Listed on EuroNext Growth Paris and known as Europe’s first Bitcoin Treasury Company, Blockchain Group (AltBG), has announced a capital increase of around 8.6 million euros to move forward with the Bitcoin finance company’s strategy. The funds are raised through two businesses, an increase in reserved capital and privately owned arrangements, both at a price of 1.279 euros per share.

just:

French Corporate Blockchain Group raises 8.6 million euros to buy #bitcoin pic.twitter.com/vjtkyfss6w

– Bitcoin Magazine (@bitcoinmagazine) May 20, 2025

This price represents a 20.18% premium over the 20-day volume-weighted average stock price, but it is a 46.26% discount compared to the closing price on May 19, 2025, reflecting the recent stock price volatility.

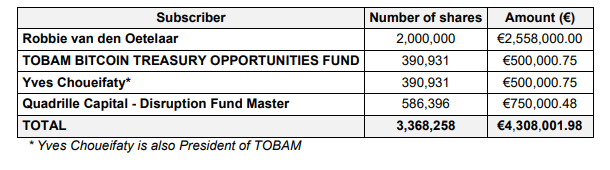

“Our board of directors decided on May 19, 2025 using the commissioner granted by the General Meeting of Shareholders held on February 21, 2025. Under the terms of the fifth resolution, shareholders for shareholders have decided through 3,368,258 new common stock, using 1.2790 common stock, including 1.2790 shares, including 1.2790 shares, including 1.2790 shares, including 1.2790 shares, including 1.2790 shares, including 1.2790 shares, including 1.2790 shares, including 1.2790 shares, including 1.2790 shares, including 1.2790 shares, including 1.2790 shares, including 1.2790 shares, including 1.2790 shares, including 1.2790 shares, including 1.2790 shares, including 1.2790 shares, including 1.2790 shares, including 1.2790 shares, including 1.2790 shares, including 1.2790 shares, including 1.2790 shares, including 1.2790 shares, including 1.2790 shares, including 1.2790 shares, including 1.2790 shares, including 1.2790 shares, including 1.2790 shares, including 1.2790 shares, including 1.2790 shares, including 1.2790 shares, including 1.2790 shares, including 1.2790 shares, including 1.2790 shares, including 1.2790 shares, including 1.2790 shares, including 1.2790 shares, including 1.2790 shares, including 1.2790 shares, including 1.2

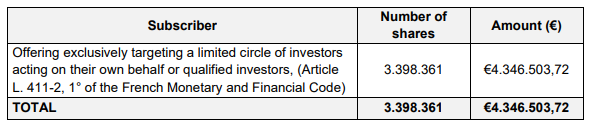

In the increased reserved capital, 3.37 million shares have been issued to selected investors, including Robbie van Den Oetelaar, Tobam Bitcoin Treasury Opportunities Fund and Quadrille Capital, raising over 4.3 million euros. The private school raised an additional 4.35 million euros through issuance of 3.4 million shares, targeting qualified investors.

“The board has also decided to increase shareholders’ unpreemptive capital through offerings to target limited investors’ circles acting on behalf of their own or qualified investors,” the press release said.

The funding supports the Blockchain Group’s ongoing strategy of accumulating Bitcoin and expanding its subsidiaries of data intelligence, AI and decentralized technologies. Following this capital increase, the company’s share capital is 4.37 million euros, split into more than 109 million shares.

“The funds raised through capital increase allow the company to strengthen the strategy of a Bitcoin financing company, which consists of accumulation of Bitcoin, and continue to develop its operational activities of its subsidiaries,” the press release states.

Additionally, on May 12, Blockchain Group announced that it had secured approximately 12.1 million euros through convertible bond issuances reserved for BlockStream CEO Adam Back.

This post Blockchain Group secured 8.6 million euros and was first featured in Bitcoin magazine, which boosted its Bitcoin strategy, and is written by Oscar Zaragaperez.