Bitcoin lost steam and fell 1.3% on Thursday morning, just below $110,000, but the flow of ETFs is strong, and that may be the key to BTC getting away from another red September, analysts said Decryption.

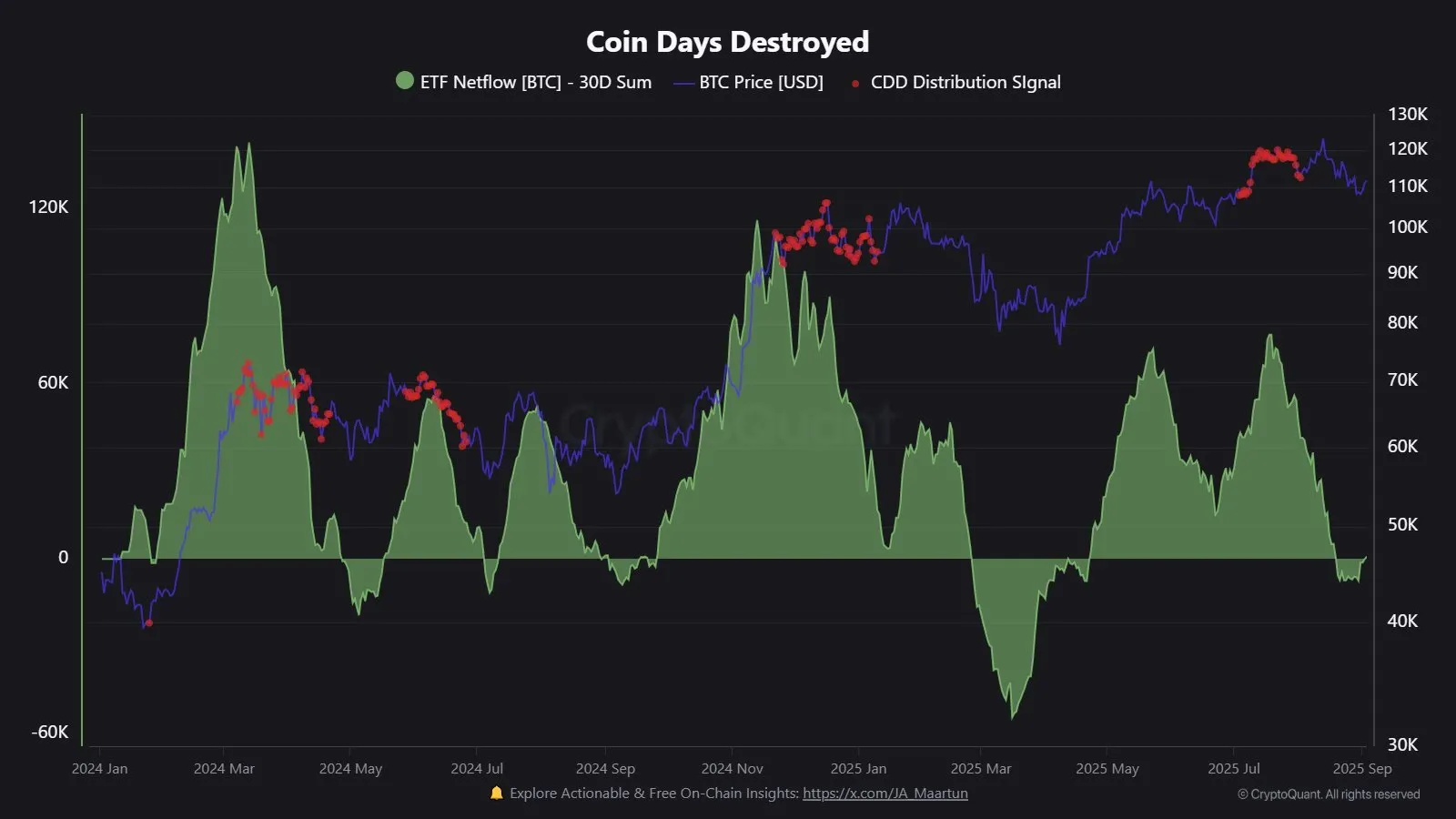

Encrypted blockchain analyst JA_Maartun said market data shows Bitcoin With long-term holders, wallets are steadily moving to ETFs.

Source: cryptoquorant / ja_mamaun

“Visually, the chart reveals a major redistribution. Bitcoin is moving from long-term holders to new addresses managed by ETFS,” he said. Decryption. “As ETFs create demand, supply is being provided by older owners.”

The Bitcoin ETF was first approved by the SEC in January 2024 after more than a decade of rejection, allowing investors to touch BTC without the need to buy, hold or store Bitcoin directly, avoiding crypto exchanges and wallet complexity. BlackRock’s Bitcoin ETF alone holds over $83 billion in assets under management.

However, recently, Bitcoin ETFs have been rebounding after being delayed compared to Etherum ETFs. The BTC fund recorded two-day inflows of over $300 million, totaling $633.3 million in both sessions.

And it’s rather unusual when much of it is facilitated by longtime Hodlers who convert stacks into ETF strains, as Martin hypothesizes.

“This redistribution is very unique,” he said. “We’ve already seen three periods like this — 2024, 2024, Autumn 2024, Summer 2025. In previous cycles, this usually only happened once.”

He added that ETF tides could be a powerful predictor of whether Bitcoin can escape from Red September, even if they see red August. If an asset ends at a lower price than its start, the month (or other period) is considered red.

September has been eight down months for Bitcoin for the past 12 years. However, for the past three years, Crimson has shifted to August, with September being green.

“ETF flows will be critical,” Maartunn said. “As long as there’s a shortage of strong new influx, I don’t expect anything spectacular. Demand needs to be picked up, or there’s a risk that new holders will add sales pressure.

However, there are other large market players to consider, such as the Bitcoin Treasury Companies, according to Rick Maeda, a research analyst at Presto Research. He is particularly interested in something like the Japanese Metaplanet, which he vowed to sell BTC Stash.

“If we got the Red September, I would expect Metaplanet to lean on it rather than retreat,” he said. Decryption. “They say they’re never going to sell, and CEO Simon Gerovich repeated that point: the cadence of their acquisition is programmatic.

But last week, Metaplanet faced headwinds. On Monday, the company’s shareholders approved a $884 million capital raise proposal, a 60% drop since mid-June.

At the same meeting, the company announced that it had acquired 1,009 BTC for around $112.2 million and raised the Treasury Department to just 20,000 Bitcoin. At current prices, the BTC stockpile is worth around $2.2 billion.

Myriad has been created by forecast market Decrypt’s Parent company Dastan, users are still pessimistic about which price milestone Bitcoin hit next: $125,000 or $105,000. The odds were flipped over several times in August, but now shows that 65% of users think Bitcoin will fall to $105,000 before it exceeds its all-time high.

And last month, only one in four of the 1,900 investors voted by Binance Australia estimated that Bitcoin will exceed $150,000 in the next six months.

Half of the polls said BTC would maintain between $100,000 and $150,000 over the same period. Half of users voted between the end of July and August 10th exchanged with the intention of increasing their Bitcoin holdings.

However, Gadi Chait, Xapo Bank’s investment manager, said there may be a change in emotions in two weeks. Decryption.

“The Federal Reserve Sept. meeting is the dominant macrocatalyst,” he says, hinting at the Federal Open Market Committee meetings on September 16th and 17th. “A potential US rate reduction on the horizon could ease liquidity conditions, increase demand for risky assets, and increase Bitcoin by 5-10%.”