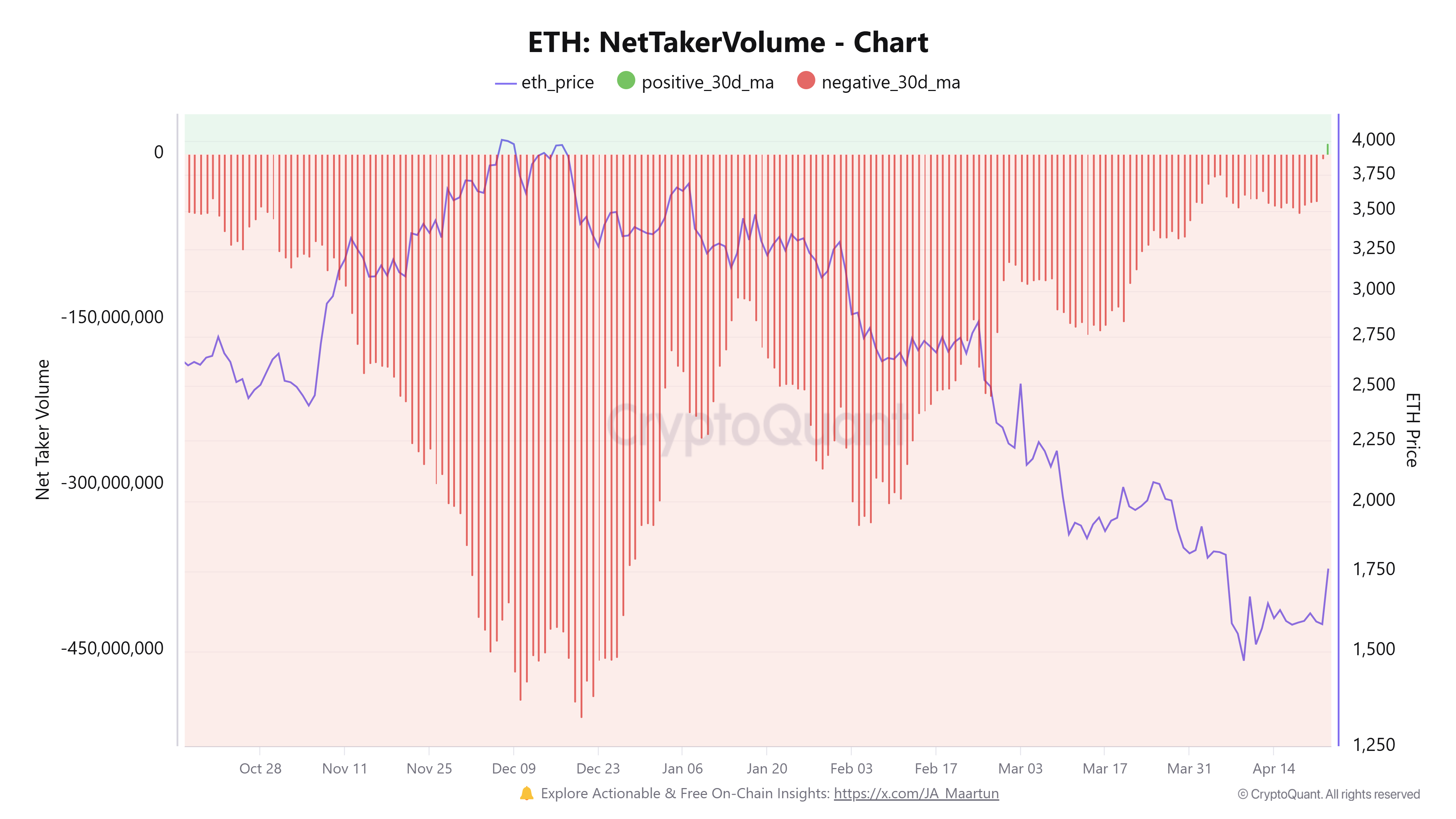

Ethereum’s Nettaker Volume draws a similar picture. Nettaker volume shows the difference in the volume of futures contracts.

Shorts have dominated ETH futures over the past six months, but Netnettaker volume has been steadily declining since January, despite ETH prices falling significantly over the period. This shows sellers are gradually seeing fatigue, lowering the April 11 price drop to $1,473, a potential price bottom.

