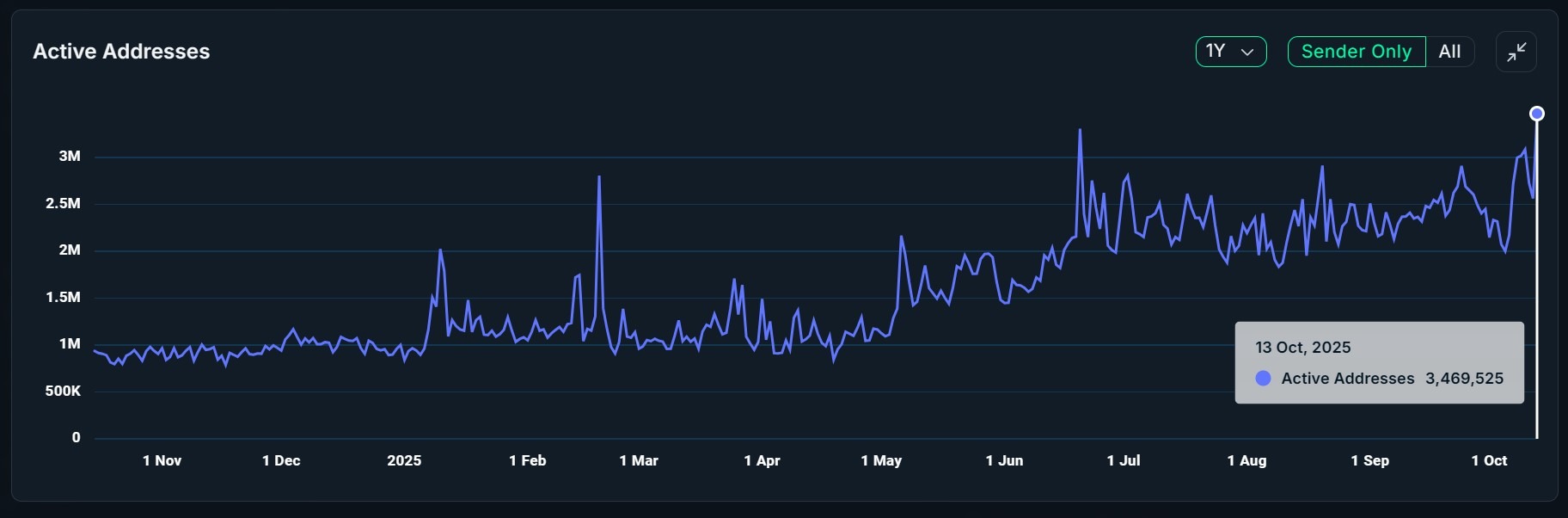

Daily active addresses on the BNB chain hit an all-time high on Monday as the blockchain’s native token reached a new price record.

Analytics platform Nansen revealed that sender-only active addresses (addresses that sent transactions, excluding internal address transfers) on the BNB chain reached a record high of 3.46 million on Monday, surpassing the previous record of 3.44 million set in December 2023.

Nansen data also showed that the number of successful transactions on the BNB chain in the past 30 days exceeded 500 million, an increase of 151% compared to the previous 30 days. The network is second only to Solana, which recorded approximately 1.8 billion transactions during the period.

In terms of active addresses last year, BNB Chain ranks third with nearly 200 million active addresses, almost surpassing Layer 2 network Base. Solana remains at the top of this metric, with around 1.3 billion active addresses last year.

The address that sent the transaction on the BNB chain. Source: Nansen

BNB hits new high after market crash on Friday

The surge in active addresses on the BNB chain coincided with its native token, BNB (BNB), which reached an all-time high on Monday. BNB soared to an all-time high of $1,370 on Monday, rebounding strongly after Friday’s market-wide crash, according to data from CoinMarketCap.

Bitcoin fell to $102,000 on Friday after US President Donald Trump announced 100% tariffs on China. President Trump said the tariffs were a response to China’s efforts to impose export restrictions on rare earth minerals essential to computer chips.

This triggered a market crash that led to nearly $20 billion in forced liquidations, surpassing other crashes such as the FTX collapse.

BNB was also affected by the selloff, dropping to $1,094 on Saturday, down nearly 14% from Friday’s $1,272. However, unlike other cryptocurrency tokens, the asset quickly recovered and hit new all-time highs after the market crash.

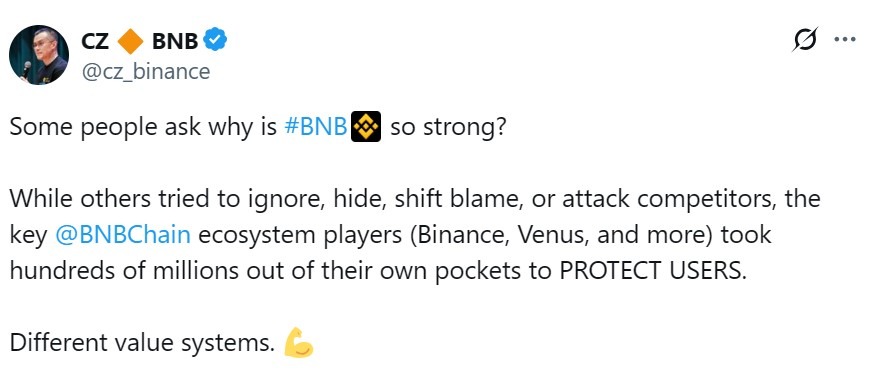

sauce: Zhao Changpeng

While some community members have questioned why BNB was “barely affected” by the crash, Binance co-founder Changpeng Chao defended the asset, saying BNB was strong because ecosystem players on the BNB chain “spent hundreds of millions of dollars out of their own pockets to protect users.”

On Monday, Binance announced that it has completed paying $283 million in compensation to users affected by the depegging of certain Binance Earn products related to USDE, BNSOL, and WBETH.

The exchange also announced that it airdropped $45 million in BNB tokens to memecoin traders affected by Friday’s market crash.

Related: Kazakhstan debuts state-backed crypto fund with BNB

BNB Chain emerges as top DeFi network in Q3

Before Friday’s market crash, the BNB chain was already showing signs of renewed user interest. According to DappRadar, the network saw a 15% increase in total value locked (TVL) in the third quarter of 2025.

DappRadar attributes the increase in BNB Chain TVL to the launch of Aster, a perpetual decentralized exchange (DEX) that became popular in September.

magazine: EU’s privacy-destroying chat control bill postponed, but the fight isn’t over