Coinbase has released its first Ethereum Validator Performance Report, revealing it currently operates 120,000 Validators, which manages 3.84 million Staked Ethereum (ETH) tokens.

Coinbase is the largest individual node operator on the Ethereum Network, as this accounting is 11.42% of the total Ethereum of full piles.

What Coinbase Ethereum Stakers Should Know

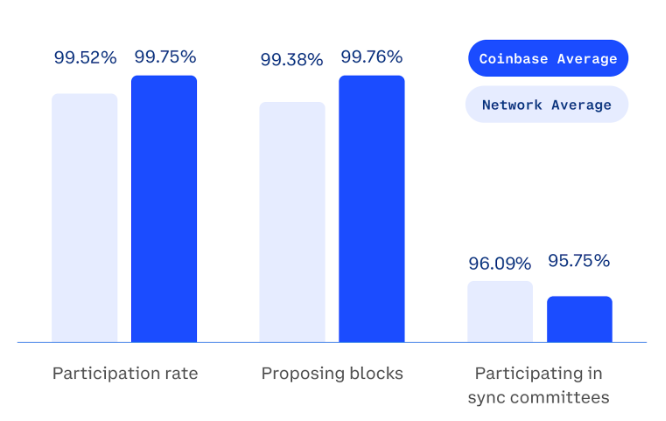

The report highlights key metrics such as participation and occupancy rates of 99.75%, ensuring that risky assets continue to generate rewards efficiently. Coinbase also does not report cases of thrashing or double signatures. This means that users’ funds remain safe. These findings could have a great deal of significance for users who bet on ETH through the platform.

Coinbase Ethereum Validator Performance Report. Source: Coinbase Blog

One of the main concerns users staking ETH is security. Coinbase emphasizes its prioritization of avoiding reduction penalties for maximizing uptime. This means that users may experience slightly lower returns than platforms that drive close to 100% uptime.

Additionally, the company distributes validators to multiple countries and cloud providers (AWS and GCP) to reduce the chances of service disruption. Another important factor for users is client diversity. Coinbase’s goal of multiple executions and consensus clients is to prevent a single point of failure.

However, as the largest individual operator, Coinbase’s impact on the Ethereum network is increasing. Some stakeholders may be concerned about the risk of centralization as Coinbase’s Ethereum Network share increases.

In fact, Coinbase’s increasing share raises questions about Ethereum’s decentralization, as large operators increase their influence on network governance.

“A single entity’s 11.42% stock concentration will raise the red flag for network security. It’s good transparency, but it’s better decentralization. It requires more decentralization,” the user commented in a post on X (Twitter).

Users may need to weigh the convenience of staking in Coinbase exchanges against the broader implications of network centralization.

Ethereum Educator Sassal has confirmed that Coinbase’s 11.42% share is the largest Ethereum node operator. However, another ETH staking protocol, Lido, remains the largest staking entity when considering collective stocks across multiple operators.

“We know how much ETH Coinbase is seeped (11.42% of total stocks) is. This of course Coinbase will be the single largest node operator on the network (lido will be bigger as a group, but each node operator will be Coinbase for transparency!”

Meanwhile, this report continues during the company’s mixed development period. Recent findings show that traffic to centralized exchanges, including Coinbase and Binance, has fallen by nearly 30%, reflecting the impact of a decline in the crypto market.

Nevertheless, Coinbase expanded its offering with the launch of a verified liquidity pool aimed at both institutional traders and retailers.

Additionally, Coinbase recently saw legal developments as the SEC stopped famous lawsuits against the company. The lawsuit was a source of uncertainty for Coinbase and the broader crypto industry, making its termination a prominent event.

“The SEC is off the back, so are they releasing these things now?” posed one user.

With the increasing role of Coinbase in the network, Coinbase’s role will continue to be discussed. While the company is taking steps to maintain diversity and decentralization of its clients, its impact on the staking ecosystem remains important.