Maestro, a leading Bitcoin Finance infrastructure provider, has published a “Bitcoinfi State of Bitcoinfi” report.

Maestro expects volumes to skyrocket as businesses continue to stack BTC at the Treasury Department and more idol coins will be revitalized for harvest and further uses.

“We’re committed to providing a range of services to our customers,” said Marvin Bertin, co-founder and CEO of Maestro. “Tradfi and Defi are witnessing the convergence into Bitcoin dominant capital markets,” he said.

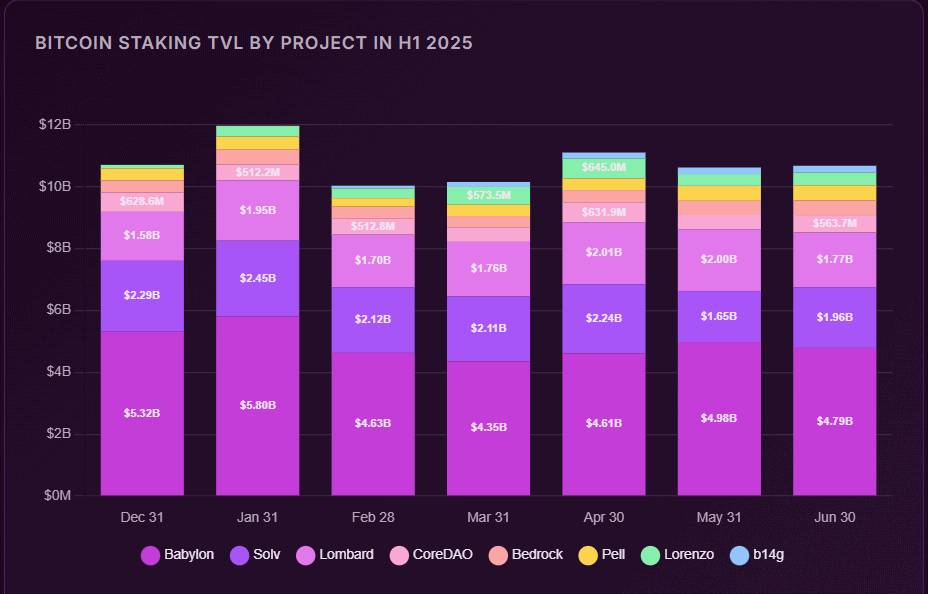

Staking and lending

With over 68,500 Bitcoin ($73.9 billion) on TVL, staking has become the most widely used application at Bitcoin Fee. Restakes are also steadily increasing, with $3.32 billion of BTC being restaked. That means the niche now has more than $10 billion through protocols that include yields.

Babylon is currently leading the scale ($47.9 billion), while Solv, Lombard and Coredao are advancing the frontier, redevelopment strategies and dual token security models for liquid staking tokens (LST). Bitcoin native lending is led by Liquidium with a volume of over $500 million.

Another form of gaining traction is dual staking, introduced by Coridao. Incentives include block rewards from native core tokens and shares of transaction fees distributed to stakers and validators.

A number of challenges remain as many staking returns do not match financial rates. We know if BTC can continue to provide sustainable rewards if the durability of a fixed network.

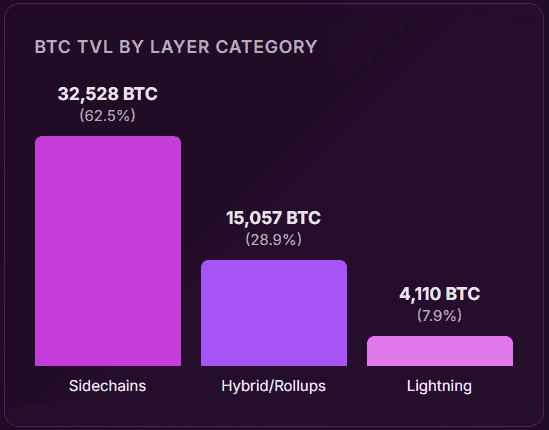

Programmer’s Layer

Bitcoin’s scaling and Layer 2 (L2) layer has $5.52 billion (52,000 coins) in total value lock (TVL), suggesting developer and user demand driven by native smart contracts, yields and asset allocation.

