Real-world asset tokenization platforms Openeden and Crypto Infrastructure Provider Bitgo have taken part in the race to issue Hyperliquid’s planned native Stablecoin, USDH, bringing the number of candidates to eight.

The high lipid validation device will begin voting for USDH proposals starting Thursday and will be able to vote until Sunday. Other suitors include Ecena, Paxos, Flux, Agora, Native Market and Sky.

According to Defillama, the winning bid decides how to manage Hyperliquid’s $5.9 billion Stablecoin Reserve, with 95.56% of that being held at USDC (USDC).

Openeden’s bid for USDH

Openeden founder and CEO Jeremy Ng on Wednesday explained the platform’s suggestions on how to handle USDH to beat VID.

The RWA platform has committed to distributing all yields generated from the USDH reserve into high lipid ecosystems, including buybacks.

Additionally, the revenue from USDH construction and redemption is used to buy back Hyperliquid hype tokens and distribute them to high lipid verification devices.

The company provided additional incentives by adding 3% of its native Eden Token Supply.

The USDH reserve is kept in the tokenized US Treasury Bill Fund, and its custody is under the Bank of New York Mellon.

The company partners with New York Mellon Bank, Chainlink, Aeon Pay and Monarch Asset Management for adoption.

Bitgo promotes regulatory skills

Meanwhile, BITGO said it will utilize US dollar-backed liquid assets, bank deposits and short-term Treasury bills to cast and redemption USDH.

The company said it will use chain link cross-chain interoperability protocols to maintain interoperability between chains.

Yields from the underlying assets are used to purchase and bet tokens of hype, and the company receives a 0.3% fee for the total reserve.

As six companies acquired the market for Crypto-Assets licenses from Dubai, Singapore, Denmark, New York and Germany, Bitgo touted regulatory compliance as a major strength.

Related: How the average number reached $300 billion in monthly trading volume with just 11 employees

The Native Market Leads the Pack

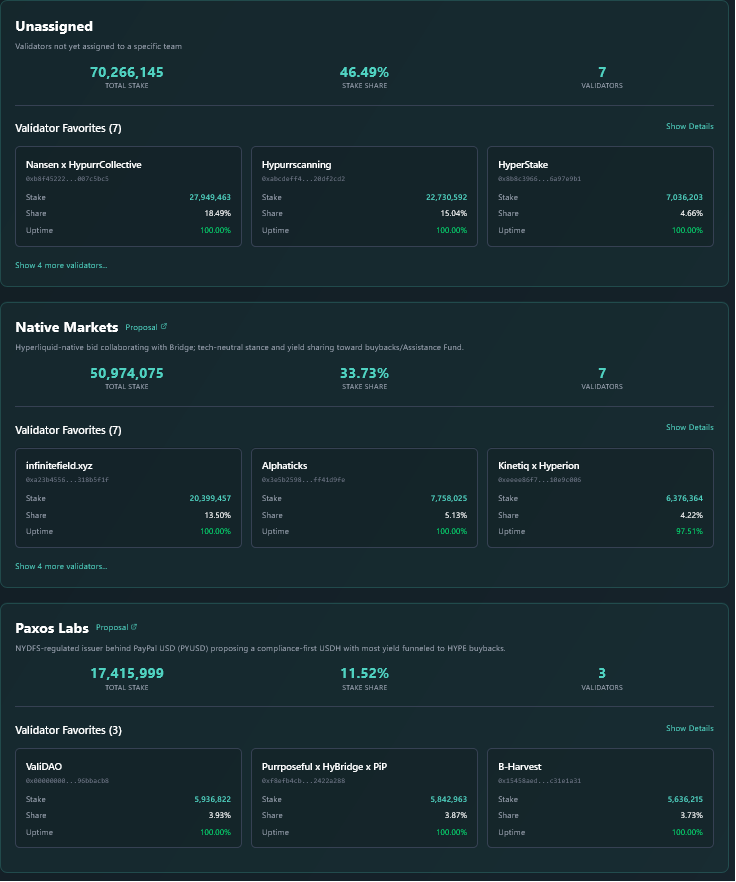

At the time of writing, Native Market has received the most votes, with 33.73% of its representative assets choosing its proposal.

The native market, co-founded by community member Max Fiege, has proposed splitting revenues from the reserves, with half of the revenue being used to buy back hype tokens and the other half being granted to the support fund. However, the proposal has been hit with the community.

Haseeb Qureshi, managing partner of Crypto Venture Fund Dragonfly, has raised questions about the native market bid.

“We’ve heard from multiple bidders that no one in the validator is interested in considering people outside the native market. It’s not even a serious argument, as if there’s a backroom deal going on,” Qureshi said.

Nansen CEO Alex Svanevik has rebutted the claim, saying they are working with bidders along with allies and encouraged them to submit proposals to make the bidding process competitive.

The dashboard shows the native market leading the vote. sauce: USDH Voting Tracking Dashboard

Paxos Labs, which submitted its revised bid on Wednesday, is currently second in a vote share of 11.52%.

However, 46.49% of the shares remain unallocated, which could significantly alter the outcomes of those who create the USDH token.

Multi-tiered votes show that market participants primarily expect native markets to win the proposal.

Other bidders include Ethena Labs, which submitted the proposal on Tuesday, and Sky, a former marker, submitted the proposal on Monday.

magazine: Meet the co-founders of Ethereum and Polkadot, who weren’t Time Magazine