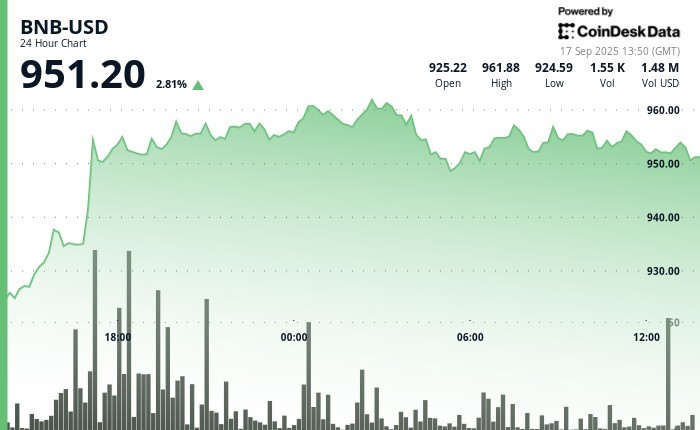

BNB prices have risen nearly 3% in the last 24 hours since Bloomberg reported that Binance had moved from a 2023 settlement with the U.S. Department of Justice to a potential deal that would end AA’s key compliance requirements.

BNB, which offers discounted trading fees on the exchange, has recently been trading nearly $950 after failing to push decisively at a rally launched after the report was published. The court-appointed monitor was appointed as part of Binance’s $4.3 billion settlement for a violation of money’s transmission.

This move follows growth trends within the DOJ. DOJ has already released at least three companies, including divisions of UK lenders Natwest Group and Shipbuilder Austin, from similar surveillance after agreeing to strengthen reporting requirements.

If confirmed, this transaction may require Binance to adopt a more stringent internal reporting system. According to Bloomberg, the DOJ has not made a final decision, and for now the Treasury’s own Binance monitor remains, the report adds.

BNB prices have settled at the highest level in months, rising to $963 in today’s trading session. The trading volume also increased sharply.

The rise allowed BNB to outperform the wider crypto market, which had stepped out on the water ahead of the Federal Reserve interest decision later on Wednesday. The Coindesk 20 (CD20) index has increased by 0.8% over the past 24 hours.

Disclaimer: Part of this article is generated with the support of AI tools and reviewed by the editorial team to ensure accuracy and compliance Our standards. For more information, please refer Coindesk’s complete AI policy.