As the overall crypto market continues to struggle for bullish momentum, Ethereum is once again under selling pressure and testing key support levels. Altcoins are losing momentum across the board, raising concerns among traders and sparking renewed discussion about the possibility of a bear market. The recent economic downturn has pushed Ethereum closer to key technical levels, and investors are watching to see if Ethereum can maintain support or whether further decline is imminent.

However, not everyone is bearish. Lookonchain’s on-chain data revealed that Bitmine, one of the largest holders of Ethereum, made a massive purchase acquiring 63,539 ETH worth approximately $251.6 million. While large, timely purchases during a drawdown do not guarantee a reversal, they often reveal where deep-pocketed participants think the value is. At the very least, it injects new demand when sentiment is fragile and reactive.

From here on, the tape becomes important. If ETH can maintain this support and compress to higher lows, the market may start treating the recent decline as a shakeout rather than a regime change. If the market loses decisively, the calls for a “bear market” will become even louder. For now, Ethereum is at a crossroads. Pressure is mounting, skepticism is mounting, and there’s one big buy that suggests the story isn’t over yet.

Bitmine adds Ethereum amid market downturn

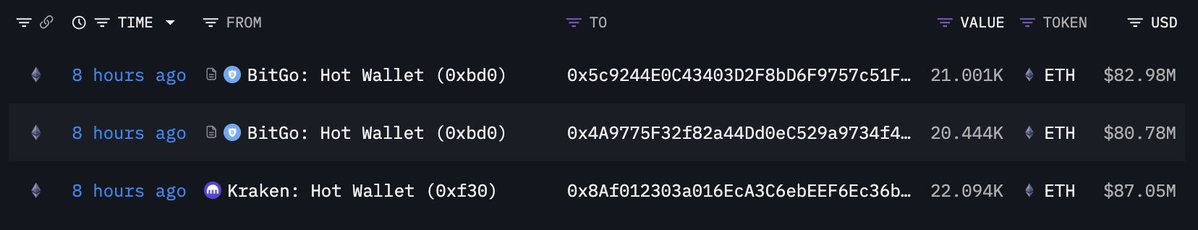

According to Lookonchain, Ethereum whale Bitmine made a big move just 8 hours ago. Three newly created wallets received a total of 63,539 ETH from Kraken and BitGo, worth approximately $251.6 million. On-chain activity has sparked new debate among analysts. This is because such large transfers during periods of selling pressure often reflect accumulation by institutional investors rather than routine repositioning.

With this addition, Bitmine’s holdings will be 3,299,553 ETH, worth approximately $13.07 billion, or approximately 2.73% of the total circulating supply of Ethereum. The sheer size of this position makes Bitmine one of the most influential holders of ETH, allowing it to influence both sentiment and liquidity across the network. Analysts often interpret this type of movement as a signal of confidence, especially if it occurs during a period of increased volatility.

At a time when Ethereum is struggling to maintain key support levels and market-wide confidence is fragile, such accumulation could act as a stabilizing force, or at least a psychological force. Historically, we have seen similar whale activity ahead of local price recoveries as supplies tighten and market participants reassess short-term bearish bias.

Still, the broader context cannot be ignored. Ethereum remains vulnerable to macro headwinds, and on-chain flows alone may not be able to offset systemic selling. But what is clear is that Bitmine’s latest accumulation stands out as a show of faith. This is a positive move that suggests some large holders still view current price levels as a long-term opportunity rather than a sign of further decline.

Test the all-important price level

On the 3-day chart, Ethereum (ETH) is currently trading around $3,871, looking to stabilize after a period of sharp selling pressure. While the broader structure still points to an uptrend, recent candlesticks show that the bullish momentum is clearly slowing. After peaking around $4,800, ETH entered a correction that pushed the price back toward the 50-period moving average (blue line), which is now an important short-term support level.

This zone has historically served as a pivot for mid-cycle consolidation, and holding above it can keep Ethereum within a healthy market structure. However, if ETH loses this level, the next key support lies between $3,400 and $3,500, where the 100-period (green) and 200-period (red) moving averages converge, an area where long-term buyers often congregate.

On the upside, a definitive close above $4,000-$4,200 is needed for ETH to regain momentum and retest the $4,500 resistance, which has been a strong rejection level since late September.

Overall, the 3D chart depicts short-term weakness within a broader bullish framework. Ethereum’s ability to defend midrange support will determine whether this correction develops into an accumulation or marks the start of a deeper market retrace.

Featured image from ChatGPT, chart from TradingView.com

editing process for is focused on providing thoroughly researched, accurate, and unbiased content. We adhere to strict sourcing standards, and each page is carefully reviewed by our team of top technology experts and experienced editors. This process ensures the integrity, relevance, and value of your content to your readers.