The growth of the Stacks layer is more than doubled in Q2, adding about 2000 BTC. The sidechain still holds most of Bitcoinfi’s assets, but the architecture is diversified, with the roll-up and execution layers looking promising.

Bitcoin’s legacy constraints are slowly peeling away, as the base layer was not for programmerism. Ethereum has more than $116 billion in Defi TVL, but the infrastructure lined up in BTC leaves over $5.5 billion behind in TVL across the scaling layer. However, new sidechains, roll-ups, and a variety of environments continue to emerge, pushing the largest assets per market capitalization beyond passive value roles.

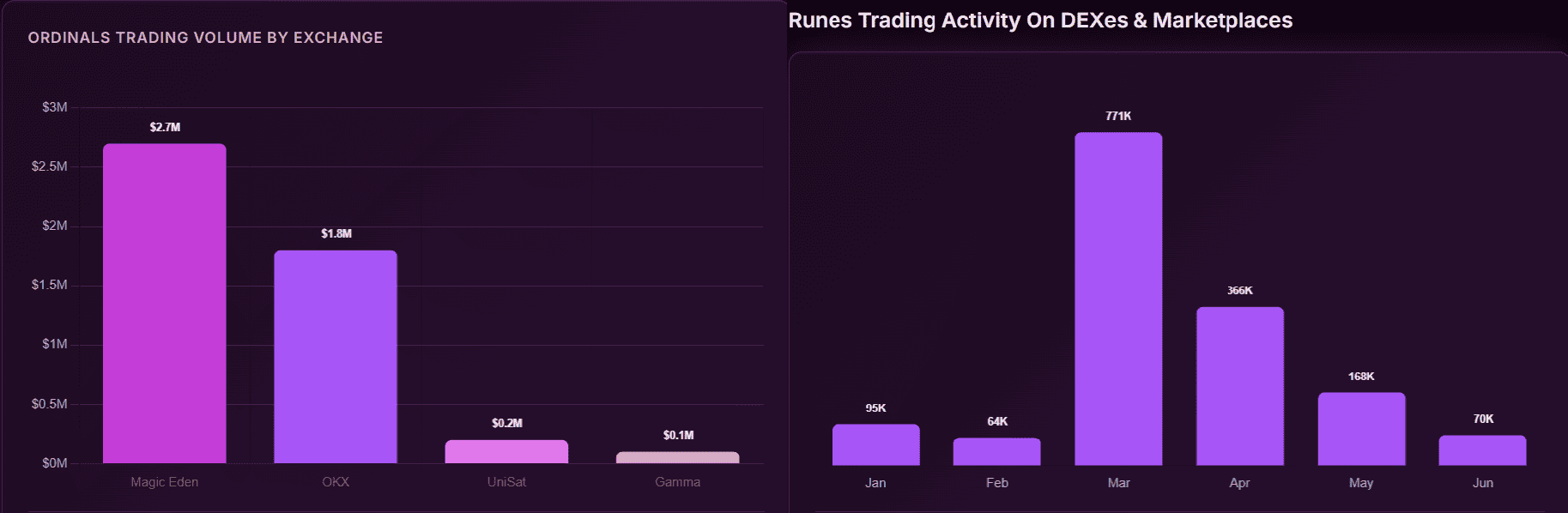

Metaprotocol

In the first half of 2025, runes, ordinals, and BRC-20 tokens accounted for 40.6% of all Bitcoin transactions, with BRC-20 volume reaching $128 million.

Following last year’s pullback, the ordinals had over 80 million inscriptions by mid-2025, generating a fee of 6,940 BTC (~$681 million). Rune is recovering from a sharp decline in construction and trading volume at the end of 2024.

