Bitmine, the crypto asset company that accumulates Ether (ETH) and Bitcoin (BTC), announced on Friday that it plans to launch a “Made in America Validator Network” (MAVAN) to stake its ETH holdings.

According to a BitMine announcement, the company is piloting MAVAN with three staking infrastructure providers ahead of a planned launch in Q1 2026.

Proof of Stake (PoS) Staking of tokens to validate a blockchain secures the network and generates revenue in the form of staking rewards paid in the blockchain network’s native token (ETH in this case).

“At scale, we believe our strategy is best in the long-term best interests of our shareholders,” BitMine Chairman Tom Lee said in a statement.

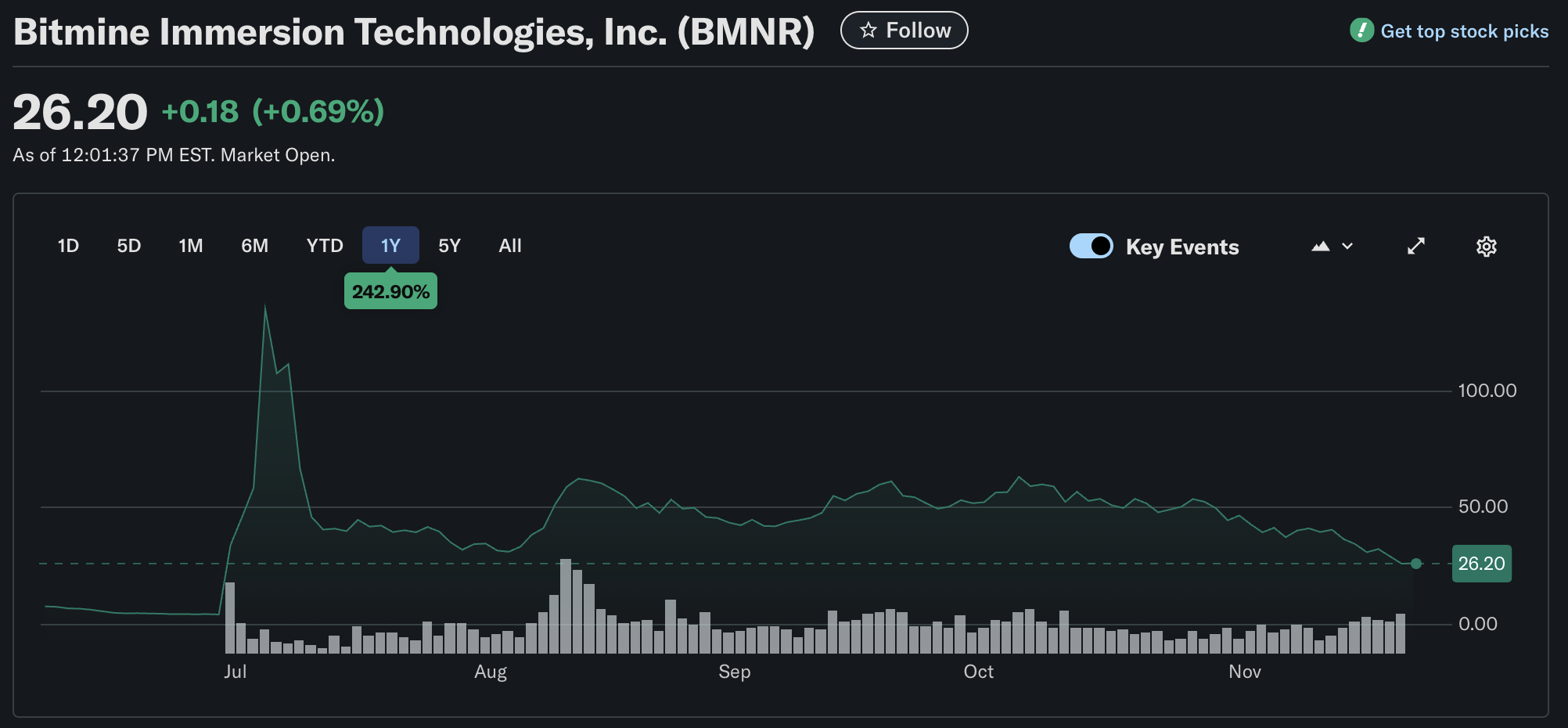

Bitmine’s stock price has crashed, along with other crypto treasury companies that have seen slow bleeding in 2025. source: Yahoo Finance

The announcement comes amid a significant downturn for the crypto market and crypto treasury companies. The company has experienced a collapse in its multiple on-net asset value (mNAV), a key metric that tracks the price premium placed on shares of crypto treasury companies.

Related: Tom Lee speculates that injured market makers are behind the crypto crisis

BitMine suffers from plummeting ETH price and market collapse

According to a report by research firm 10x Research, Bitmine has unrealized losses of more than $3.7 billion due to the plummeting ETH price.

A report published on Thursday pegged the price of ETH at $3,023, but ETH’s decline widened on Friday, with the price dropping to around $2,700 at the time of writing.

The price of ETH hit an all-time high of over $4,900 in August before crashing. sauce: TradingView

The drop in price means that the company is currently underwater by more than $1,000 per ETH it holds, despite having built up assets towards all-time highs in July and August.

A crash in ETH below $3,000 could wipe out a year’s worth of profits for crypto companies that hold ETH, and further declines in price could lead to further financial stress for these companies.

“Treasury companies will face a harsh reality: Attracting new retail investors will be nearly impossible when existing shareholders are saddled with billions of dollars in losses,” 10x Research wrote.

The treasury model faces increased competition and market share erosion from asset managers such as BlackRock and exchange-traded fund providers, allowing investors to gain exposure to digital assets and staking rewards at lower costs, according to 10x Research.

magazine: If the crypto bull market is ending… it’s time to buy a Ferrari: CryptoKid