CoreWeave’s transformation from a crypto miner to a large-scale AI infrastructure provider highlights a broader shift in the way computing resources are reused across technology cycles.

In our latest newsletter, The Miner Mag outlined how Ethereum’s move away from proof-of-work reduced the demand for GPU-based mining and started increasing demand for computing, leading companies like CoreWeave to redeploy hardware towards AI training and other high-performance computing workloads.

As previously reported by Cointelegraph, CoreWeave began its exit from crypto mining in 2019, first moving to the cloud and high-performance computing, and then completely repositioning itself as a GPU infrastructure provider for AI workloads.

Since then, this axis has been gaining momentum. Chipmaker Nvidia recently agreed to a $2 billion equity investment in CoreWeave, a move that strengthens the company’s position as one of the largest independent GPU infrastructure operators outside of major cloud providers, Miner Mag said.

CoreWeave’s growth has also created significant liquidity for the company’s executives, who have made about $1.6 billion from stock sales since the company’s initial public offering last March, Minor Mag said.

Coreweave (CRWV) stock. Source: Google Finance

Related: Bitcoin Mining 2026 Prediction: AI Turnabout, Margin Pressure, and Fight for Survival

From virtual currency mining to AI data centers

The shift to AI workloads has proven profitable for several crypto miners, including HIVE Digital, TeraWulf, Hut 8, and MARA Holdings.

Like CoreWeave, these companies are repurposing energy infrastructure and computing power originally built for mining into data centers that support AI and high-performance computing.

However, AI data centers are starting to face some of the same challenges that Bitcoin (BTC) miners encountered early on. As Cointelegraph recently reported, several regions with large AI facilities are experiencing local opposition related to power consumption, grid strain, and land use.

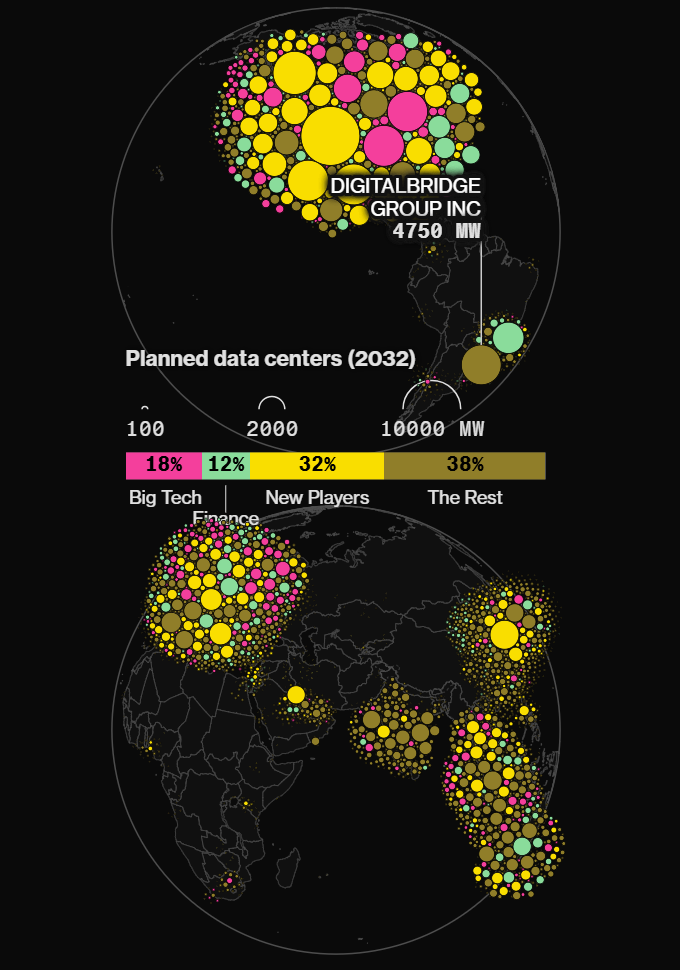

Still, the market remains fluid. Data cited by Bloomberg based on research by DC Byte shows that thousands of new entrants are entering the data center business. By 2032, Big Tech companies could have less than 18% of the world’s computing power, suggesting a more fragmented and competitive market.

If this trend holds, AI data centers could increasingly operate outside of the direct control of large technology companies, similar to cryptocurrency mining before them.

As new operators enter the market, AI data centers may become less concentrated among Big Tech companies. sauce: bloomberg

Related: What role remains for distributed GPU networks in AI?