Bitcoin (BTC) mining difficulty is predicted to increase during the next difficulty adjustment scheduled for December 11th, as hash price, a key measure of expected miner profitability per unit of computing power, is at a record low.

According to CoinWarz, Bitcoin’s next mining difficulty adjustment is expected to occur at block 927,360 at approximately 12:09:34 AM UTC, slightly increasing the difficulty from 149.3 trillion to 149.8 trillion.

The latest adjustments made on Thursday reduced the difficulty from 152.2 Trillion to 149.3 Trillion, resulting in an average block time of approximately 9.97 minutes as of this writing, just below the 10 minute goal.

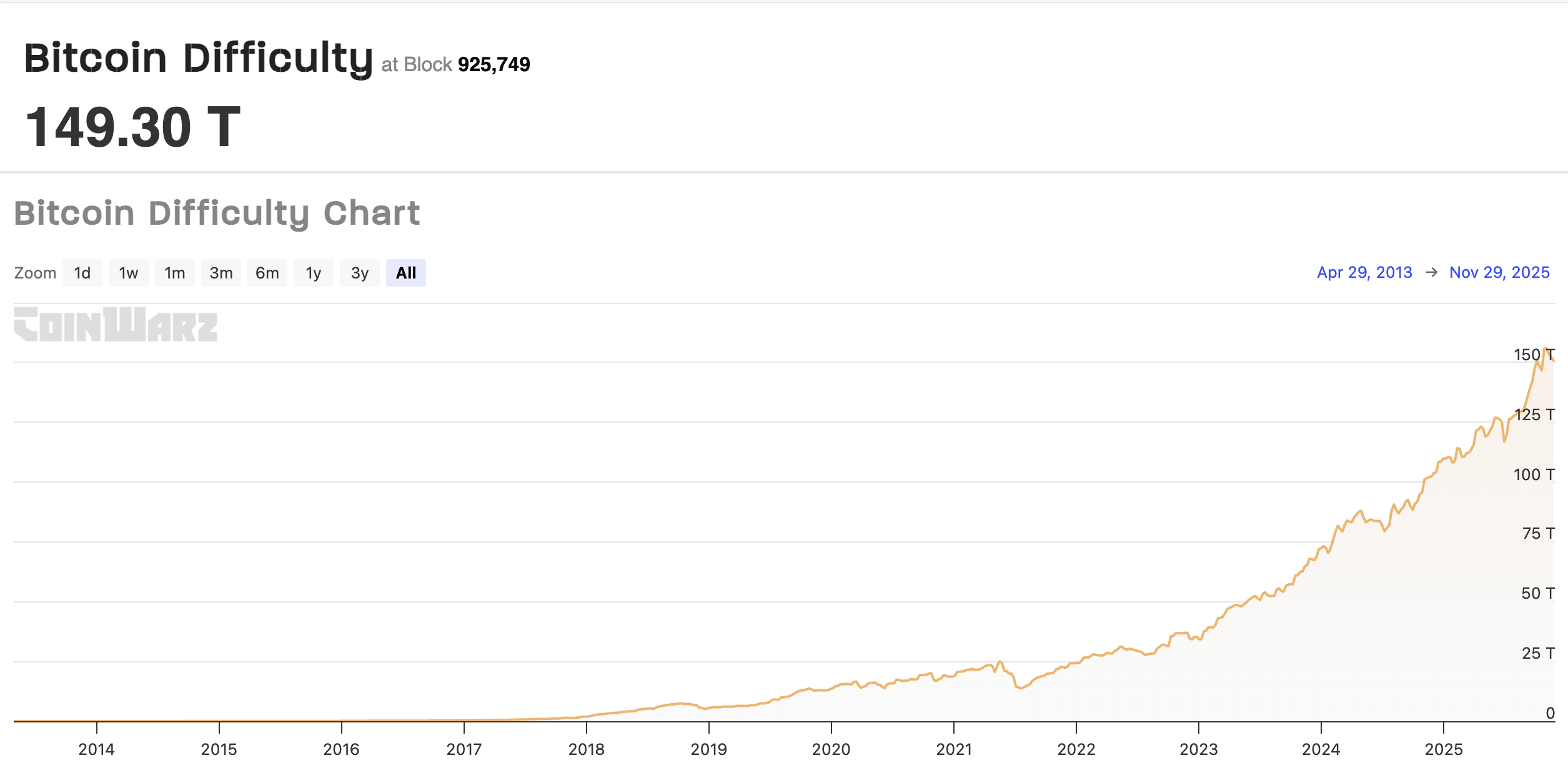

Bitcoin mining difficulty from 2014 to 2025. sauce: coinwords

Despite the recent decline in mining difficulty, hash prices are hovering around 38.3 petahashes per second (PH/s) per day, according to the Hashrate Index, up from an all-time low below 35 petahashes per second (PH/s) on November 21st.

For context, a hash price of 40 PH/s is the break-even point for miners, the point at which they must consider turning off their machines or continuing to run them.

The Bitcoin mining hash price, a key measure of miner profitability, has fallen below $40, hovering near record lows. sauce: hash rate index

The mining industry continues to face mounting challenges, including regulatory bans and restrictions, rising energy costs, and geopolitical tensions between the United States and China that could disrupt supply chains for critical equipment.

Related: 13 years after the first halving, Bitcoin mining looks a lot different in 2025

US investigates the largest manufacturer of virtual currency mining hardware, raising concerns about shortages

The US Department of Homeland Security (DHS) is investigating Bitmain, a China-based mining hardware maker, to determine whether its machines could be remotely accessed or used for espionage.

In 2024, US Senator Elizabeth Warren, one of the most vocal critics of cryptocurrencies, suggested that ASICs could be used to spy on US military bases and sensitive defense facilities.

Bitmain is a leading manufacturer of application-specific integrated circuits (ASICs) used to mine proof-of-work (PoW) cryptocurrencies. According to the University of Cambridge, the company has an 80% market share.

Restrictions, tariffs and sanctions imposed on the company by U.S. authorities could create supply chain problems for the mining industry, which is highly dependent on Bitmain.

magazine: AI may already be using more electricity than Bitcoin, threatening Bitcoin mining