ETH Net Taker Volume. Source: Cryptoquant

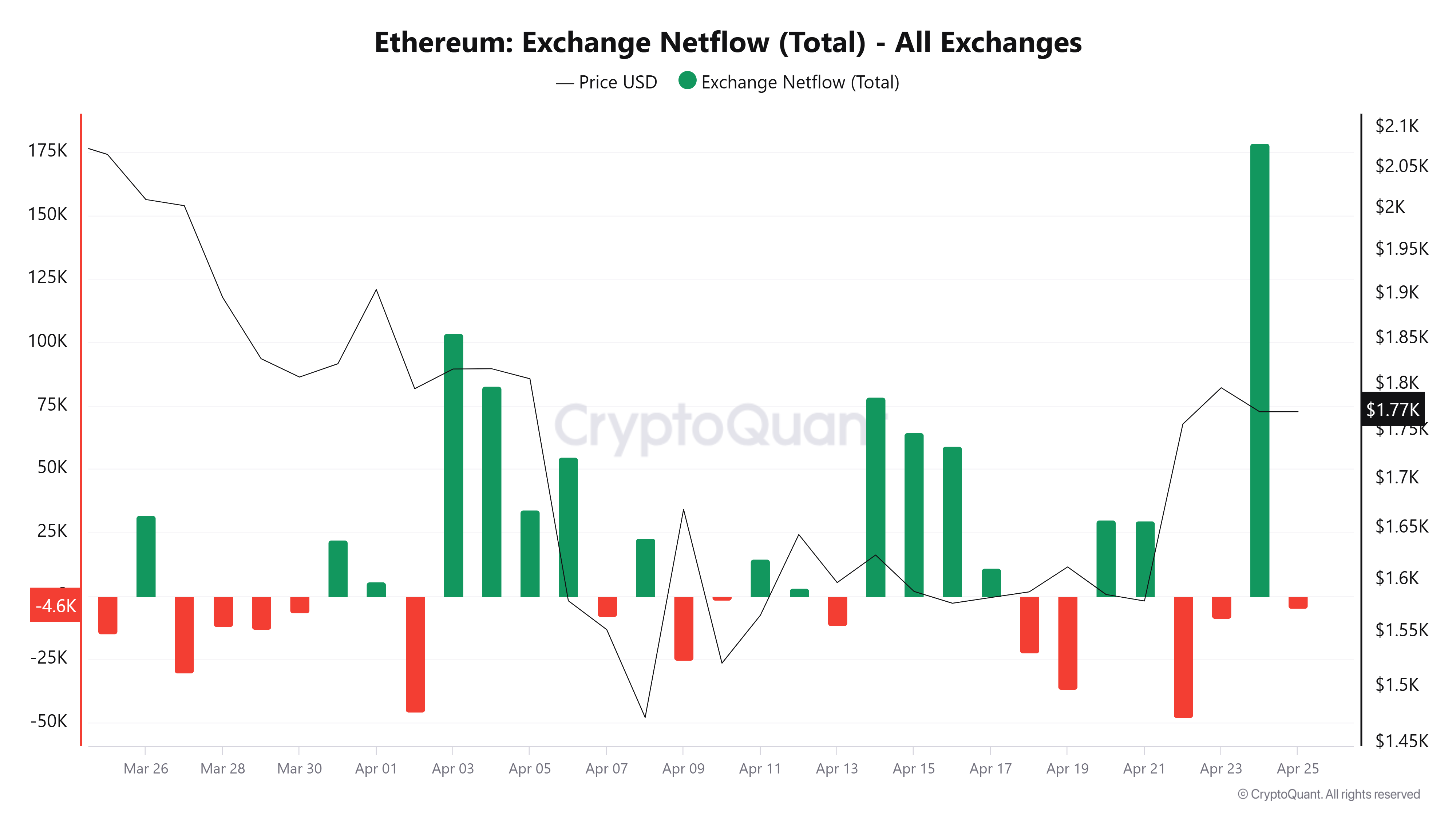

However, ETH Exchange’s net flow reveals that despite the price surge and recovery seen across the general crypto market, investors still show signs of fear.

Ethereum saw one of the largest daily net inflows of exchange in 2025 on Thursday as investors may have caused net sales of over 178,900 ETH, worth around $317 million. Exchange Netflow indicates the difference in coins that enter and exit the crypto exchange. Positive values indicate an increase in sales pressure, and vice versa indicates a negative value.

Eth Exchange Netflow. Source: Cryptoquant

As a result, ETH has temporarily declined below $1,750 in the past few hours, showing a slight recovery. Selling activities during price increases after weeks of consolidation or downtrends is often attributed to short-term traders or investors reducing losses as prices return to cost-based.

