Cardano prices have slipped down in the past few weeks, falling below key support levels and the sale could continue after the whales begin to surrender.

The Cardano (ADA) price fell for five consecutive days, reaching its lowest level of $0.65, the lowest since May 8th. This has been down 21% from the highest point in May, and has been down 50% since November 2024.

On-chain data shows that Cardano investors have begun to surrender. According to Santiment, the number of ADA holders fell to 4.49 million, down from 4.55 million at its highest point in May.

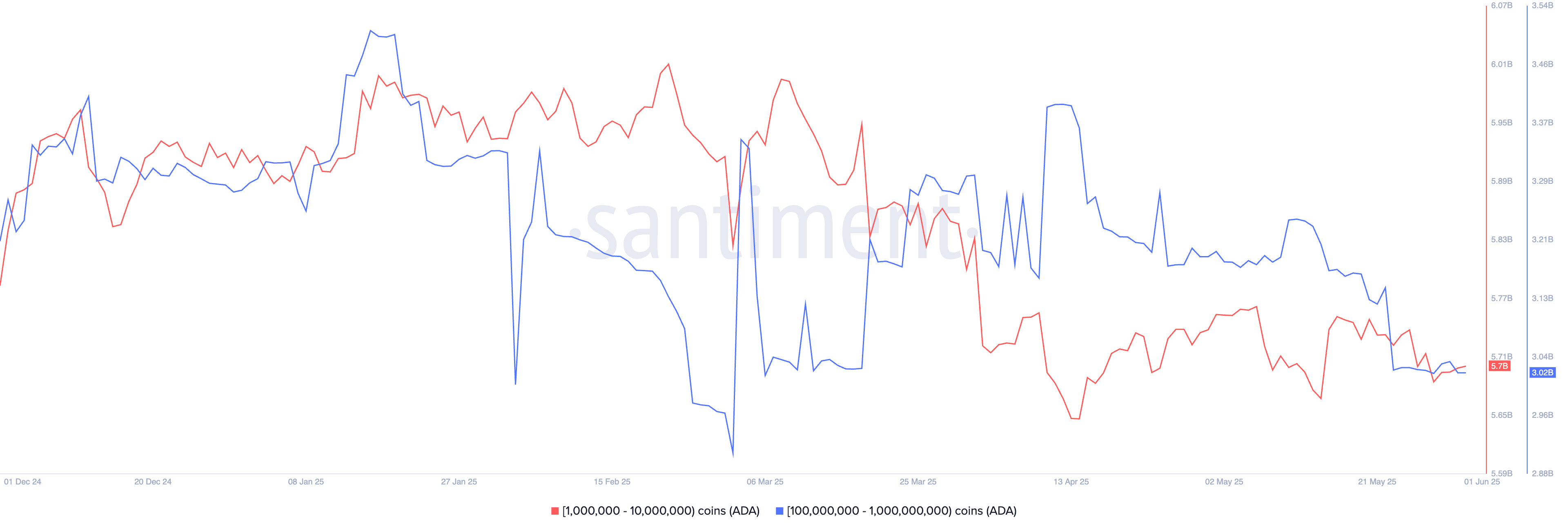

More data shows that whales continue to sell coins and signs that they hope prices continue to fall. The whales, holding 100 million to 1 billion coins, hold 3.02 billion coins today, from a height of 3.4 billion in April.

Cardano Whale Transaction | Source: Santiment

Similarly, those with 1 million to 10 million have reduced their holdings from an annual high of 6 billion to 5.7 billion. These sales came as the number of profitable ADA tokens fell from 27 billion in April to 226.9 billion.

Cardano, once touted as a viable alternative to Ethereum, continues to suffer performance in all regions. The total amount locked into decentralized finance has dropped to $391 million, but cumulative DEX transactions are $4 billion.

In contrast, Unichain has over $702 million in TVL, and Dex’s volume jumped to over $14 billion a few months after its launch.

Cardano is currently experiencing growth in integration with Bitcoin (BTC). The argument is that by incorporating Bitcoin, BTC holders can wager their property and earn rewards. However, the technology already exists, with Bitcoin staking platforms like SolvProtocol and Lombard Finance holding billions of assets.

You might like it too: Can XRP go back to $2.20? Ripple Foundation Movement

Technical Analysis of Cardano Prices

ADA Price Chart | Source: crypto.news

Daily charts show that ADA prices have crashed in the past few days. The sale continued after forming a double-top pattern for $0.839. It is currently moving under the neckline of this pattern for $0.710, confirming bearish bias.

Cardano is also below the 50- and 200-day moving averages, with risk of forming a death cross.

So the coin could continue to fall as sellers target psychological points for $0.50 and go 25% below the current level.

Cardano Audit

Cardano also finds himself on the receiver of the abominable allegations made by mysterious token artist Masato Alexander.

Alexander founder Charles Hoskinson claims he diverted $619 million with Ada Tokens. Hoskinson denied the allegations.

The audit is currently underway to expose the claims, he said. If an audit clears these accusations projects, it could restore investor confidence and cause a strong rebound in Cardano. However, if the findings raise more concerns, the ADA could continue with recent downward trends.

The allegations are concentrated on the ADA relocation of 318 million people during Allegra Hard Fork in 2021.

Hoskinson, one of the co-founders of Ethereum, launched the project in 2015. The Cardano Blockchain was officially released on September 29, 2017.

Hoskinson established the Cardano Protocol through IOHK or Input Output Hong Kong. The project was named after 16th century Italian mathematician Gueroramo Cardano and his native cryptocurrency, ADA.

read more: Ethereum is preparing for the next bull run, but is Wall Street Ponke the 100x engine behind it?