Currently, the Bitcoin market is at least 22.94% below its all-time high peak, roughly 1.84% below its March 1 closing price. The US stock market experienced a 6% decline this month. Experts have denounced the sharp decline in global liquidity in downward trends of markets. However, the report suggests that global fluidity has touched the bottom. Can Bitcoin see the reversal? This is what you need to know!

Why Experts believe Bitcoin will soon turn around

The report suggests that global fluidity has hit a bottom. This indicates that liquidity is likely to start to increase soon.

According to experts, there is an 80% correction between Bitcoin and global liquidity. The 80% correlation is very high. This means that if global liquidity improves, there is an 80% chance that Bitcoin prices will rise.

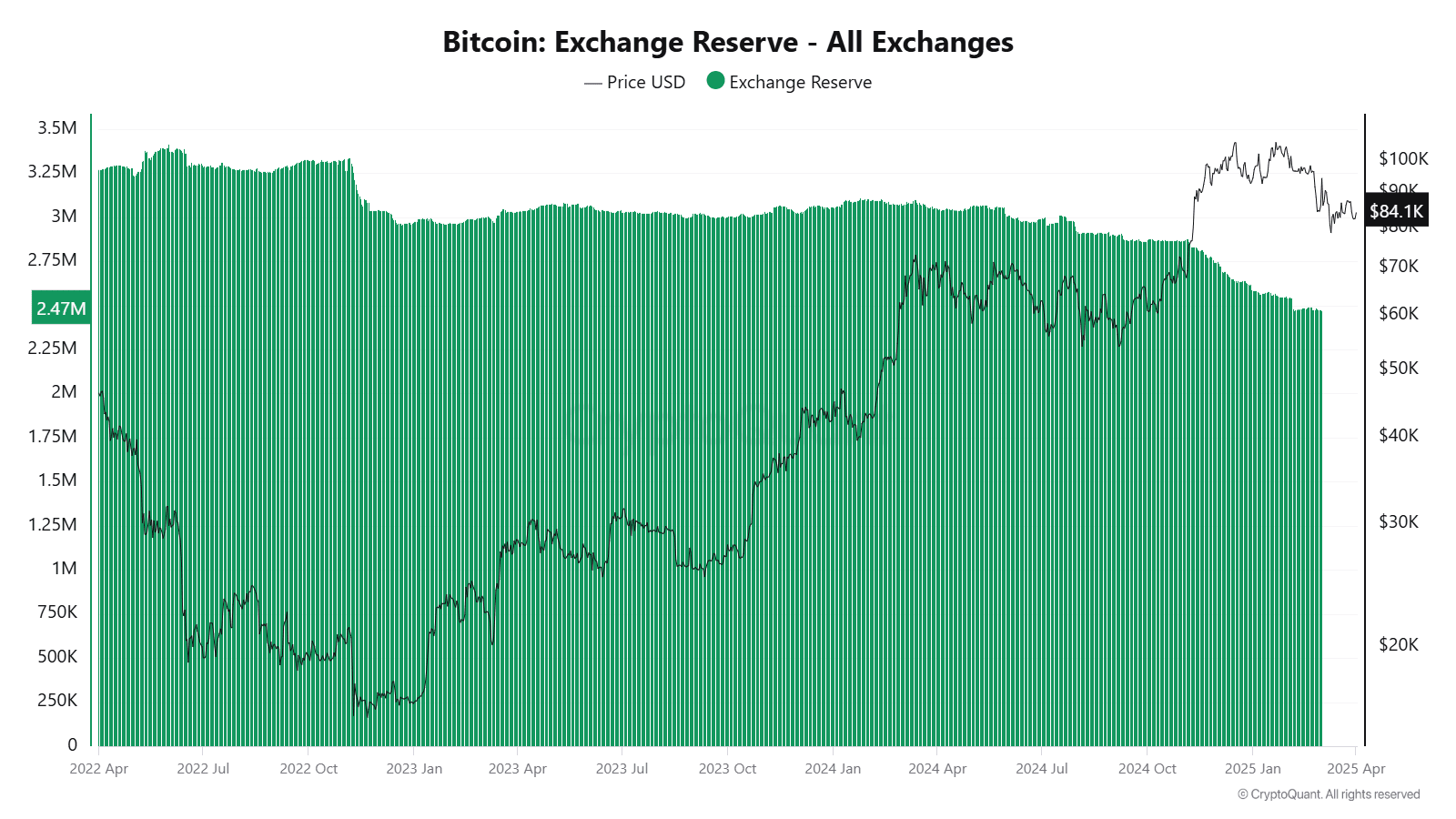

According to Coinglass, the total exchange expenditure for BTC is at 2,197,123.37. That 24-hour change is +16629.17, and the 7-day change is -7184.75. Yesterday, Bitcoin Wallet Netflow was +3.81k BTC.

Technical indicators

Golden crosses with long-term average crosses above the long-term average are often considered bullish signals. The BTC’s SMA-50 remains at $88,254.66, while the asset’s SMA-200 is at $86,180.45.

The RSI for BTC remains at 46.57. As RSI moves consistently above the neutral level, heading towards the acquired territory (over 70), it can show an increase in purchasing momentum.

In conclusion, Bitcoin may be ready for an upward movement, as global liquidity shows signs of recovery.