A new report from the Coinbase Institute argues that the most important divide in global finance is no longer between the rich and the poor, but between those with direct access to capital markets and those without, what it describes as “intermediaries” and “disintermediaries.”

The report estimates that traditional intermediary rails prevent approximately 4 billion unintermediated individuals from owning productive assets or raising significant capital. To close this gap, the group argues, core market infrastructure needs to be restructured to allow smaller investors and issuers to participate directly, bypassing layers of intermediaries.

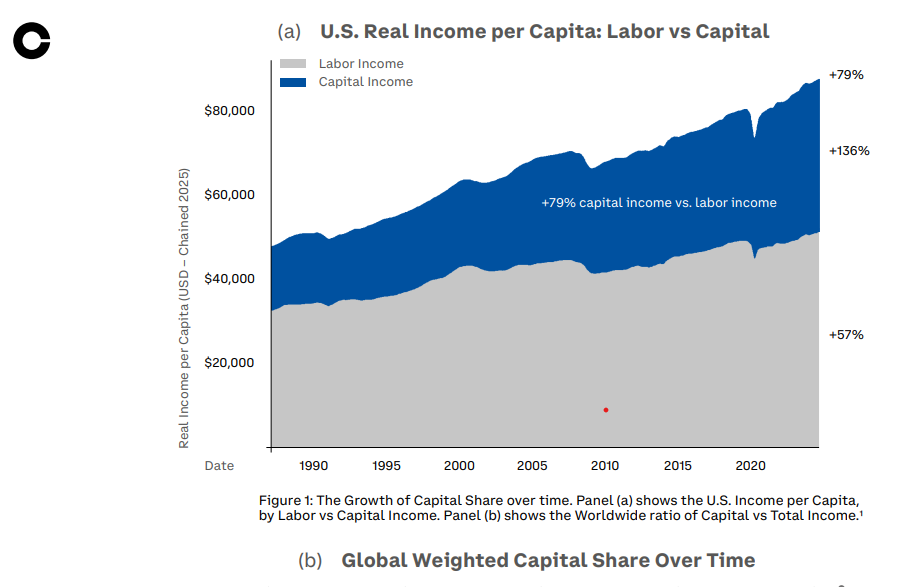

In the United States alone, capital income has increased by 136% over the past 40 years, while labor income has increased by only 57%, according to the report.

The central argument of this paper is that access to capital markets, not just basic banking, is the real gatekeeper to wealth creation.

capital income and labor income. sauce: Coinbase Institute

Because traditional systems rely on layers of brokers, custodians, and clearinghouses, it is uneconomic to serve small investors and issuers, leaving a “capital gulf” between the mediated minority and the rest.

Related: Bermuda partners with Coinbase and Circle for ‘fully on-chain’ economy

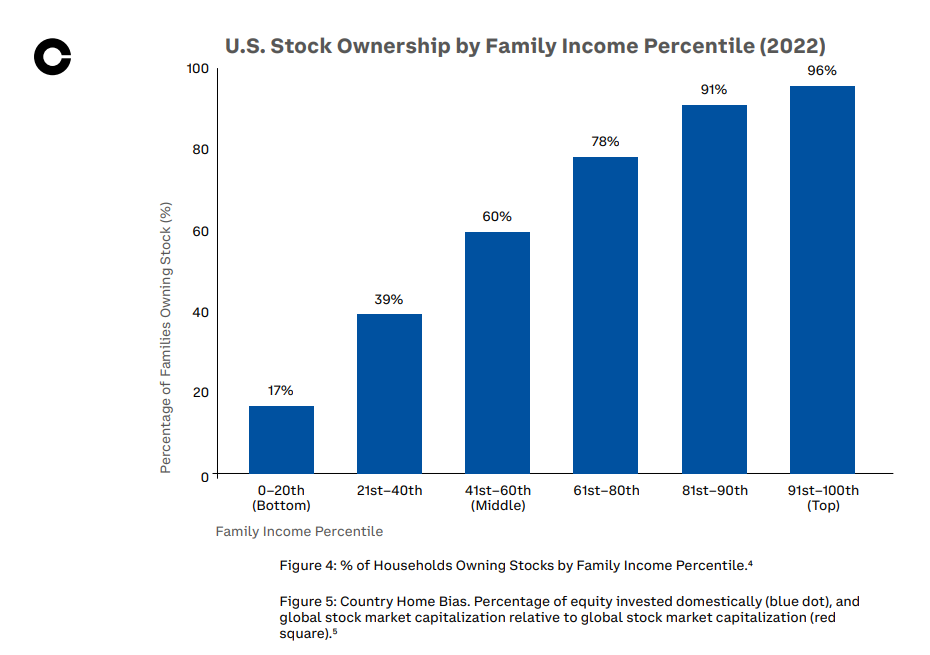

Meanwhile, ownership of stocks, bonds, and funds is concentrated in developed countries, i.e., already intermediated households.

U.S. stock ownership by family percentile. sauce: Coinbase Institute

Why Coinbase Needs Permissionless Rails

Coinbase’s argument is not just that tokenization is important, but that permissionless tokenization is essential for the disintermediate to benefit.

The report argues that permissioned consortium and closed enterprise blockchain models tend to reproduce existing power dynamics, with a small number of gatekeepers deciding who can issue, list, and access tokenized assets.

In contrast, we liken open, permissionless architectures to Internet protocols such as TCP/IP. This architecture allows everyone to build on the same rails, and interoperability cannot be quietly reversed later.

Related: Signum expects tokenization and national Bitcoin reserve increase in 2026

Tokenization is already happening

The report comes as tokenization is already moving from pitch decks to production in both cryptocurrencies and traditional finance.

For example, Franklin Templeton’s tokenized US money market fund shares issued on a public blockchain provide investors with on-chain fund units that can be settled more quickly while staying within existing securities rules.

In the banking industry, JPMorgan operates a live tokenized collateral network on the Kinexys platform, where blockchain-based tokens representing assets such as money market fund shares can be used to more efficiently move collateral between institutional clients while keeping the underlying assets on the bank’s balance sheet.

Meanwhile, the New York Stock Exchange on Monday announced plans for a 24/7 trading venue for tokenized stocks and exchange-traded funds (ETFs) with blockchain-based post-trade infrastructure and stablecoin payments.

The report’s release coincided with the World Economic Forum’s annual meeting in Davos. Coinbase CEO Brian Armstrong said in a post on X that the conference will be used to discuss market structure laws, tokenization, and what he describes as the economic freedom of a modern financial system.

Magazine: TradFi is building Ethereum L2 to tokenize trillions of dollars in RWA — Inside Story