- Bitwise’s Spot Solana ETF recorded positive inflows for eight consecutive days, totaling $312.

- Solana price is poised for a bullish rebound from the $150 floor.

- Solana surpassed Ethereum in app revenue, generating $4.34 million in the last 24 hours.

SOL, the native cryptocurrency of the Solana blockchain, made a bullish rebound from the $150 support on Friday, posting an intraday gain of 5.3%. The rally comes as a broader market correction slows, with Bitcoin showing resilience above the $100,000 level. However, Solana gained even more momentum as the Bitwise SOL Spot ETF continued to receive inflows and Solana’s app revenue increased significantly. Will this trigger be enough to fuel a sustained recovery for this altcoin?

Bitwise Solana ETF records 8 consecutive days of inflows

Following the crypto market decline on November 3rd, Solana price moved sideways above the $150 support. Since then, price action has shown several failed attempts to break out of this support, but a long tail rejection shows that demand pressure remains intact.

In addition to the slowing market correction, Solana price resilience can be attributed to consistent investor demand for the recently launched Bitwise Solana ETF (ticker: BSOL).

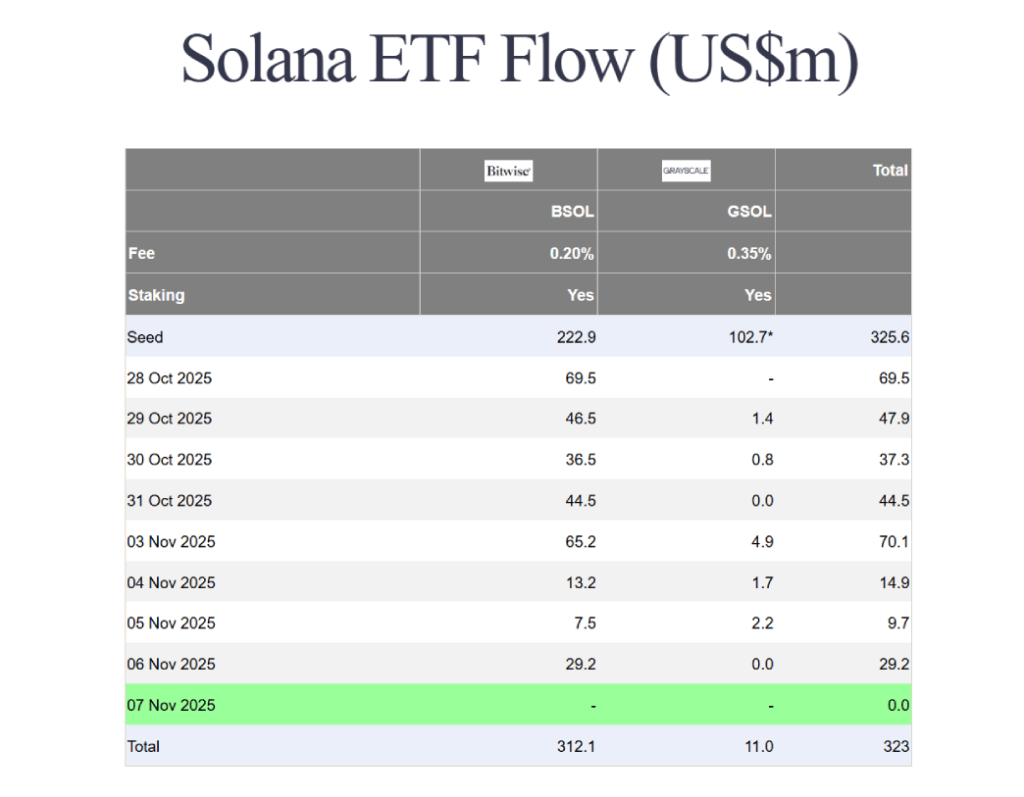

According to data shared by Farside Investors, the Bitwise Solana ETF has recorded eight consecutive days of net inflows, bringing the total amount invested since the ETF’s inception to $312 million. The product did very well during this period, attracting approximately $39 million in new funding per day. This shows interest from institutional investors and retailers despite the overall market volatility.

While asset flows are showing positive signs, on-chain performance data shows that Solana is outperforming its closest rival Ethereum in surprising areas. According to DeFiLlama, decentralized applications on the Solana network generated an estimated $4.33 million in revenue in the past 24 hours, compared to $1.82 million for Ethereum-based applications.

Over a 30-day period, the difference is even more dramatic, with Solana continuing to lead in terms of total app revenue. This is a rare reversal of the long-term trend in which Ethereum dominated in protocol and application revenue metrics.

Ethereum has consistently outperformed its rivals in terms of network activity and developer revenue in previous quarters, but Solana’s rapid growth in DeFi and consumer applications is likely to change that dynamic.

Solana price poised for short-term rebound towards $180

Over the past two weeks, Solana’s price has seen a notable correction from $205 to its current trading price of $163, a 20% loss. As a result, the asset market capitalization plummeted to $90.5 billion.

During this pullback, the coin price decisively broke away from the support trend line of the channel pattern on the daily chart. Since March 2025, the altcoin has followed a steady recovery trend within this channel, with the price resonating between two parallel trend lines.

The recent breakout therefore signals a change in market dynamics, strengthening sellers’ control over this asset. However, with today’s 5.32% increase, Solana price shows a rebound from the $150 support and a possible retest of the broken trend line at $180.

The broken trendline is now in line with the 200-day exponential moving average, providing a strong defense against price increases. If sellers continue to adhere to this barrier, the correction could move below the $150 floor and extend towards the $125 support.

SOL/USDT-1d chart

Conversely, if the coin price manages to make a bullish breakout at $1.80 and re-enter the channel range, the bearish thesis will be invalidated.