In other news, Ethereum celebrates its 10th anniversary since the Genesis Block on July 30th. Ethereum Foundation (EF) announcement Working with community members, we will support and sponsor “a series of global meetups, on-chain artifacts and livestreams to ring together Ethereum over the next decade.”

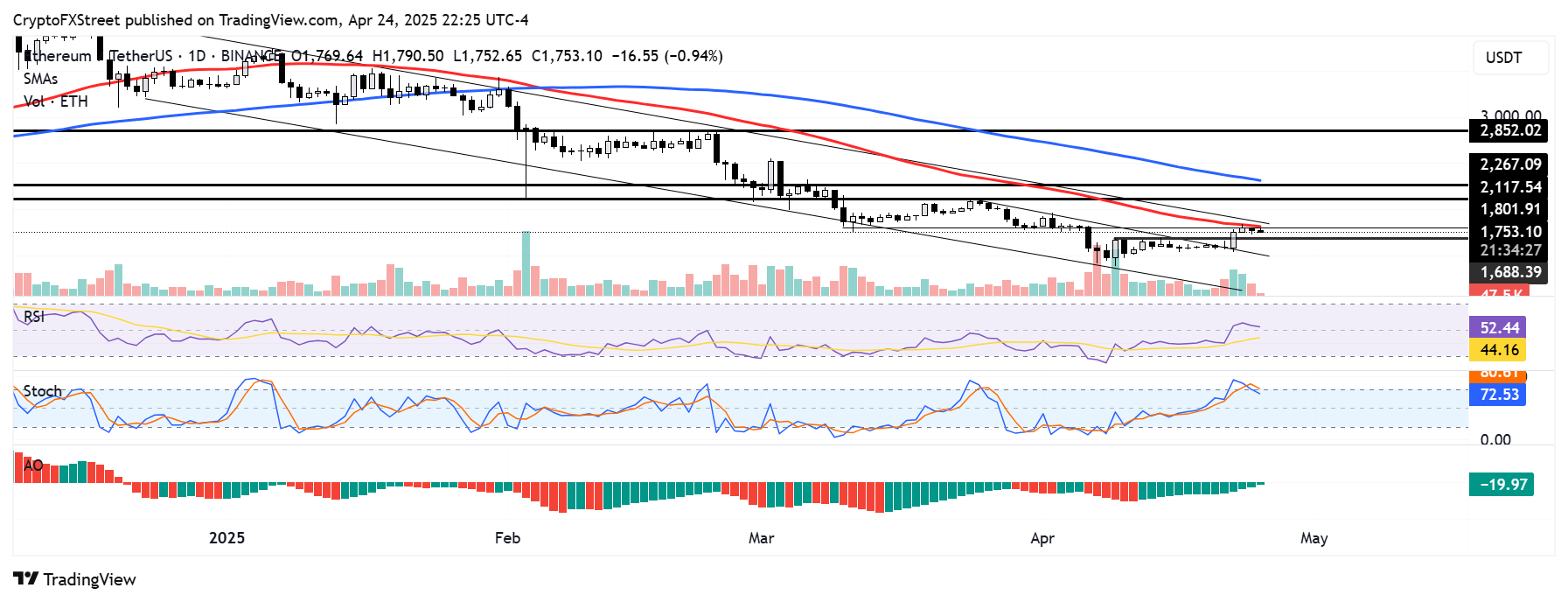

Ethereum price forecast: ETH cannot clear $1,800 and 50 days of major SMA resistance

Ethereum has maintained $40.22 million in Futures liquidation over the last 24 hours per Coinglass data. The total amounts of long and short liquidations are $2,707 million and $13.16 million, respectively.

ETH was rejected at the $1,800 level. This was enhanced by the 50-day Simple Moving Average (SMA). When Top Altcoin bounces off the $1,688 level, it could retest a psychological level of $1,800 and potentially clear the upper limit resistance of the downward channel.

ETH/USDT Daily Chart

This kind of move allows ETH to regain a key level of $2,000 and challenge the $2,100 to $2,200 resistance range. However, since we were unable to hold $1,688, we can send an ETH to find support on the main descending trendline.

The Stoch Oscillator (Stoch) retreated from the buy-out area after two days. The relative strength index (RSI) is above its neutral level, while the great oscillator (AO) consistently posts a regression histogram bar below its neutral level. This shows a modest domination in bullish momentum.