The White House has confirmed that a 104% tariff on China will withstand the misery of the crypto market in the midnight tonight. After a brief recovery to $79,000, Bitcoin fell to $76,000 between $300 million in total liquidation liquidation.

There are several points in optimism as Bitcoin’s long position rose to 54%. Tomorrow will be the important day that follows. It may bring Chaos to Tradfi, but Crypto could survive the storm.

Trump’s tariff genocide crypto market

Trump’s tariffs are about to come into effect, and the market is at a deep moment of uncertainty. Over $1 billion was liquidated from the Crypto market yesterday, but optimism about potential deals supported today’s prices.

The White House has since confirmed that a 104% tariff on China would take effect in the middle of the night, urging Crypto to fall again.

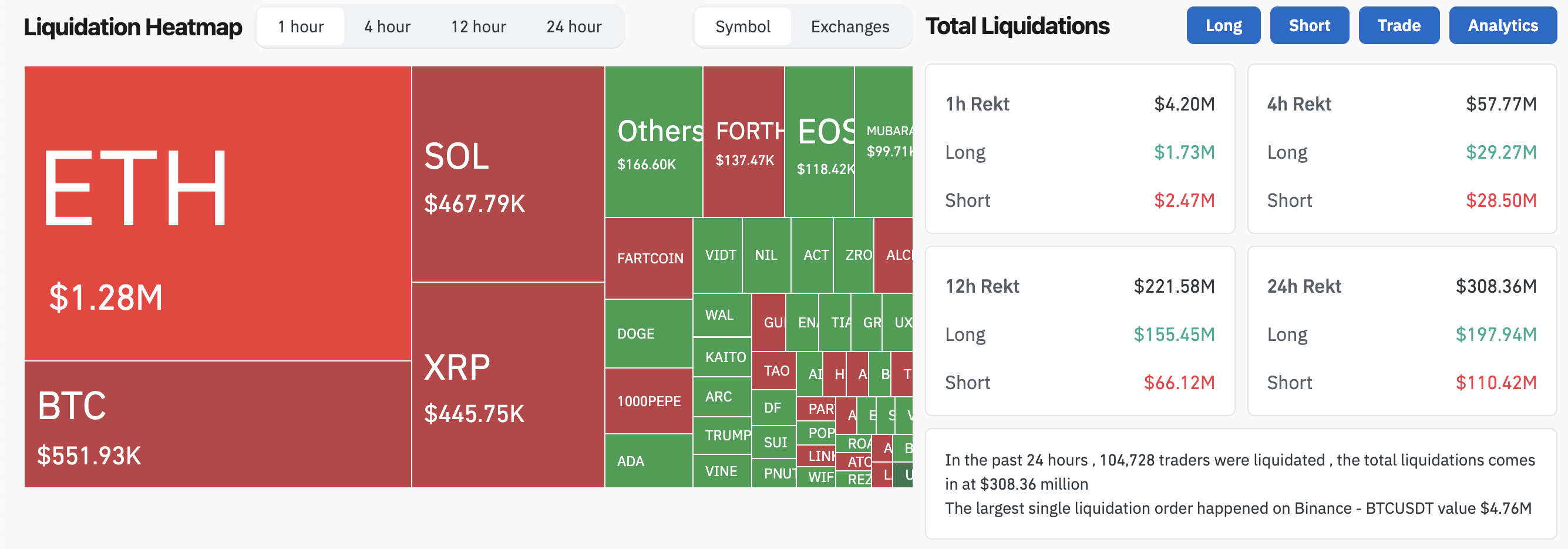

Crypto-clearing heatmap. Source: Coinglass

China is like that America’s largest trading partner partner, and these drastic tariffs could destroy the market. However, ciphers are particularly devastated. With MicroStrategy’s MSTR exceeding 11%, publicly listed crypto companies faced another day of severe decline after checking tariffs.

Additionally, Coinbase, Robinhood, and published All Bitcoin Miners have come close to a 5% drop.

MicroStrategy MSTR stock price. Source: Google Finance

Bitcoin may be in a particularly dangerous position. Recent reports claim it is one of the most tariff-prevention assets in the crypto sector, but its risk profile may be changing.

Today it’s down 2.6% and approaches the $75,000 price mark as more than $300 million has been liquidated from Crypto. If Bitcoin falls below this point, it could trigger more price routes.

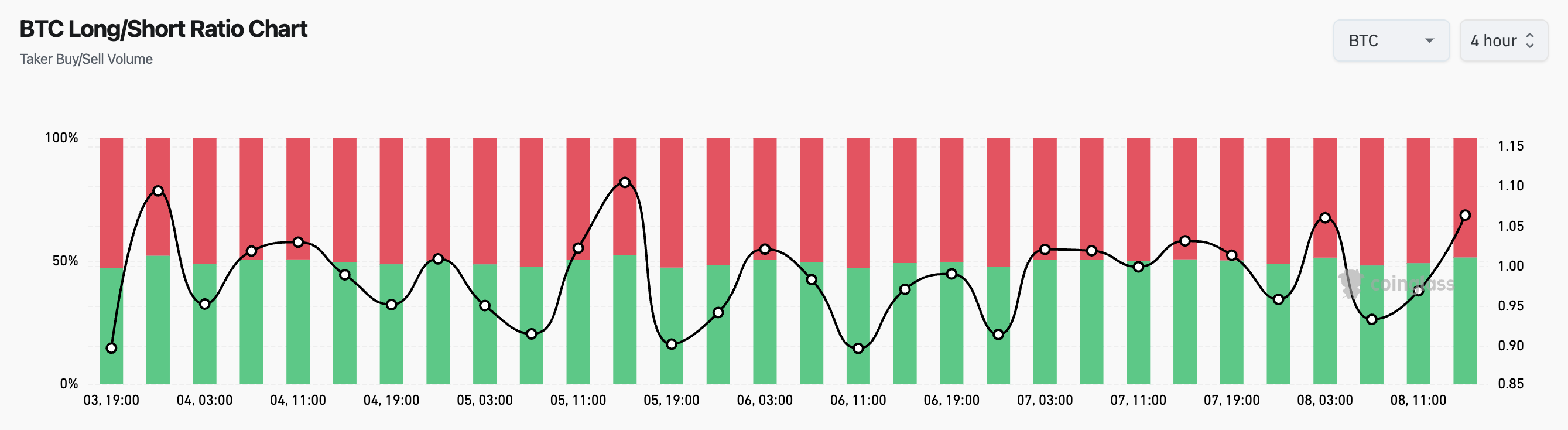

Bitcoin’s long short ratio promotes optimism

As prices are clearly shown this morning, there is still a lot of optimism in the market. This helps all cryptos withstand tariff threats, including Bitcoin.

That long position has skyrocketed to 54%, indicating that most traders are betting on BTC and are back at a higher price.

Traders have been on the way with Bitcoin despite tariffs. Source: Coinglass

Ultimately, tomorrow will be a very important day for the tariffs, crypto and the entire Tradfi market. It’s probably too late to embrace Trump’s hope of deciding not to escalate with China.

However, it remains to be seen whether tariffs are alive and whether the crypto market will continue to collaborate with the stock market after risky assets reverse course against potential inflation fears.