The smarter web company, the UK’s largest company Bitcoin holder, is considering acquiring competitors struggling to expand the Treasury Department, CEO Andrew Webley said.

Webley told the Financial Times that it would “certainly consider” buying up competitors and getting Bitcoin (BTC) at a discounted price.

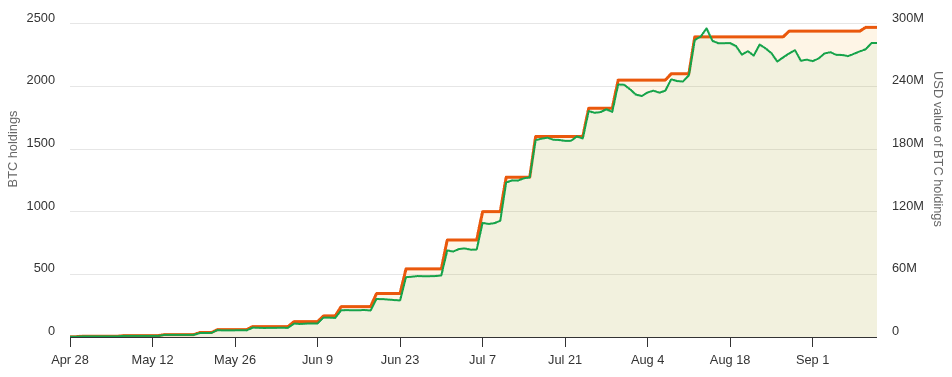

According to data from bitcointreasuries.net, the smarter web company is the 25th largest in the world and the UK’s top corporate Bitcoin Treasury. It currently holds 2,470 BTC, nearly $275 million.

Smarter Web Company’s BTC Holdings (Orange) and BTC Holdings USD Value (Green). Source: bitcointreasuries.net

The CEO of Smarter Web Company said the company is aiming to join the FTSE 100. This is the index of the top 100 UK companies. He also said that companies that would change their name were “inevitable,” but that it would need to be “to do it properly.”

“Purchase assets from bankrupt crypto companies often promise discounts, but in reality it’s much tougher than everyone thinks,” said Alex Obchakevich Research founder.

Related: Metaplanet, Smartweb adds nearly $100 million to Bitcoin to the Treasury

Obchakevich cited the bankruptcy of Crypto Exchange FTX and Crypto Lender celsius. He explained that the discount initially reached 60% to 70%, but “after deducting liabilities settled in bankruptcy, liabilities removed by courts and taxes, the net discount falls to 20-50%.”

“This attracts expert investors because assets are undervalued due to urgency.”

Webley’s comments come after Smarter Web’s stock fell nearly 22% on Friday, down from $2.01, which was open to $1.85 at the time of writing. The decline occurred despite BTC having increased by more than 1% over the last 24 hours.

Smarter web company stock charts. sauce: Google Finance

Last month, Bitcoin also lost more than 4% of its value, but prices for smarter web companies fell by around 35.5%.

The Smarter Web price adjustments will also occur after the UK allowed retail investors to access Cryptocurrency Exchange Debts (CETNS) in early August, which became effective from October 8th.

Related: The UK’s smarter web company is raising $21 million through Bitcoin-denominated bonds

Make profit from competitor failures

Webley’s comments on the acquisition of competitors follow reports that Bitcoin’s finances, particularly new and small Treasury, are likely to run into trouble. Coinbase research director David Duon and researcher Colin Basco recently said they have entered the “player vs. player” stage where public companies buying crypto are fiercely competing for investor money.

They said, “Strategically placed players will flourish.” Analysts also said the market segment has been rapidly oversaturated, and many cryptocurrency ministries cannot survive in the long term.

Josip Rupena, CEO of lending platform Milo and former Goldman Sachs analyst, told Cointelegraph late last month that Crypto Treasury Companies reflected the risks of secured debt that played a key role in the 2008 financial crisis.

“For example, there is this aspect of people taking pictures of pretty healthy products, mortgages today, and Bitcoin and other digital assets today.

magazine: Bitcoin can sink to “Under $50K” on Justin Sun’s WLFI Saga: Hodler’s Digest, August 31st – September 6th.