Ethereum faces major resistance with strong bullish momentum, but liquidation data highlights ongoing market volatility.

In the first week of 2026, Ethereum (ETH) was trading at $3,253.44, down just 1.2% in the past 24 hours. With a stable market capitalization of $392.7 billion and a solid 24-hour trading volume of $28.85 billion, ETH maintains its number one position in the world. A solid 2nd rank.

Ethereum is up 9.5% over the past 7 days and 11% over the past 14 days, reflecting strong positive momentum.

CoinGecko’s chart shows positive momentum, especially after January 6, with the price rising sharply until stabilizing above $3,240. Given the bullish trend, Ethereum price could rise keep risingespecially if it breaks out of the immediate resistance level above $3,300.

Ethereum price analysis

Ethereum is currently testing a major Fibonacci retracement level as it approaches potential resistance at $3,303, which coincides with the 0.786 Fibonacci level. Although recent price action shows a strong rally, ETH faces challenges at this level, which could act as overhead resistance.

Ethereum daily chart

The next important resistance level is the $3,447 area, which is the top of the current range. If Ethereum is able to close above $3,303, it could confirm a breakout and target higher levels, pushing it towards the $3,400 to $3,600 zone.

On the downside, ETH has set $3,190 as potential support marked at the 0.618 Fibonacci retracement level. If Ethereum declines, this area is likely to act as an important floor and provide buying support. A break below this level would open the door for further decline towards the next important Fibonacci levels at $3,100 or $2,980.

The Awesome Oscillator also supports this, and as long as the market remains above these support zones, the green bars indicate bullish momentum.

Ethereum liquidation data

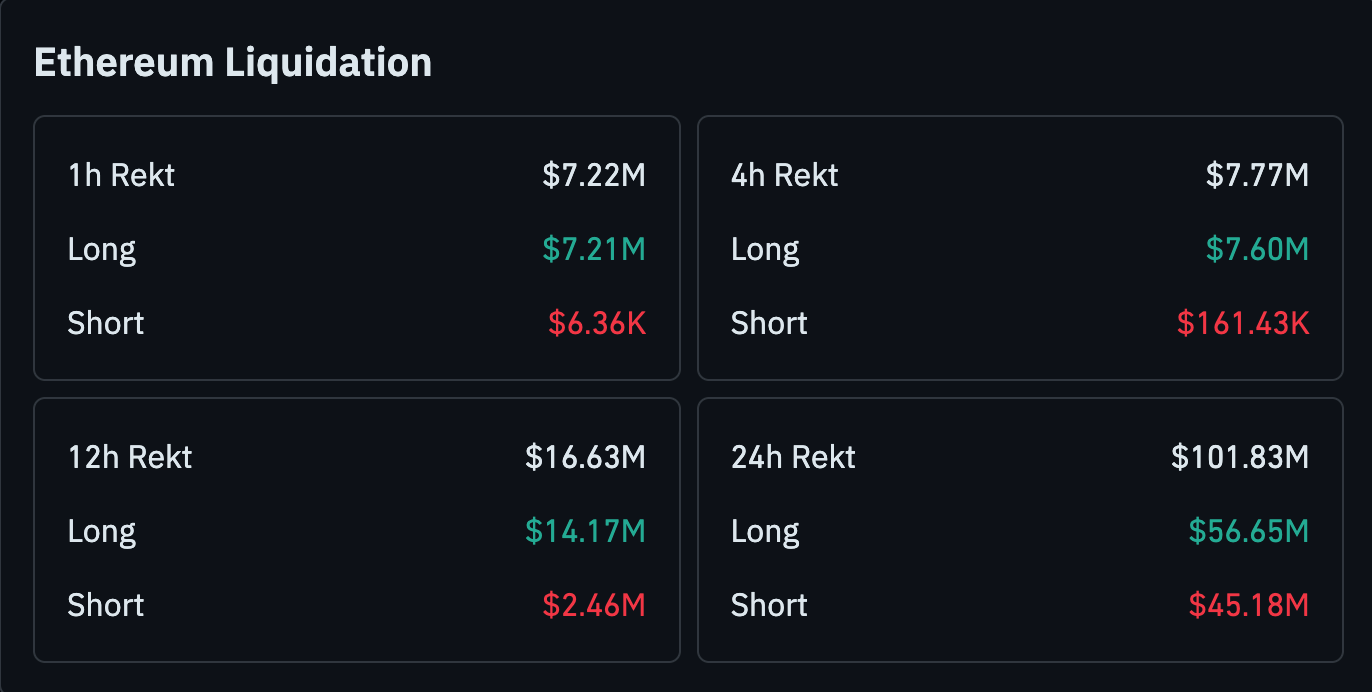

The Ethereum futures market is still showing significant volatility and the potential for price swings, although the situation is against the bulls. A total of $101.83 million in liquidations occurred in the past 24 hours, of which $56.65 million came from long positions and $45.18 million from short positions.

Ethereum liquidation

On shorter time frames, long positions consistently lead liquidations. For example, on the 4-hour and 1-hour time frames, long positions worth $7.6 million and $7.21 million were liquidated, respectively. Significant pressure on long positions suggests a bullish bias in Ethereum price action, while high liquidation amounts are a sign of caution.