Ethereum is trading again at a critical level after regaining the $4,000 mark, a zone closely monitored by traders and analysts. The Bulls are able to defend the $4,100 area and are showing resilience after weeks of volatile price fluctuations. However, momentum remains vulnerable, and ETH requires a critical push above the higher resistance level to ensure that a trend shift is ongoing. Without such a breakout, the risk of an updated integration remains on the table.

Despite the uncertainty of price action, on-chain data provides a more constructive view of the market. The fresh figure reveals that the whales continue to accumulate ETH despite wider emotions shaking. This steady inflow of capital from large owners suggests increased confidence in Ethereum’s long-term outlook, reinforcing the idea that recent revisions may represent opportunities rather than weakness.

This accumulation has historically preceded a period of new strength. If ETH can maintain its holding and maintain momentum above $4,100, whale activity could provide the support it needs to cause a stronger recovery. For now, all eyes remain in Ethereum’s ability to maintain this critical level and challenge higher zones of resistance.

Whale activity demonstrates trust in Ethereum

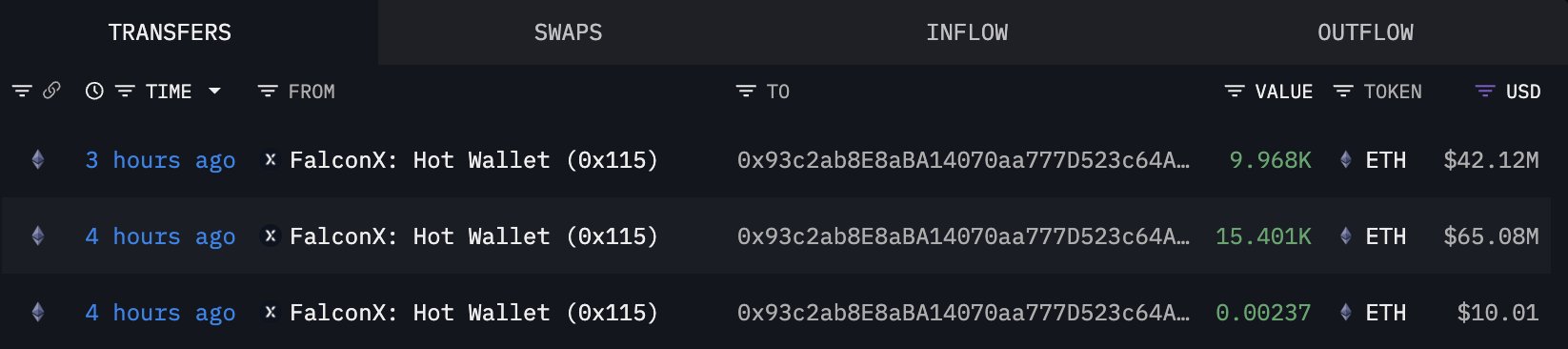

Ethereum’s recent price action has left traders uncertain, but the whale’s actions tell a different story. According to Lookonchain data, large holders continue to accumulate ETH despite recent market declines. In the past few hours, two major transactions highlighted this continuing trend.

The newly created wallet, 0x93c2 (where analysts may belong to Bitmine), received 25,369 ETH, worth around $106.74 million from Falconx just three hours ago. Such a large influx into fresh wallets suggests a strategic accumulation aimed at long-term holdings or staking rather than short-term transactions. In parallel, another new wallet, 0x6F9B, retracted 4,985 ETH (approximately $21 million) from OKX just an hour later. These moves limit immediate sales pressure and reduce the supply of exchanges, which are often seen as a sign of bullishness.

This pattern highlights the dynamics of the broader market. Retailers and small participants respond to short-term volatility, but whales appear to view correction as an opportunity. Their accumulation shows confidence in Ethereum’s resilience, as well as it shows preparation for future price increases. Historically, consistent whale influx into fresh wallets has coincided with periods of structural support and ultimate recovery.

ETH is struggling to get back $4,200

Ethereum is trading nearly $4,138 after a volatile week in which it saw its price fall below $4,000 before it bounced. The 8-hour chart highlights attempts to recover, but ETH is currently facing significant resistance at a $4,200 level where the moving averages for the 100th period (green) and 200th period (red) converge. This confluence creates a heavy supply zone that the Bulls have to overcome to see even more reverse momentum.

The recent decline from the $4,600 to $4,800 range left Ethereum in a vulnerable state, and sales pressures increased during the decline. Rebound shows resilience, but price action is capped by overhead resistance, keeping emotions careful. Not regaining the 50th moving average (blue) has previously highlighted the challenge of reversing short-term bearish momentum.

On the downside, the $4,000 mark serves as your first important support. A breakdown below that level could reabsorb ETH to $3,800, or even $3,600, which could lead to stronger demand. For now, Ethereum is trading in the consolidation phase, and the next critical move could depend on whether the Bulls can force a breakout of over $4,200. A higher clean movement opens the door towards $4,400, but a rejection updates downside pressure.

Dall-E special images, TradingView chart

Editing process Bitconists focus on delivering thorough research, accurate and unbiased content. We support strict sourcing standards, and each page receives a hard-working review by a team of top technology experts and veteran editors. This process ensures the integrity, relevance and value of your readers’ content.