2025 has been a difficult year for the cryptocurrency market and industry, and Bitcoin exchange traded funds (ETFs) have not been spared. The US-based Bitcoin ETF market has experienced wet and dry seasons in equal proportions throughout the year.

However, BlackRock’s spot Bitcoin ETF, iShares Bitcoin Trust (ticker: IBIT), has performed spectacularly at times this year. According to the latest market data, its 2025 performance positions it as one of the best funds in the global ETF market.

BlackRock’s IBIT to record $25 billion net inflows in 2025

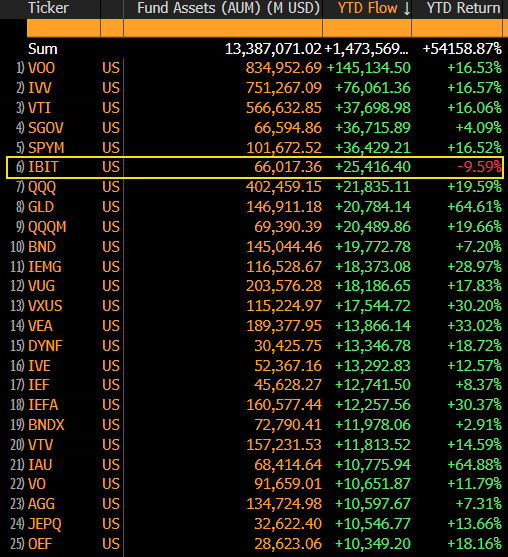

Bloomberg senior analyst Eric Balchunas said in a recent post on social media platform X that BlackRock’s Bitcoin ETF ranked sixth in net capital inflows last year. This feat comes despite BTC exchange-traded funds posting negative returns over the same period.

BlackRock’s IBIT has seen net inflows of about $25 billion so far last year, according to data shared by Balchunas. What’s interesting is that the Bitcoin ETF has drawn this significant capital despite being the only fund among traditional stock and bond ETFs to have negative performance, as seen in the chart below.

Source: @EricBalchunas on X

Interestingly, SPDR’s GLD ETF, the world’s largest physically collateralized gold exchange-traded product, lags BlackRock’s IBIT in terms of capital inflows, despite returning 64% annually. Notably, Vanguard’s S&P 500 ETF (VOO) led the cohort with capital inflows of over $145 billion to date.

Balchunas also emphasized that while the cryptocurrency community will understandably complain about the returns of Bitcoin ETFs, it is also important to recognize its significant achievement of raising the sixth largest capital base despite these negative returns. According to ETF experts, this annual performance bodes well for the long term.

Balqunas wrote:

If you can make $25 billion in a bad year, imagine the liquidity potential in a good year.

The Bloomberg analyst credited older, long-term investors (boomers), whom he called the “HODL clinic,” for the positive net inflows seen in BlackRock’s Bitcoin ETF.

Bitcoin ETF records $497 million in weekly outflows

US-based Bitcoin ETFs ended the week on Friday, December 19, with net outflows totaling $158 million, according to SoSoValue data. This resulted in ETF outflows of approximately $497.05 million over the past week.

The dismal performance of the Bitcoin ETF market can be seen in some of the best cryptocurrency price action in recent weeks. Bitcoin price is down exactly 30% from its all-time high of $126,080.

As of this writing, the BTC price is around $88,293, down 2% over the past seven days.

The price of BTC on the daily timeframe | Source: BTCUSDT chart on TradingView

Featured image by Getty Images, chart by TradingView

editing process for focuses on providing thoroughly researched, accurate, and unbiased content. We adhere to strict sourcing standards, and each page is diligently reviewed by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of the content for readers.