The recession has had a particularly impact on crypto stocks, with a significant portion of stocks experiencing double-digit declines as the crypto economy has dropped by $150 billion since Monday.

Synchronous sell-off: Unbreakable bonds between crypto and stock market

Crypto stocks have faced considerable pressure this week, in line with the wider market slump that unfolded over the same period. By Friday, all four benchmark US indexes had concluded the trading day with red, casting considerable value.

On March 24, the crypto economy was valued at $2.82 trillion, but by March 29 it had fallen to $2.67 trillion. This shrinkage weighs heavily on crypto stock, many of which have the full power of decline.

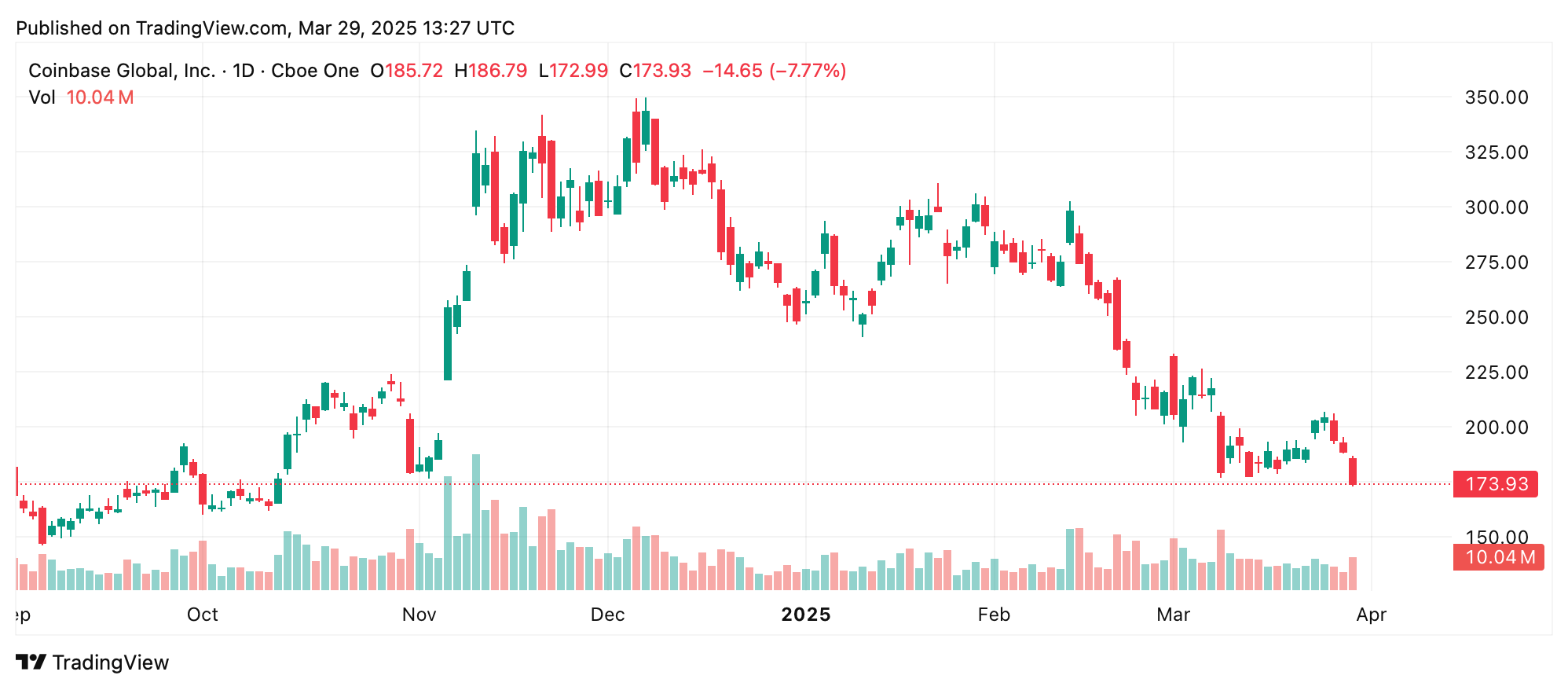

Coinbase (NASDAQ: COIN) on March 29th, 2025.

Take, for example, a Coinbase coin. This is down 11.93% against the US dollar since Monday. The current market capitalization of the coin is $44.16 billion. Meanwhile, Strategy’s MSTR experienced an 8.46% drop across five consecutive trading sessions. Publicly traded mining companies are also suffering heavy losses, with Mara Holdings stock receding 14.64%.

