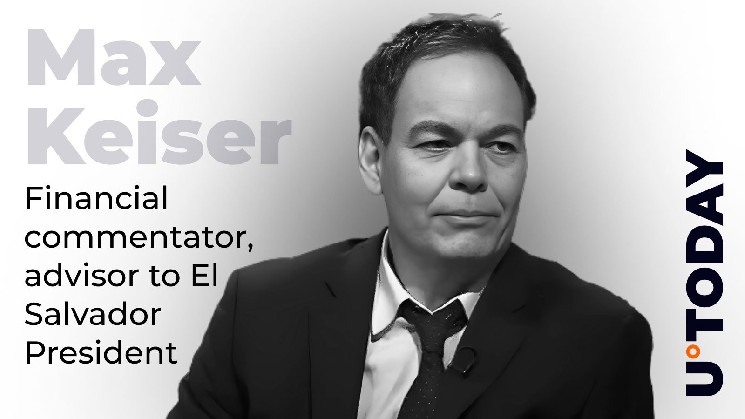

Max Kaiser, a prominent Bitcoin (BTC) proponent, has argued that Bitcoin (BTC) is superior to traditional metals such as gold and silver as a store of value. Kaiser highlighted Bitcoin market performance versus traditional “hard money”.

Bitcoin’s scarcity makes it the ultimate store of value

Kaiser pointed out that Bitcoin’s rise from $1 to $100,000 has proven that absolute scarcity wins in the financial world. he emphasizes that Bitcoin outperformed All other assets, including gold and silver, are primarily due to their rarity.

Remarkably, only 21 million Bitcoins will ever exist, which helps maintain the value of the flagship digital asset. So Mr. Kaiser said, “No. gold Or silver? no problem. Please accumulate Bitcoin. ” He claims that BTC is an alternative haven in the investment ecosystem.

Bitcoin supporters argued that it was the asset’s existence that woke up investors to the idea of a rare, non-inflationary asset. He believes this has indirectly caused people to reevaluate precious metals.

Don’t have gold or silver?

no problem.

Accumulate Bitcoins.

Bitcoin’s rise from $1 to $100,000 showed how an absolutely rare asset can outperform everything else. In a sense, Bitcoin caused the collapse of gold and silver by awakening the masses.

Legacy systems and non-Bitcoin systems… https://t.co/Jo0dCt9RwN

— Max Keiser (@maxkeiser) October 14, 2025

Kaiser argued that gold’s current rally to $4,100 and silver reaching $52 is not competition.

“The big move in gold and silver is an evolutionary step,” he said.

Bitcoin supporters imply that gold and silver are simply reacting to current economic instability. He believes these are just a conduit for moving funds into major digital assets.

Interestingly, financial journalist Michel Macoli believes there is a systemic crisis in traditional precious metals markets. He pointed out that silver could be subject to a short squeeze due to excessive paper leverage.

Makori claims that bullion banks are selling too much “paper” silver, implying that there are far more claims on ounces of silver than actual physical assets. Since the buyer is demanding physical delivery, if the contract is not honored, the contract may fall apart.

Despite Bitcoin’s long-term strength, market volatility continues

In the broader market, Bitcoin is change It traded at $110,752.38, representing a decline of 3.23% in the past 24 hours. The asset fell from a peak of $116,020.49 as rising macroeconomic tensions affected market sentiment and price outlook.

Trading volume also fell by 19.9% to $77.5 billion during the same period. Market participants are likely waiting for the current volatility to subside before putting more money into the asset.

On the other hand, famous financial commentator Peter Schiff said, The bottom could come out of Bitcoin. anytime. He recently predicted that BTC could plummet to $75,000.