Even as the broader crypto market faces volatility and pullbacks, individual traders continue to make huge profits from high-conviction bets.

One such case involves Solana (SOL)-based traders identified by wallet address. BxNU5aAccording to the latest on-chain data obtained by Finbold from below, early accumulation of AI agent token Pippin (PIPPIN) turned an initial investment of approximately $180,000 into approximately $3.6 million in less than two months. look on chain December 17th.

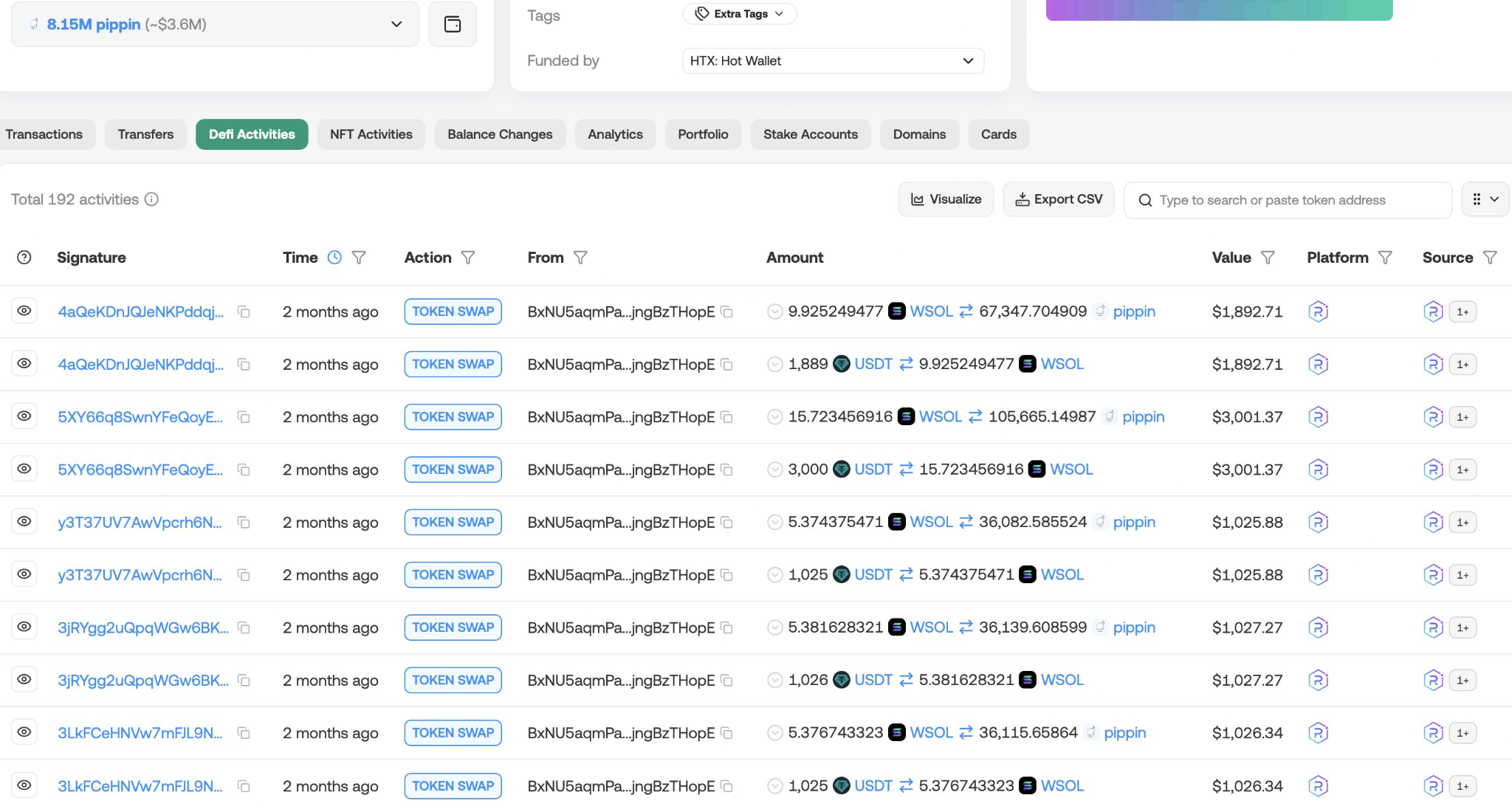

On-chain data shows that the trader began building a position on October 24th by executing a series of token swaps on Raydium, converting USDT to wrapped SOL (WSOL) and then Pippin.

Rather than deploying the entire amount in a single transaction, the wallet accumulated tokens through multiple swaps, with each swap ranging from approximately $1,000 to $3,000.

These transactions purchased approximately 8.15 million Pippin tokens at relatively low prices when the asset was still trading near its initial reference level.

DeFi activity records show repeated USDT to WSOL conversions and subsequent WSOL to Pippin swaps, with individual transactions acquiring tens of thousands of Pippin tokens per trade.

At the time, these purchases reflected modest dollar value, but collectively they built a sizable position while liquidity remained thin. There is no corresponding sell transaction recorded in the wallet, indicating that the trader continues to hold the full allocation.

Understanding PIPPIN’s rally

Since then, Pippin has made a sharp comeback. At the time of writing, PIPPIN is trading at $0.4229, down about 10% in the past 24 hours. On a weekly basis, the token is still up nearly 30%, with a monthly gain of over 1,400%.

This rise was partially fueled by active purchases by large investors, with Whale Wallet accumulating around $1.5 million worth of tokens and pulling large amounts of supply from exchanges.

Notably, more than 44% of circulating supply has been pulled from trading platforms in recent weeks, creating a supply squeeze that amplifies demand. The move is also being driven by increased interest from retailers and widespread enthusiasm for AI-related tokens.

But this surge comes with notable risks. Supply data suggests that a single entity may control over 70% of PIPPIN tokens across multiple wallets, making the market vulnerable to sudden declines.

While such concentration is common for early-stage projects, the limited transparency around distribution and token management raises concerns that sentiment could quickly reverse if large holders begin to exit.

Featured image via Shutterstock