Ethereum recently bounced back from its key support level of $1.5,000, but has struggled to break through the bearish order block near the $1.8K mark. If this resistance cannot be cleared, another pullback may follow.

Technical Analysis

Shayan Market

Daily Charts

Prices quickly gathered in the order block at the $1.8,000 mark, creating a clear bull inversion pattern at the $1.5,000 support level. Meanwhile, if the market experiences rejection from the order block, the bullish fair value gap below the price can provide support and push assets back higher.

With 100-day MAs dipped at a level of $2.2,000, the area is a bullish target for ETH in daily time frames.

4-hour chart

In the 4-hour time frame, ETH created a clear bullish market structural shift, and the downward channel was broken inversely. The impulsive gathering won prices from an area of $1.5,000 to a level of $1.8,000 in just a few days.

The $1.8K Resistance Zone is a key zone as it has provided support to the market several times before over the past few months. So bullish breakouts over this area could be the beginning of even more bullish continuation.

On-Chain Analysis

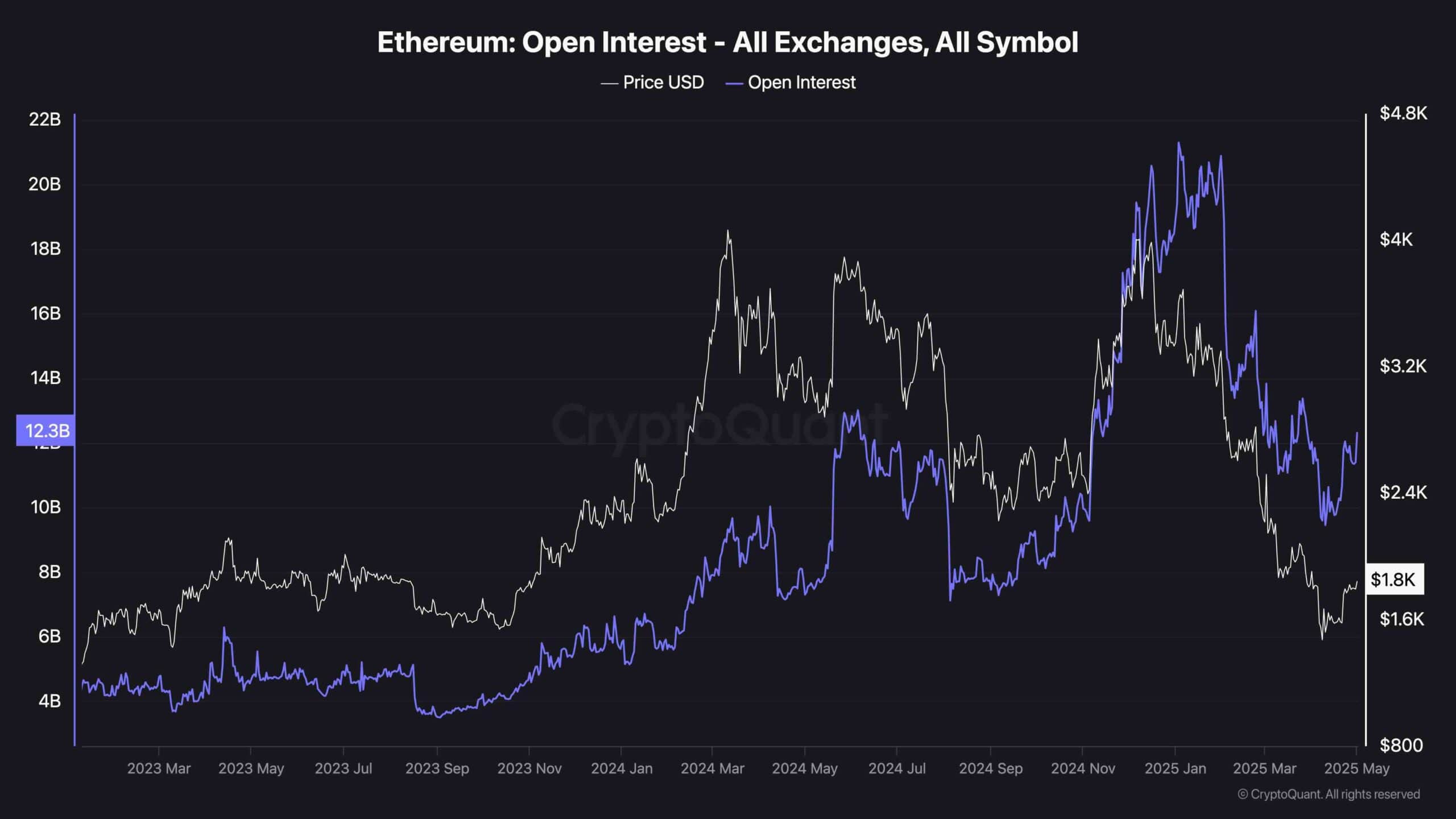

Cryptoquant’s Ethereum Open Interest Chart provides valuable insight into the current derivatives market sentiment surrounding ETH.

During the last few cycles, Ethereum’s open interest showed a strong correlation with price trends, steadily rising in bullish stages and declined sharply during revisions.

I’ve seen slight recovery in recent weeks. The assets are rebounded to $1.8,000, and open interest is once again rising towards the $12 billion level. This growing open interest during the price recovery signal has led to an updated speculative positioning, with a breakout or continued relief likely expected.

However, considering past patterns, if prices turn sharply back again, this also increases the risk of unstable flashes. Therefore, risk management remains important in the coming weeks.