Bitmine Immersion added 78,791 ETH to its finances, bringing its total holdings to nearly 1.8 million ETH.

summary

- Bitmine Immersion spent $354.6 million to win 78,791 ETH, increasing its total holdings to 1,792,960 ETH, worth more than $8 billion.

- The company aims to hold 5% of its total supply of Ethereum.

- Tom Lee predicts that ETH could reach $5,500 and surge from $10,000 to $16,000 each year.

- The strategic pivot from Bitcoin to Ethereum was announced in late June and is supported by a $250 million salary increase.

Bitmine Immersion has added 78,791 Ethereum (ETH) to its holdings, spending approximately $354.6 million. The purchase will bring the company’s total Ethereum holdings to 1,792,960 ETH, worth more than $8 billion as ETH trades around $4,400. It also brings Bitmine closer to the stated goal of gaining 5% of total ETH supply.

This latest purchase continues Bitmine Immersion’s aggressive Ethereum accumulation strategy. Under Tom Lee’s guidance, the publicly-published company announced its strategic pivot from Bitcoin (BTC) mining to Ethereum accumulation in late June. The move was marked by a $250 million salary increase aimed at purchasing Ethereum as the company’s main Treasury Protected Asset. The announcement has resulted in Bitmine’s stock price surged by 3,000%.

You might like it too: Tom Lee predicts that Ethereum will be at the bottom a few hours after Bitmine snaps 4,871 ETH

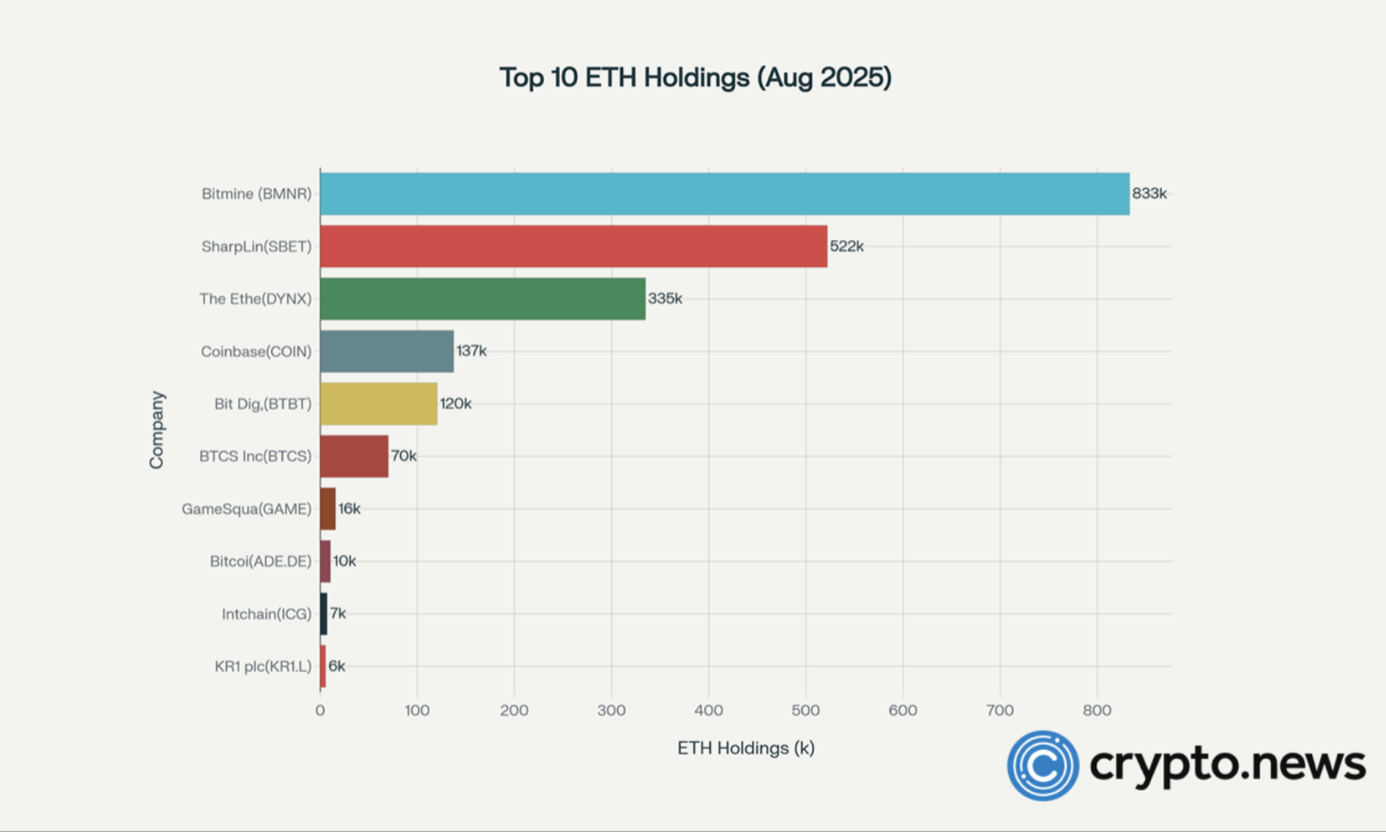

Bitmine Immersion leads the system’s ETH accumulation

Bitmine Immersion’s pivots on ETH accumulation reflect the growing institutional interest in Ethereum for this bullish circulation. This trend contrasts with the previous cycle in which ETH was largely lacking support from key corporations or institutional finance ministries.

Alongside Bitmine, other publicly available ETH financing companies, including Sharplink Gaming (SBET) and BTCS Inc. (BTCS), are seeing similar momentum.

Source: crypto.news

Analysts suggest that ETH Treasury stocks may offer more attractive valuation and operational flexibility than ETFs, as they combine liquidity, efficiency and potential profits through a capital structure that is not available in passive ETF products.

You might like it too: Bitmine Immersion’s $500 Million ETH Pivot Shakes Crypto Financial