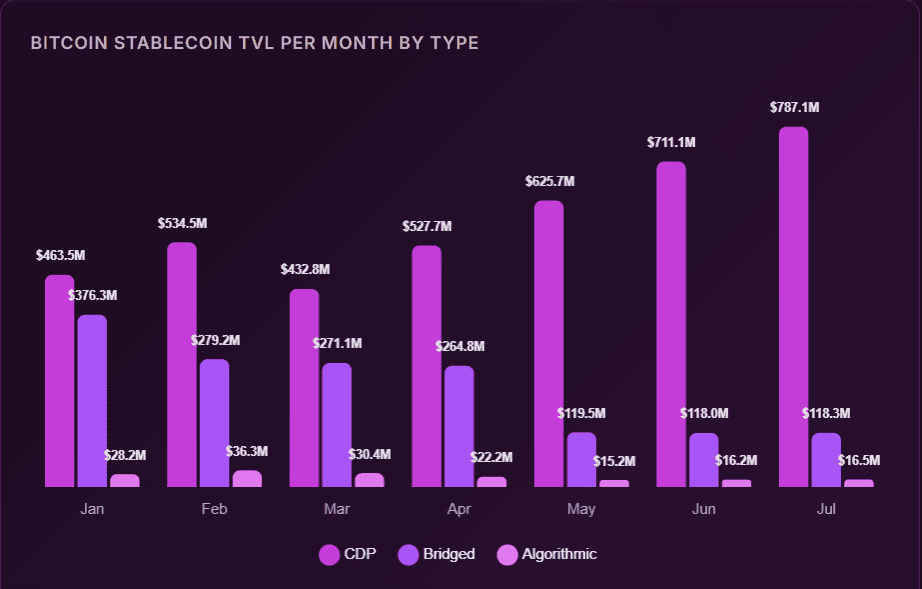

stablecoins

With TVL having $860 million (over 42% quarterly), this asset class reached prevalence within the Bitcoin ecosystem thanks to the maturation of L2S and the increased demand for traditional primitives.

CDP-based (secured debt position) Stabrecoin, such as Avalon’s USDA ($559 million), has discovered early traction at Bitcoin Fee. High-yield stubcoins, including Hermetica’s 25% APY offering, point to the demand for capital-generating assets.

With fragmented liquidity (the lack of clearing arrangements prevents transactions with one or more participants), several hurdles remain, limiting the depth of the chain and L2 market.

Oracle’s design is a CDP (secured debt position) issue, and the trade-off of complexity introduces rigidity between performance and diversification.

Venture funding

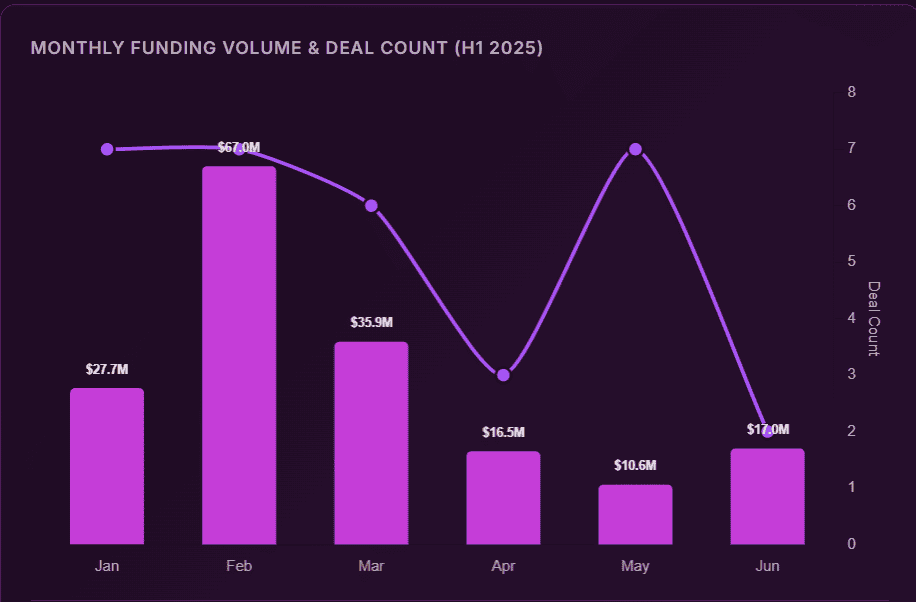

After a period of interest declines, Bitcoinfi’s funds surged to $175 million in 32 rounds in the first half of 2025, with activities focusing not only on infrastructure. In the same half of the year, out of 32 transactions, 20 targeted Defi, Apps and Custody.

Capital is shifted to usability and products, and infrastructure is currently in the backseat.

Earlier this year, major investment companies such as Pantera Capital, Founders Fund and Standard Crypto examined Niche in particular as a popular frontier in the cryptocurrency universe. These notable transactions demonstrate a strong combination of infrastructure depth and application layer traction, with investors’ interest coming from both traditional and crypto companies.