Blockchain analytics platform Glassnode shared some important insights into Bitcoin’s liquidity levels during a rather volatile market period. In particular, the leading cryptocurrency struggled to maintain its “Uptober” form after its price soared to $126,000 and then corrected significantly below $105,000. Bitcoin has seen some recovery activity since then, but has yet to break above the $115,000 resistance, with a total monthly gain of 0.47%.

Bitcoin Liquidity Rising, Testing Demand Strength

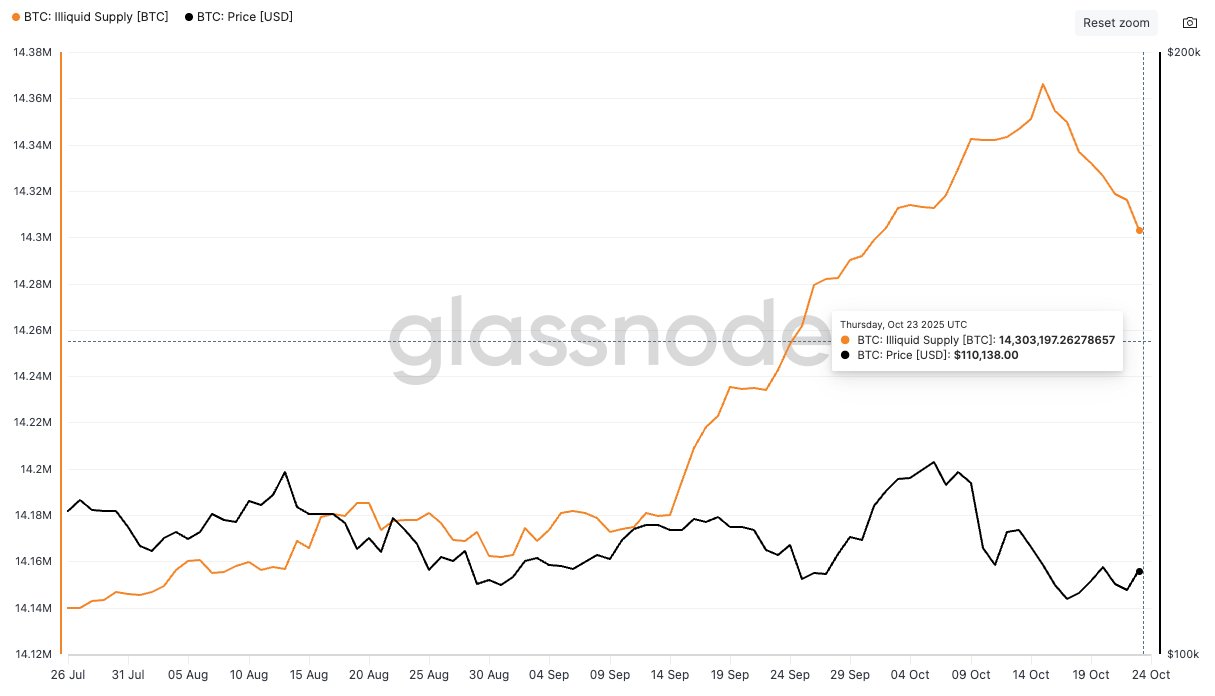

Glassnode reported in an X post on October 25 that Bitcoin’s illiquid supply has decreased by 62,000 BTC since mid-October. For context, Iliquid Bitcoin refers to BTC sitting in a wallet with little or no sales history. These are essentially coins that are unlikely to move because holders spend very little and are kept out of the market.

Therefore, a decrease in illiquid BTC means that more coins are actively in circulation, increasing the available supply. This dynamic could make sustained price increases more difficult unless offset by a strong surge in demand.

Glassnode explains that before the recent decline, the increase in illiquid supply was a positive catalyst in this market cycle. Historically, similar downturns, such as the 400,000 BTC drop in January 2024, have tended to slow market momentum by increasing the amount of Bitcoin in active circulation.

Who is behind the sales?

In analyzing this illiquid BTC drop, Glassnode further discovered that the accumulation activity of Bitcoin whales has accelerated. Notably, BTC wallets have increased their holdings over the past 30 days and have yet to liquidate large positions since October 15th.

Therefore, the increase in BTC liquidity has been driven by retail investors. More data from Glassnode shows that wallets holding between 0.1 and 10 BTC, or $10,000 to $1,000,000, continue to experience massive outflows. Notably, these traders have been steadily reducing their BTC exposure since November 2024.

Regarding the recent price action, Glassnode analysts note that momentum buyers, primarily retail investors, are increasingly exiting the market. Although the activity of deep buyers (whales) has increased, their demand has not been able to absorb the excess supply, leading to the price imbalance currently observed.

As of this writing, Bitcoin is trading at $111,570, up slightly 0.89% over the last 24 hours. On a higher note, the leading cryptocurrency has recorded an increase of 4.11% over the past week and is up a modest 0.05% over the past month.

Featured image from Flickr, chart from Tradingview

editing process for focuses on providing thoroughly researched, accurate, and unbiased content. We adhere to strict sourcing standards and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of the content for readers.