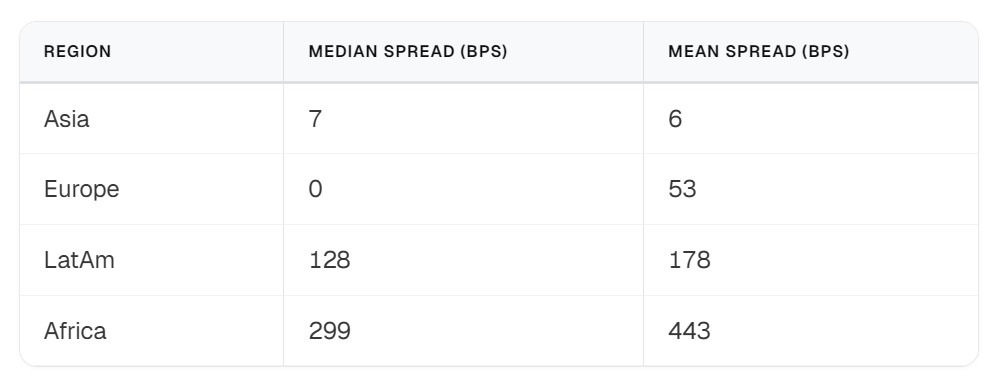

According to data observed by payments infrastructure company Borderless.xyz, covering 66 currency corridors and approximately 94,000 rate observations, Africa had the highest median stablecoin-to-fiat conversion spread among tracked regions in January.

The median regional spread was 299 basis points, or about 3%, compared to about 1.3% in Latin America and 0.07% in Asia. In Africa, conversion costs ranged from about 1.5% in South Africa to almost 19.5% in Botswana.

The data measures the “spread,” or the difference between a provider’s buy and sell rates for a stablecoin and fiat currency pair. Similar to the bid-bid spread in traditional markets, it reflects the execution cost paid when converting a stablecoin to local fiat currency.

The findings suggest that although stablecoins are being promoted as a cheaper alternative to traditional remittance rails, their actual costs vary widely across African markets and are likely to be closely linked to local provider competition and liquidity.

Median regional spread for stablecoin conversion. Source: borderless.xyz

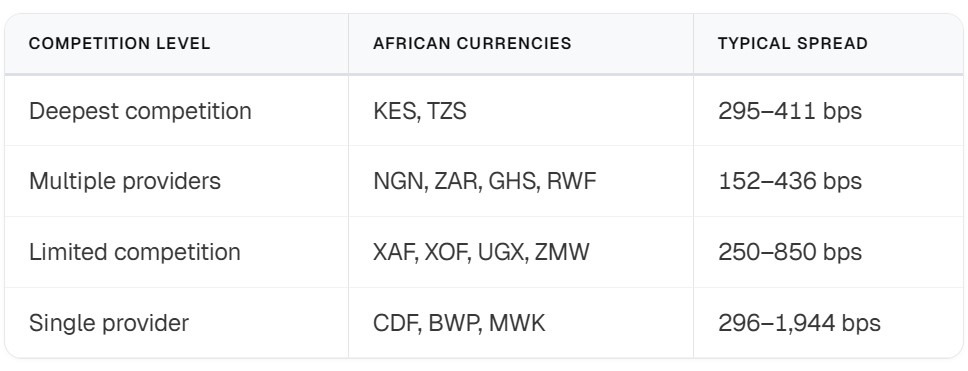

Competition causes price differences

Borderless.xyz found that in markets with multiple competing providers, conversion costs are typically around 1.5% to 4%. In markets with only one provider, costs often exceeded 13%.

Botswana had the highest median conversion cost in January at 19.4%, but pricing improved later in the month. Congo’s costs also exceeded 13%. In contrast, in South Africa, which has a more competitive foreign exchange market, costs were around 1.5%.

The report suggested that these differences are primarily driven by local market conditions such as liquidity and competition, rather than the underlying blockchain technology. In countries with multiple providers operating, conversion costs remained close to regional averages.

Conversion costs at different competition levels. Source: borderless.xyz

Related: Ugandan opposition leader promotes Vichat amid fears of internet blackout

Comparison of stablecoins and traditional forex

The report also compares stablecoin median rates to traditional interbank foreign exchange rates, measuring what is called the “TradFi premium.”

This indicator reflects whether the stablecoin’s exchange rate is lower or higher than the traditional foreign exchange mid-market rate.

Across 33 currencies around the world, the median difference between stablecoin exchange rates and traditional mid-market exchange rates is approximately 5 basis points (0.05%), indicating that they are closely matched.

In Africa, the median difference was even wider, at about 119 basis points, or about 1.2%, although the gap varied widely by country.

On January 24, economist Vera Songwe said at the World Economic Forum in Davos that stablecoins are helping to reduce the cost of sending money across Africa, where traditional money transfer services charge around $6 per $100 sent.

New data adds context and suggests that while stablecoins offer faster settlements and potential savings compared to traditional services, conversion costs within certain corridors remain high.

magazine: Hong Kong stablecoin BitConnect kidnapping arrest in Q1: Asia Express