It is threatening that the US government’s closure will be long, so rating agencies could downgrade the country’s credit. This bearish signal causes chaos of tradfi, but is a possible opportunity for Web3.

Specifically, the agency warned that further deadlocks could undermine the US credit rating. The forecast market is currently confident that this shutdown will last longer than its historical average.

Can a shutdown cause a credit downgrade?

After a narrow vote in Congress failed last night, the US federal government has concluded a closure that could have a major impact on the crypto market.

For example, even if Tradfi’s stock goes down, the crypto sector feels bullish.

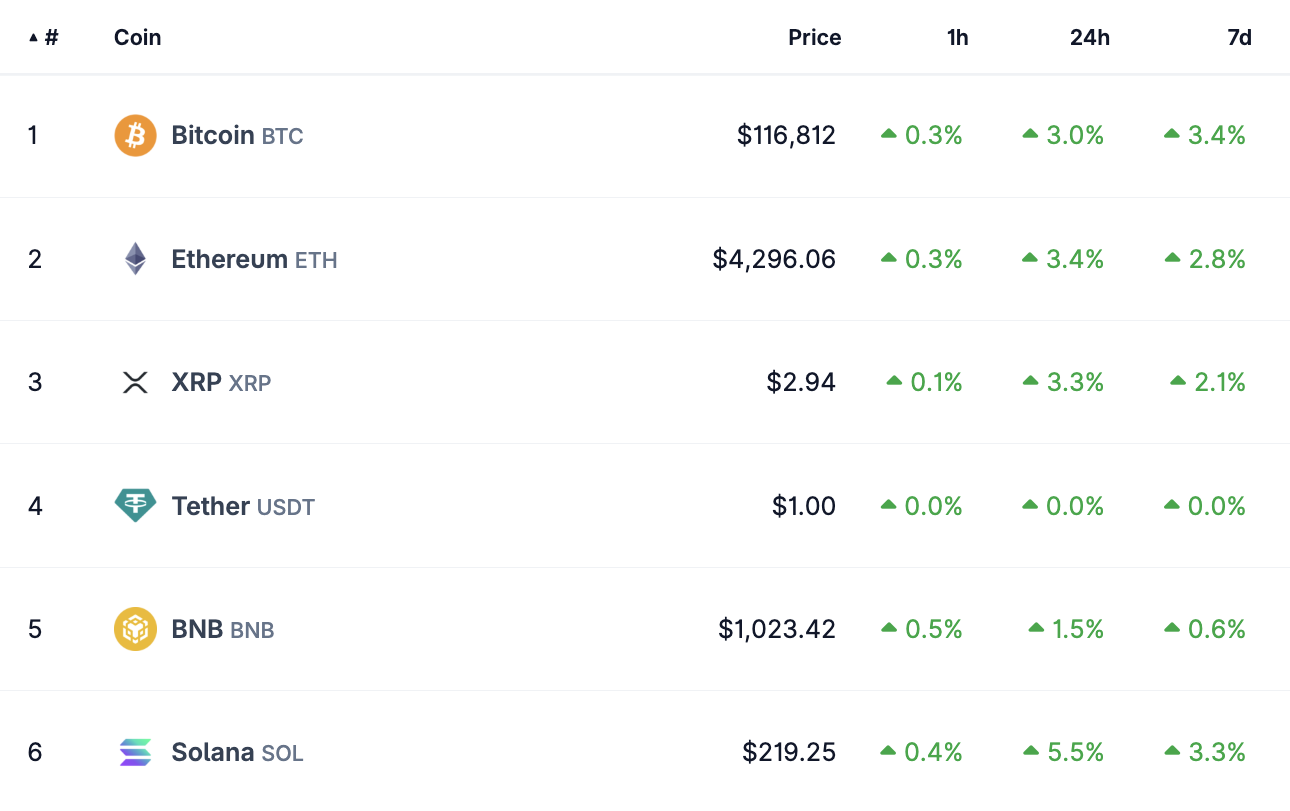

Crypto responds to us shut down. Source: Coingecko

However, there is one wildcard here, which proves to be a real stress test for the use of Crypto as a hedge in a recession.

Specifically, there is growing concern that the shutdown could potentially downgrade U.S. credits. The move will exacerbate continued losses from the chaotic incident.

US Government Closure:

For the first time since 2018, the US is about to take part in government shutdowns, and investors are preparing for it.

This hits 750,000 workers per day and costs $400 million in daily compensation.

What does that mean? Let me explain.

(Thread) pic.twitter.com/oewtteoatc

– September 30th, 2025, Kobeissi letter (@kobeissiletter)

How plausible is this scenario? Unfortunately, there is good reason to believe that another government shutdown could lead to a downgrade in credit.

In 2023, Fitch cited the 2018 shutdown and other congressional smoothness when it reduced its US credit rating. Moody’s would do the same in May 2025, and be aware of the government that more downgrades could continue.

