KI YOUNG JU, CEO of Blockchain Analytics Platform Cryptoquant, declared that the Bitcoin Bull cycle is over. In particular, Premier Cryptocurrency has been struggling to set up a continuous rise in January after the new record of $ 109,000 in the new history, causing questions about the viability of the current bull.

The price that Bitcoin does not respond is pointed out the beginning of the market.

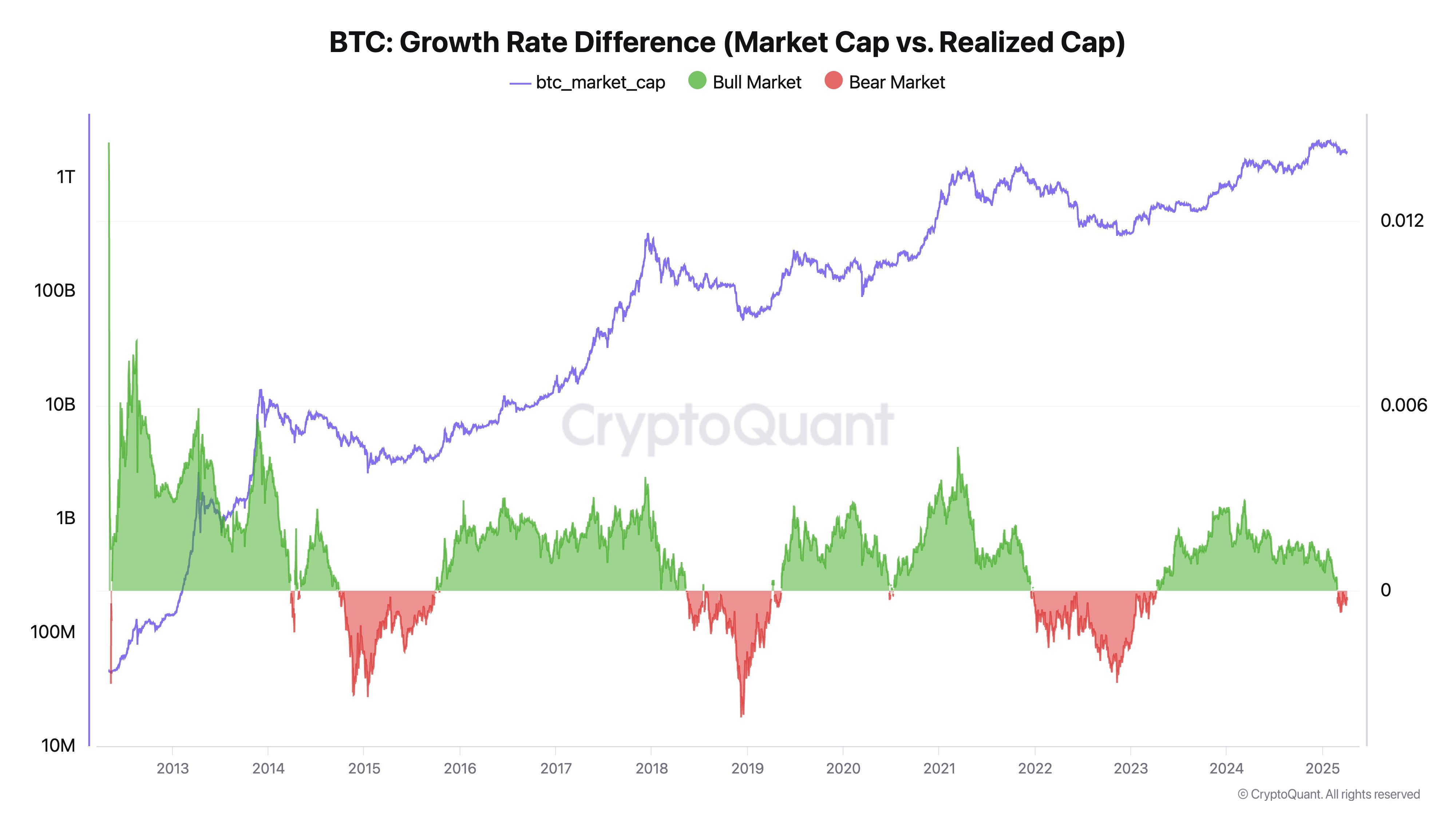

On April 5, in the X post, KI Young Ju shared an interesting theory about why Bitcoin concluded the current bull. The noticeable encryption figures are based on this estimates based on the realized CAP and the warm chain data concept around the market cap.

Young Ju describes the realized CAP as a total capital flowing to the BTC market, as revealed by the actual warm chain. The realized CAP combines the last price of each coin to show more accurate measurements of the BTC network.

On the other hand, the market capitalization provides BTC network evaluation based on the latest exchanges. Cryptoquant CEO explains that the market cap/price does not increase or decrease in proportion to the size of the transaction according to the general misunderstanding, but does not increase due to the balance between purchasing and sales pressure.

Young JU says that the price and market cap can increase due to low sales pressure. On the other hand, large -scale bitcoin purchases are composed of market sellers, so it may not affect positive price response.

Looking at both concepts, the realized CAP measures capital inflows into the BTC market, while the market capitalization shows a price response to these inflows. Therefore, Cryptoquant Boss shows a classic weak signal because the increase in the realized upper limit is that the price is reduced or maintained in a state that does not change, but the price does not respond positively despite the new investment.

Alternatively, the stagnant upper limit with an increase in market cap is a strong signal that reflects low -level sellers. Therefore, a small amount of new capital can cause significant prices.

KI YOUNG JU is currently rising at prices that have failed to rise in prices, as indicated by the chain data from the exchange, ETF market and management wallet activities that the previous situation is currently underway in the Bitcoin market. This development suggests the presence of the bear market. Young Ju says that the current sales pressure can be lost at any time, but historical data supports at least six months of reversal.

Bitcoin price outline

Bitcoin at the prestime time, reflecting a 0.94% decrease last day, to $ 83,700.

Things’ main image of TRADINGVIEW

Editorial process focuses on providing thorough research, accurate and prejudice content. We support the strict sourcing standard and each page is diligent in the top technology experts and the seasoned editor’s team. This process ensures the integrity, relevance and value of the reader’s content.