The strong wave of institutional buying that has fueled Bitcoin’s rise since early 2024 could also amplify the correction if market fatigue continues, according to Markus Thielen, CEO and former portfolio manager at 10x Research.

In an interview with Bloomberg, Thielen said the crypto market, and Bitcoin (BTC) in particular, is showing clear signs of fatigue after a difficult October that saw the largest liquidation event in industry history. These losses exacerbate the underlying macroeconomic risks that Bitcoin increasingly reflects, he noted.

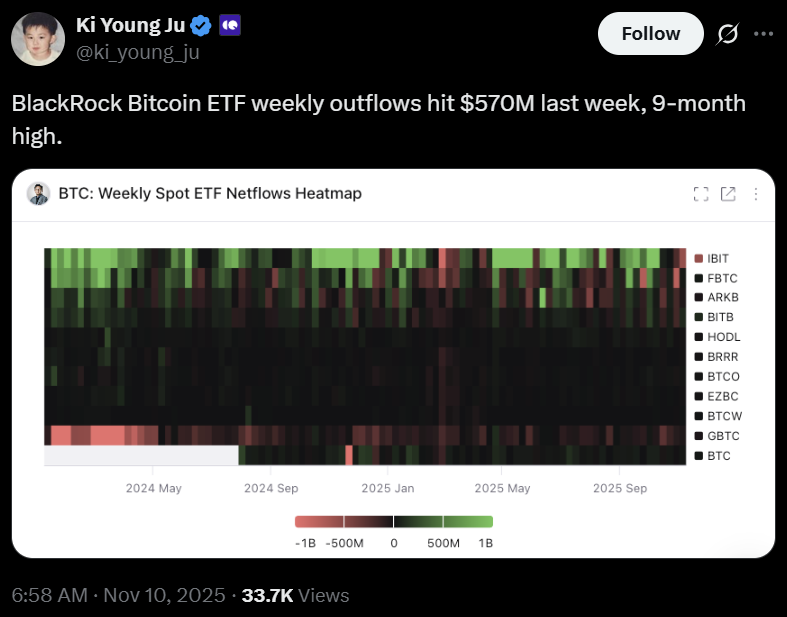

Thielen warned that institutional inflows, particularly from spot Bitcoin exchange-traded funds (ETFs), are the primary driver of stock price gains in 2024, so downward pressure could accelerate among that same investor base if activity continues to slow.

“At some point, a risk manager may step in and say, ‘We need to exit the position or reduce the position,'” Thielen said. “There is a risk that Bitcoin will continue to underperform as people need to rebalance their portfolios.”

The comments come amid rising outflows from U.S. spot Bitcoin ETFs. Last week, funds recorded a total of $939 million in withdrawals, reflecting a decline in investment appetite among institutional investors, according to CoinShares data.

sauce: Ki Young Joo

Related: ISM Manufacturing PMI suggests Bitcoin cycle could extend beyond historical norms

Bitcoin performance will be poor in 2025

Surprisingly, Bitcoin has underperformed most major asset classes so far this year. This is an unusual pattern in the calendar year following the most recent halving. The world’s largest cryptocurrency has lagged gold, tech stocks and even some Asian stock indexes since January, despite hitting multiple all-time highs, including a peak above $126,000 in early October.

Bitcoin has outperformed gold in annual returns for most of its history, but 2025 is shaping up to be different. Bitcoin is up more than 8% since the beginning of the year, while spot gold is up 57%. sauce: curved

Still, Thielen’s 10x Research is not completely bearish on Bitcoin. As Cointelegraph recently reported, the company believes shorting Ether (ETH) is a more effective hedge than betting on Bitcoin itself, which remains a preferred asset for institutional investors seeking exposure to cryptocurrencies.

Much of Bitcoin’s recent weakness has been attributed to whales, which are large Bitcoin holders, profiting above the $100,000 level. Alex Saunders of Citigroup told Bloomberg that the number of wallets holding more than 1,000 BTC has been gradually decreasing in recent weeks.

Related: Sorry, Moonvember Candidates, Macro Uncertainty Signals a Sideways Moon