Bitcoin (BTC) price rallies may have stalled recently, but bullish convictions certainly aren’t the case as whales continue to wager millions on expanded market rallies.

Recently, such whales have implemented key bullish options targeting $200,000 by the end of the year. This strategy includes simultaneously purchasing 3,500 contracts for the $140,000 December call option registered with DeLibit, and short selling (or writing) 3,500 contracts for the $200,000 December call option.

This complex trade, the spread of bull call, led to the first net debit to $23.7 million. As Deribit Insights pointed out, “2 million calls have been dominated since December 1400, buying December 140KK IV and funding with a higher IV 200K call.”

If BTC is above the higher strike price, in this case $200,000 by the expiry date, the strategy will achieve maximum profit.

This strategy generates net debit as the premium paid for the lower strike call option (purchase) exceeds the premium received from the sale of the higher strike call. This spread provides a limited benefit for limited risk and keeps the $200,000 increase while ensuring the largest potential loss is included in the initial debit.

Options are derivatives used to speculate and hedge against price movements. Call Options grant, but is not an obligation, the buyer the right to purchase the underlying asset at a given price prior to the specified future date. Cole buyers are implicitly bullish in the market, while put buyers are bearish.

Bitcoin spot prices exceeded a record high of 123,000 on July 14th, and have since been consolidated in a narrow range of $116,000 to $120,000.

Record optional activities

Increased BTC prices and increased institutional interest in structured products with volatility sales have boosted activity in the options market.

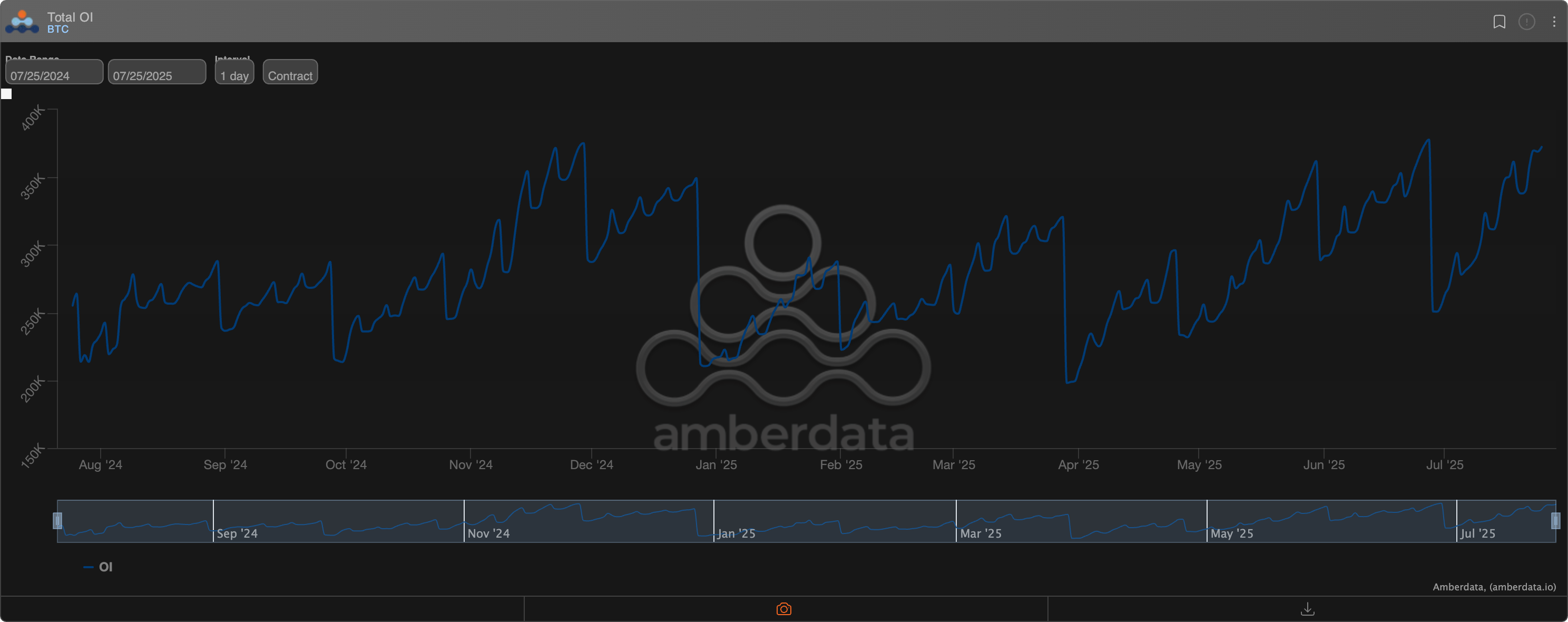

At Deribit, which accounts for more than 80% of global options activities, the number of open interest or open option contracts for BTC options was 372,490 BTC at the time of writing.

Total BTC options are open to interest at DERIBIT. (Amber Data)

Meanwhile, open interest in ether options reached a record high of 2,851,577 ETH, according to data source Amberdata. In Deribit, one option contract represents one BTC or ETH.