Bitcoin is broken below the 100-day moving average below 113.4K, indicating an increase in bearish sentiment after the recent sale. Prices are currently integrated in key zones where demand levels determine the next direction movement.

Technical Analysis

By Shayan

Daily Charts

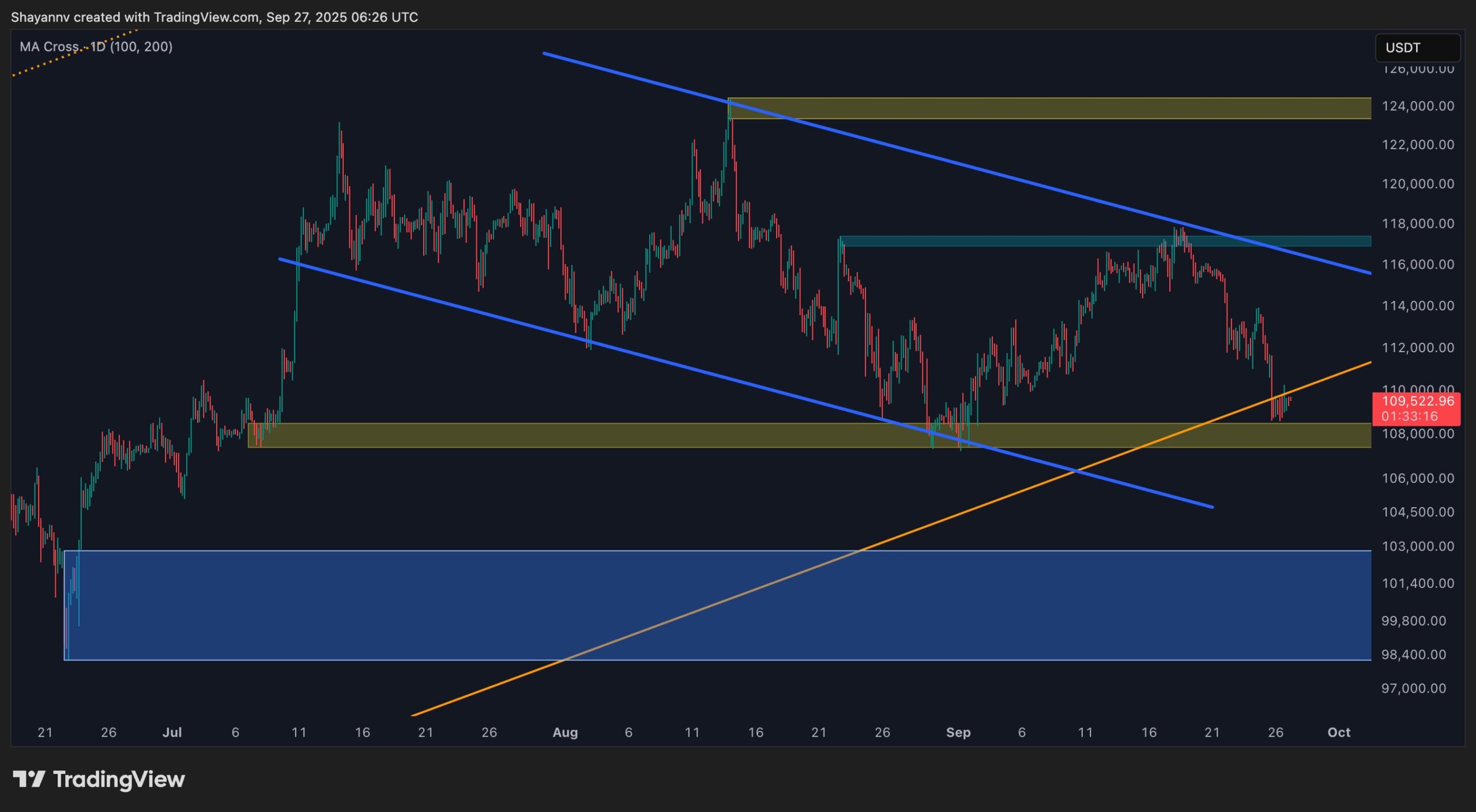

In the daily time frame, Bitcoin fell below the 100-day MA, with prices stolen between the 100-day ($113,000) and the 200-day ($104,000) moving average. This range often functions as “man’s land” reflecting indecisiveness until either the buyer or seller has regained momentum.

The downward channel structure remains intact, suggesting sustained downward pressure unless the Bulls are able to protect the lower boundary, nearly $109,000. Holding it above this region is essential to prevent 200 days of MA and deeper testing into demand zones ranging from $100,000 to $102,000.

In particular, there is a visible sales side liquidity pocket below $107K, which could potentially lower prices with liquidity sweep before attempts at large inversions unfold.

4-hour chart

In the four-hour time frame, Bitcoin was actively rejected from $117,000, causing a cascade of sales. The decline has resulted in a bullish flag structure, with BTC currently hovering just above the key demand zone below $110K.

This area is essential to maintaining bullish potential. If buyers successfully defend it, Bitcoin can rebound to its recent highs. However, the breakdown here could accelerate travel to a deeper liquidity pool of nearly $10,000, in collaboration with the MA for 200 days. The next leg will depend on whether demand can withstand the pressure of continuous selling, or whether sellers will push the market to a fresh low.

Emotional analysis

By Shayan

The Binance BTC/USDT liquidation heatmap (2-week view) reveals how recent volatility is liquidity-driven. A cluster of large liquidation has been formed beyond the $117,000 swing high, with aggressive sales being forced to liquidate. The band highlights the severe concentration of the stop loss, which amplified rejection, and the overcovered long.

In contrast, the heatmap does not show any major liquidity clusters below the current price, meaning that sellers may already be exhausting their short-term downside liquidity. With Bitcoin stabilising around $109,000, this lack of a lower target could temporarily limit the decline even further, unless a fresh order flow is built below.

For now, the market remains defined by this imbalance. The overhead of the $117,000 liquidity band serves as a supply-controlled cap, but a $109,000 demand base should be kept to avoid a deeper slide towards the $10,000 zone.