“If policy effectiveness or institutional strength is eroded to a degree that substantially weakens the sovereign credit profile, the rating could be downgraded (and further) if it leads to degradation of economic resilience to medium-term growth or shocks, or with global investment and continued movement by global investors.”

Certainly, the rating agency did not explicitly cite the government closure as part of its downgrade decision, but that certainly seems like a plausible subtext. Furthermore, this case could prove particularly punishable.

Long deadlocks and cipher opportunities

Specifically, analysts determined that the average US government closure lasted only eight days. But Trump’s 2018 deadlock is a major outlier. In 35 days, the entire dataset was distorted significantly upwards.

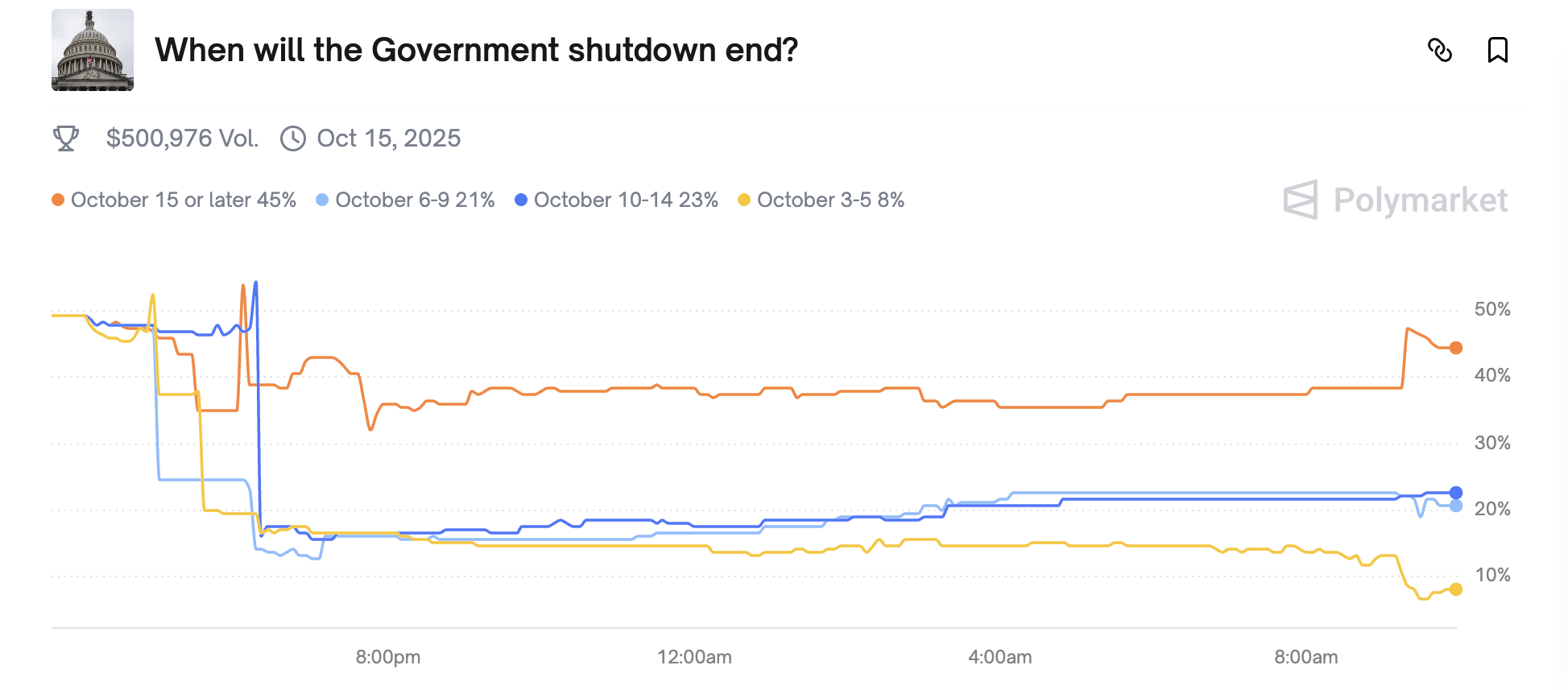

Now, as economists have pointed out, the forecast market believes the closure will last for more than two weeks.

The forecast market assesses shutdown length. Source: Polymarket

Of course, Polymarket is not always right, but it acts as an important barometer for market sentiment. If multiple investors believe this shutdown will be much longer than average, it could further drive a credit downgrade.

This bearish signal can cause any number of downstream effects.

That’s Crypto’s high performance on Shutdown’s first day. There is a lot of controversy about how Bitcoin will work in a longer recession, but here is an important opportunity to collect some hard data.

If the token market continues to rise through shutdowns and credit downgrades, it will constitute a strong signal that crypto will become a valuable recession hedge.

Is this post possible that government shutdowns could downgrade US credit ratings? It first appeared in Beincrypto.