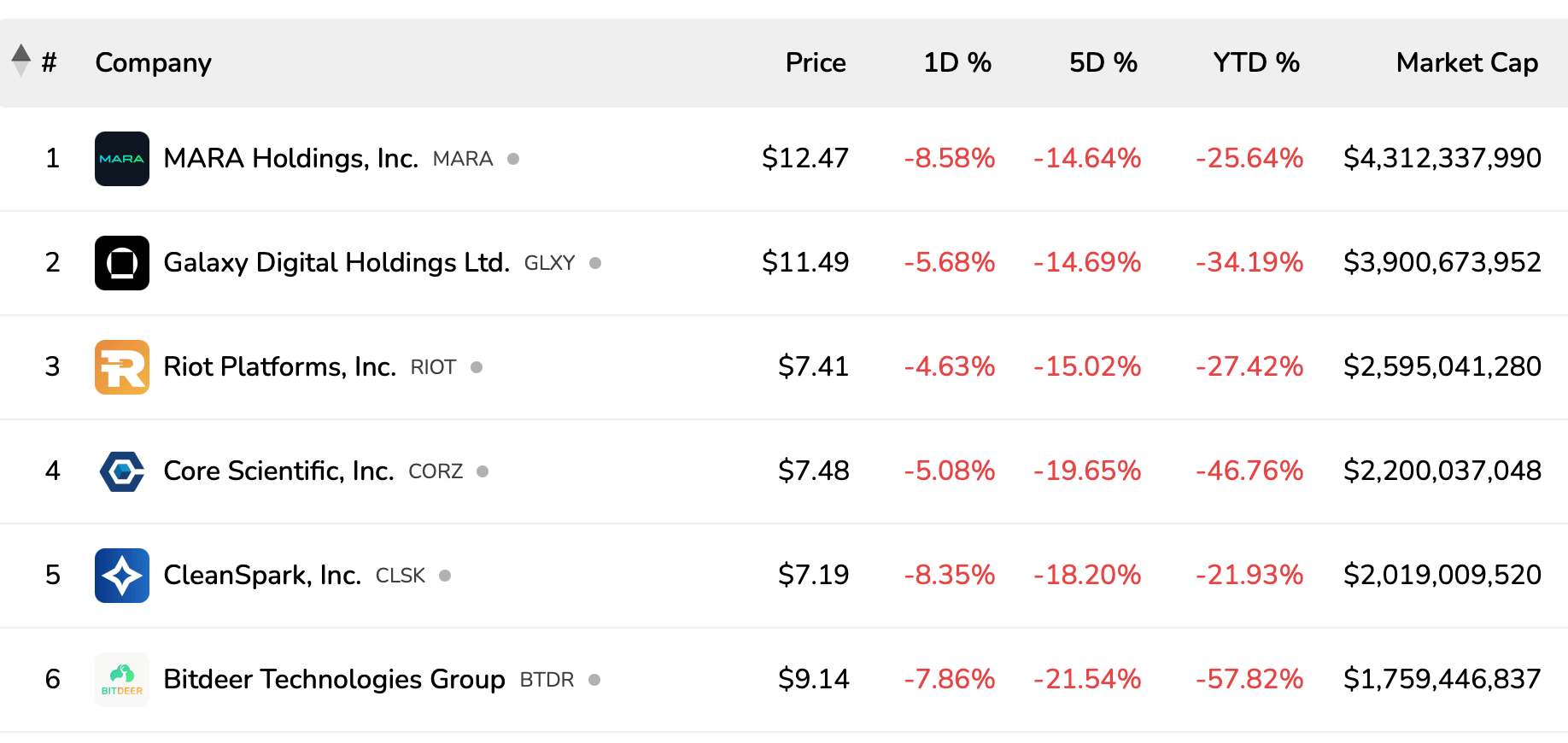

Top six mining stocks by market capitalization on March 29, 2025, via BitcoinminingStock.io.

Galaxy Digital (GLXY) abandoned 14.69%, Riot Platforms (Riot) fell 15.02%, and Core Scientific (CORZ) fell 19.65% during the previous week. CleanSpark (CLSK) saw its value drop by 18.2% against the US dollar, while Bitdeer (BTDR) fell 21.54% over the same five-day stretch. Additionally, Iren Limited (Iren) and Applied Digital (APLD) witnessed a decrease in the range of 21.06% to 28.41%, respectively.

Crypto-related stocks often reflect the crypto economy due to their inherent relationship to the performance of digital assets. Like crypto assets, these stocks are heavily influenced by market sentiment and macroeconomic factors that affect cryptocurrency. When spot prices drop, investors’ trust is shaking, encouraging them to sell both crypto assets and related stocks.

Furthermore, many publicly traded companies have important crypto reserves, amplifying their vulnerability to market slump. This interconnectivity promotes synchronized losses in both domains.