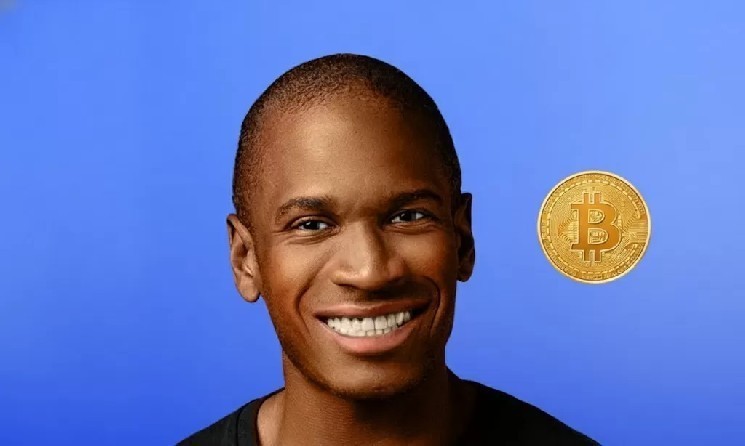

Arthur Hayes, founder of BitMEX and closely followed in the crypto market, has published a new article titled “Frowny Cloud”.

In his article, Hayes points out that Bitcoin (BTC) may not perform as expected throughout 2025 due to tight USD liquidity. According to him, the tightening of dollar lending conditions in the global financial system is suppressing appetite for risk assets, which has a direct impact on the cryptocurrency market.

Hayes said the liquidity situation will become more challenging in 2025 due to the Federal Reserve’s tight monetary policy stance, balance sheet reduction process and more cautious lending trends in the banking sector.

In this environment, high-risk and volatile assets like Bitcoin become less attractive to investors, he said. According to Hayes, BTC‘s weak price performance should be explained by macroeconomic trends rather than technical factors.

However, savvy investors paint a more optimistic picture for 2026. Mr. Hayes predicts that USD-denominated credit will enter a new phase of expansion.

In this context, he said the Fed expects new balance sheet growth, increased bank lending appetite and lower mortgage rates. He argued that these developments could create a supportive environment for risk assets by injecting new liquidity into the market.

Hayes said if this scenario plays out, cryptocurrencies, and Bitcoin in particular, could regain strong upward momentum, similar to stocks and other risk assets. According to him, unless the macro liquidity situation improves, a sustained bullish trend in the cryptocurrency market will be difficult.

*This is not investment advice.