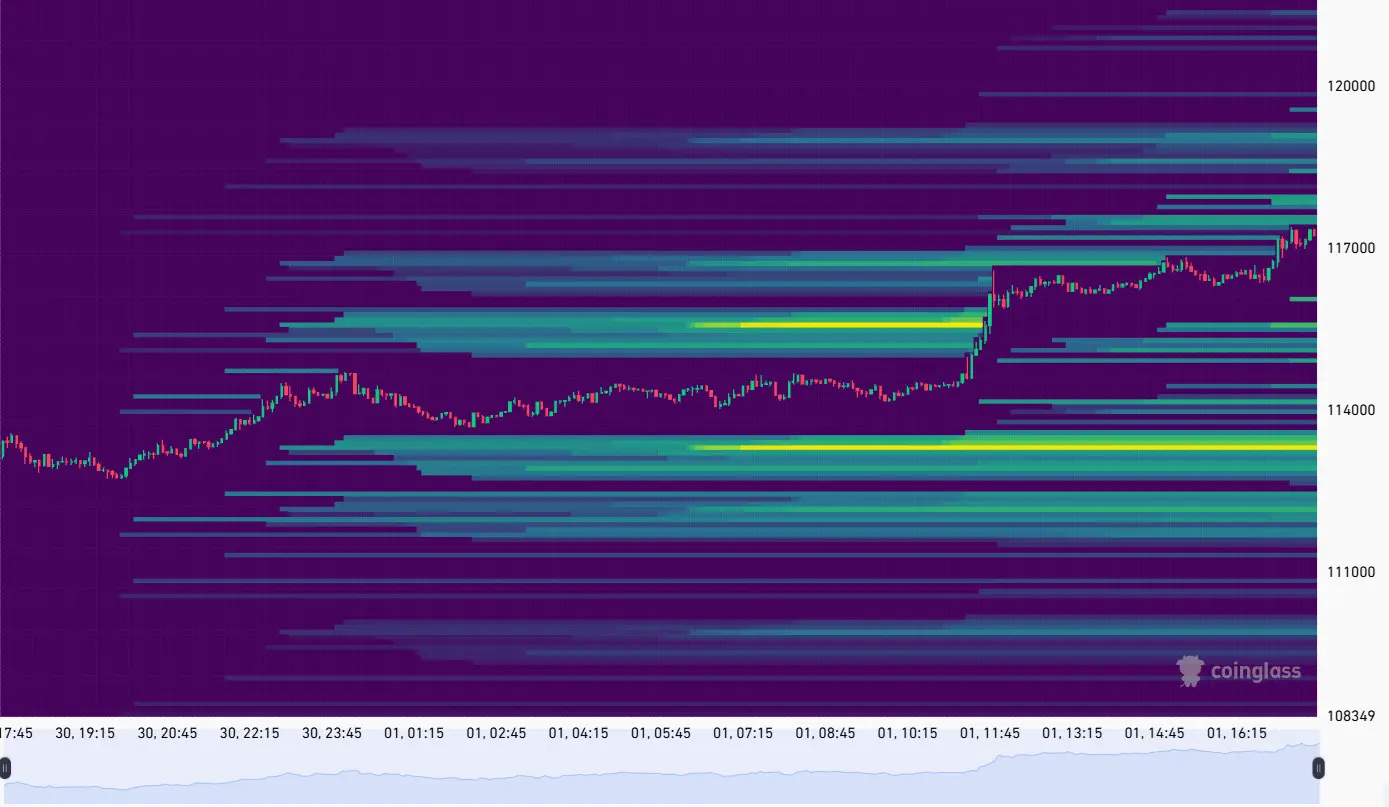

BTC switched to a short liquidation and wiped out $15.79 million in short positions within an hour. Overall, the short liquidation exceeded $268 million at a weekly high.

BTC recovered above $117,300 with a rapid shift in emotions. The move went over $15.79 million in short positions in just an hour. Over $178 million has been liquidated in BTC shorts in the past day. Based on other methodologies, crypto liquidation has counted over $600 million in the past day.

BTC recovered the $117,000 level, causing a wave of short liquidation | Source: Coinglass

Crypto Markets’ sentiment quickly changed direction after a long week of liquidation. This time, BTC traders chose to immerse themselves in the $107,000 range, but price action moved to a short position in liquidation.

Based on the recent relocation, BTC restructured its long positions at around $113,000 to $112,000, forming a new zone of resistance. However, current feelings about “Uptober” may be added to the liquidation to drive BTC high.

The sentiment of the deal remains neutral, suggesting that recent gatherings may not be sustainable and may be leveraged attempts. Another possibility is the rush to crypto assets as a precaution against weaknesses with US government closures. USD.

Historically, government closures led to BTC rallies, followed by rapid revisions. A week of peak long and short liquidation may determine the price direction for the last quarter of the bull market year. Previously, BTC had shown its role as a safe haven asset, but the rally in early October is considered a potential trap for enthusiastic traders.

BTC retains its advantage and ends the Altcoin season

BTC also showed strength on several markers, with market capitalization dominance rising to 57%. The recent BTC rally meant that the Altcoin season was officially over.

However, BTC strength also allows for specific AltCoin rallies. The recent BTC recovery has also raised the prices of major coins. ETH was recovered over $4,300, with BNB at $1,022 and Sol back at $220.

A series of old coins and tokens from previous bull markets are also continuing their revalued rally. Zec, an early privacy coin, exceeded $89.

ETH is also at a crossroads in liquidation

Eth Lixitidity has a setup that could push prices up in either direction. A hike to $4,400 may be liquidated by a disadvantage up to $1 billion, unless traders are closed. More liquidity is built for a long liquidation at $4,200. As Cryptopolitan recently reported, short-term variability in ETH is being used by strategic whales to increase strategically.

Liquidity may change and accurate liquidation may change. During the latest market promotions, ETH saw a much smaller liquidation compared to BTC, with around $8 million over the four-hour time frame and $152 million.

Both ETH and BTC have ample support from long-term holders and spot buyers. Recent market metrics show that BTC may be searching for local bottoms, setting up another year-end rally.