Digital asset treasuries will soon evolve beyond the famous “static vaults” of cryptocurrencies and instead aim to offer tokenized real-world assets, stablecoins and other income-producing assets, according to crypto industry executives.

“The next step for Web3 Treasury is to transform its balance sheet into an active network where capital can be staked, re-staked, lent or tokenized under transparent and auditable conditions,” said Maja Vujinovic, CEO of Ether (ETH) treasury company FG Nexus.

“The lines between Treasury and protocol balance sheets are already blurring, and companies that treat Treasury as a productive on-chain ecosystem will perform better.”

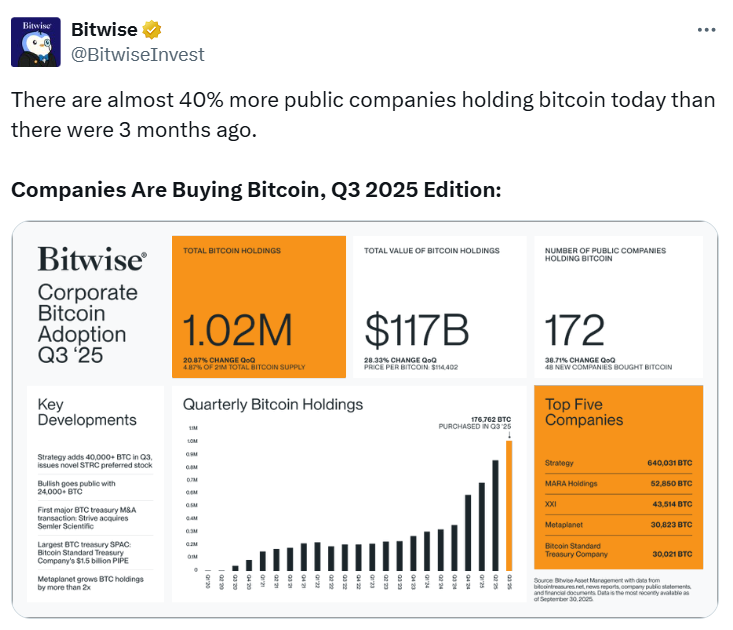

The number of crypto government bonds has exploded this year, with asset management firm Bitwise’s October report reporting that 48 new Bitcoin (BTC) bonds were added to the balance sheet in the third quarter.

sauce: bit by bit

Sandro Gonzalez, co-founder of KWARXS, a Cardano-based project that connects real-world solar infrastructure to blockchain, said DAT will move from speculative storage to strategic allocation.

“The next wave of adoption will include assets that link blockchain participation to tangible outputs, such as renewable energy, supply chain assets, and carbon reduction mechanisms,” Gonzalez said.

“Over time, this will redefine how organizations think about balance sheets in the Web3 era – not just as a store of value, but as a means of measurable and sustainable contribution to real economic activity,” he added.

Finance company expands past virtual currencies

Brian Huang, CEO of crypto investment platform Glider, said that determining what can be adopted as a financial asset is limited only by what is on-chain.

“On-chain equities and tokenized RWA are the most obvious things to include in your treasury. Gold has skyrocketed this year, and it’s easier to hold tokenized gold than physical gold,” he said.

“Additionally, there are also illiquid investments such as NFTs and tokenized real estate. The point to emphasize here is that the limit is just the assets that are on-chain.”

John Hallahan, director of business solutions at Fireblocks, a digital asset custody platform, predicted that there will be more adoption of stablecoins, tokenized money market funds, and tokenized U.S. Treasuries.

“The next wave of digital assets adopted for financial purposes will be cash-equivalent products such as stablecoins and tokenized money market funds,” he said.

“In the long term, more types of securities will be issued on-chain, including government bonds, corporate bonds, and physical assets such as real estate. More unique assets, such as real estate, could be represented by non-fungible tokens.”

Digital media and entertainment company GameSquare Holdings announced in July that it had purchased Cowboy Ape NFTs along with Ether for a $5.15 million “strategic investment.”

sauce: game square Holdings

Nicolai Søndergaard, research analyst at on-chain analytics platform Nansen, said decisions about which assets to adopt in the future will likely be driven by legislation and companies’ risk appetite.

“I can’t say for sure, but I don’t think it would be unexpected for companies to add equity to their net worth, which was previously not considered possible,” he said.

Factors influencing which assets are adopted

However, Marcin Kazmierzak, co-founder of blockchain oracle provider Redstone, said that in theory any tokenized asset could be held as a treasury reserve asset. What is ultimately adopted will come down to accounting, regulation, and fiduciary responsibility.

“Holding Bitcoin or Ethereum is easy for auditors and boards of directors. NFTs require a valuation methodology, but most frameworks lack a standardized answer. More importantly, the Treasury is supposed to hold assets that retain value and can be liquidated if necessary.”

“That’s easier to do with Bitcoin than with speculative NFTs, where there may be limited buyers. There is a limit at the point where liquidity dries up and the board can’t justify holding it to shareholders or regulators,” he added.

Related: Are struggling companies using crypto reserves as a PR lifeline?

In the long term, Kazmierczak predicts that adoption by traditional companies is likely to remain small outside of the top five cryptocurrencies, as risk-adjusted returns are not sufficient to justify a transition for most boards.

“Once the legal framework becomes clearer, tokenized real assets may gain traction, but pure Web3 assets beyond the major cryptocurrencies will remain experimental and limited to crypto-native companies and ventures specifically prepared for that risk,” he said.

“What could be accelerated are tokenized real-world assets such as high-yield bonds and commodities, which have unique value propositions that are independent of market sentiment.”

magazine: How do the world’s major religions view Bitcoin and cryptocurrencies?