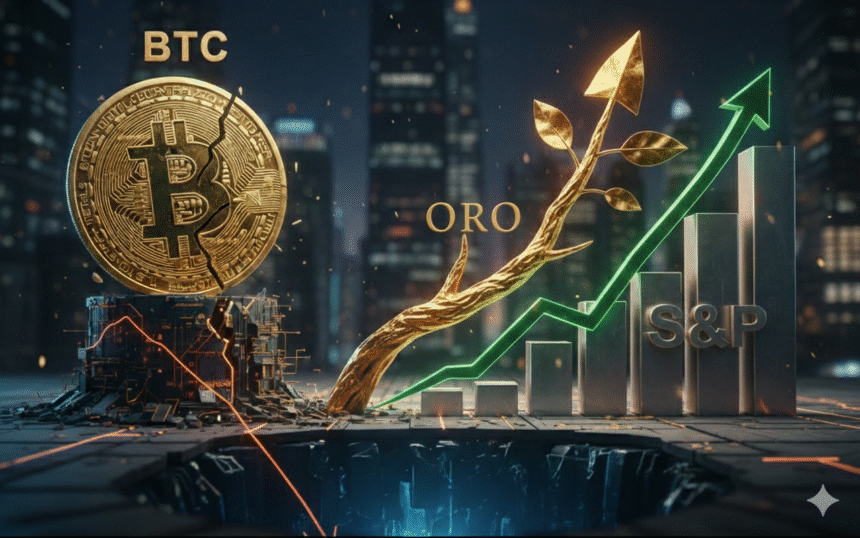

Bitcoin (BTC), gold (GOLD/USD), and the S&P 500 index (SPX) are experiencing distinctly different movements. While metals markets and U.S. stock markets maintained their gains, Bitcoin erased gains made during the year after hitting new highs last month.

As reported by CriptoNoticias, on October 6, 2025, the price of Bitcoin reached an all-time high of $126,000 (USD). Since then, the stock has fallen about 30%, hitting $80,000 this week.

This setback erased the year’s accumulated performance. Bitcoin has recorded a decline of 7.79% since the beginning of 2025 to date. This means that the asset has lost all the profits it earned.

BTC started the year strong on the back of new institutional flows and positive macroeconomic expectations, but the recent correction has kept annual fluctuations in negative territory.

Gold will continue to rise by more than 50% in 2025

Gold maintained a different behavior. In October, it reached an all-time high of more than $4,300 per ounce. The metal has retained most of this year’s gains, although it has since registered a slight correction.

In fact, in 2025 it will show a growth of 55.05% compared to Bitcoin’s decline. Over the year, gold prices have remained positive due to demand for safe-haven assets and persistent global economic uncertainty.

The S&P 500 also continues to maintain high prices. The index will maintain its cumulative gains in 2025, supported by a stock market that has shown resilience despite turbulence. Unlike Bitcoin, SPX has not suffered a decline that reversed its annual performance.

SPX registered a 10.59% gain for the year, albeit slightly down from the US$6,900 it hit last month. This can be seen in the following graph.

The Bitcoin correction is closely related to the wave of liquidations in the derivatives market. CriptoNoticias reported that over $1 billion was liquidated in leveraged positions in BTC during the fall, which accelerated selling pressure and deepened the decline.

On top of that, Retreat occurs at macroeconomic uncertainty: Market adjusts expectations about Federal Reserve interest rates. While many were observing a new rate cut, recent decisions raised questions and Bitcoin reacted with high volatility.